06 August 2025

Consolidated Results as of 30 June 2025

Generali achieves strong start to its “Lifetime Partner 27: Driving Excellence” plan driven by P&C, Life and Asset Management

The 2025 half-year financial results record a positive performance and a continued growth in operating result, setting a strong start to Generali’s “Lifetime Partner 27: Driving Excellence” strategic plan.

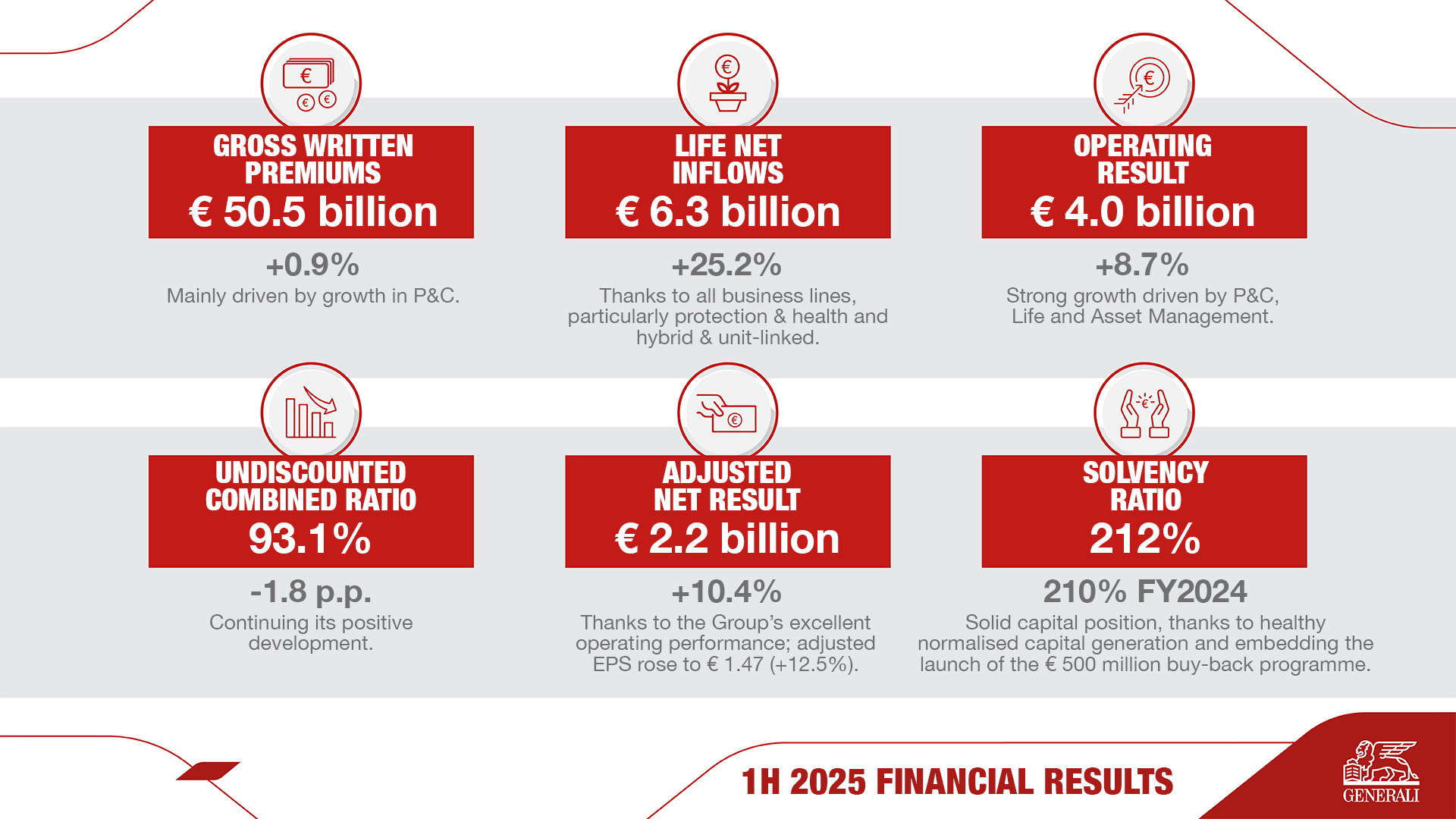

- Gross written premiums reached € 50.5 billion (+0.9%), mainly driven by growth in P&C (+7.6%)

- Life net inflows were positive at € 6.3 billion thanks to all business lines, particularly protection & health and hybrid & unit-linked

- Combined Ratio improved significantly to 91.0% (-1.4 p.p.); undiscounted Combined Ratio continued its positive development to 93.1% (-1.8 p.p.)

- Strong growth in operating result to € 4.0 billion (+8.7%), driven by P&C, Life and Asset Management

- Adjusted net result grew to € 2.2 billion (+10.4%) thanks to the Group’s excellent operating performance; adjusted EPS rose to € 1.47 (+12.5%)

- Solid capital position, with Solvency Ratio rising to 212% (210% FY2024), thanks to strong normalised capital generation and embedding the launch of the € 500 million buy-back programme

Generali Group CEO, Philippe Donnet, said: “Our excellent half-year results confirm a very strong start to the Group’s ‘Lifetime Partner 27: Driving Excellence’ strategic plan with positive performance across our Insurance business and global Asset Management platform. In Insurance, P&C grew substantially in all our main geographies driven by our focus on maximising profitable growth and Life net inflows continued their growth trajectory driven by our preferred business lines. Our Asset Management platform also recorded a solid performance supported by the contribution of Conning. We achieved these very positive results thanks to the efforts of all our colleagues and distribution networks. We will build on this momentum, pursuing excellence in being a Lifetime Partner to our customers, in our core capabilities and in the Group operations. We remain fully focused on the Group’s clear priorities under our strategic plan and will continue delivering value for the benefit of all our stakeholders.”

Building on rising premium growth, strong operating performance, and a solid capital position, Generali has established a firm foundation for the goals set out in its strategic plan. Moreover, the Group’s excellent capital position and solid cash generation allowed for the launch of the first €500 million strategic buyback, demonstrating Generali’s commitment to a growing shareholder remuneration.

These achievements highlight the Group’s dedication to delivering lasting value for all stakeholders while advancing its vision for excellence, to continue being a leading Italian, independent, and international Group.

Discover more on the consolidated results as of 30 June 2025 in the full press release.