22 February 2021

The global push towards sustainability

Generali Investments’ Market Perspectives

Author: Michele Morganti, Senior Equity Strategist di Generali Investments

The last months saw a major political commitment towards carbon neutrality: The US has just re-joined the Paris Agreement. EU leaders have set a new emission cut target from 40% to 55% by 2030. Korea, Japan and China are now on the same page of EU, setting a carbon neutrality target by 2050 (2060 for China). Other EMs are likely to get on board soon. Financial regulators are introducing climate risk disclosure as mandatory and institutional investors are making sustainability the new standard for investing. At the same, corporations are setting more ambitious ESG targets, with increasing focus on the social dimension.

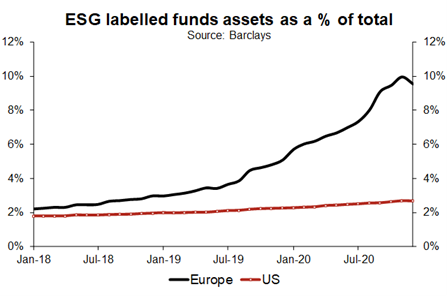

This change of attitude will further boost the ESG market, after an already positive 2020. Indeed, in terms of flows, ESG all equity funds registered +33.4% increase, with ESG Global equity funds at +60.6%. The US is still a laggard, with ESG funds’ assets representing just over 2% of total equity assets, but with the new Administration we expect the US to catch up. In terms of performance, both US and EU ESG equity indices overperformed traditional ones and not only during the drawdown. This proof of resilience will represent another point of attraction for international investors.