Global View – Enjoy summer while it lasts

By Generali Investments’ Research Team

- The policy-led rally has flattened out but we expect risk sentiment to be resilient over summer. Investor positioning, the economic bounce, dollar weakness and ongoing policy support still dominate for now.

- But clouds will be mounting this autumn. Already the US recovery is floundering, and hopes of a V-shape will die after summer. Covid will prove more threatening, and political risk will be rising.

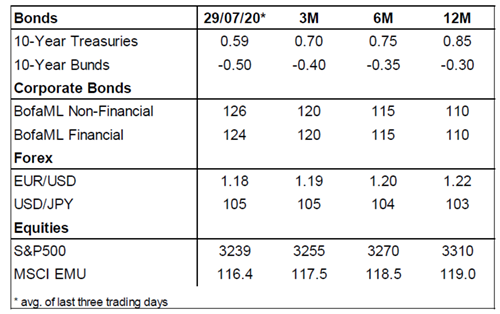

- Our allocation recommendation retains a risk-on bias for now, but a cautious one, focused on IG Credit. The equity OW is minimal and defensive. We stay bearish USD and warn against duration shorts.

As lockdowns have been lifted and global activity rebounded from the Q2 nadir, hopes of a strong recovery have helped risk assets advance further over July, benefitting our pro-risk tilt in the portfolios. With global equities (MSCI World) now almost flat on the year again despite the historically deep recession, there are mounting concerns that markets have become complacent.

Indeed, the sharp rise of new infections in the US and Brazil underscores the sticky threat from Covid-19. Even in Europe and Asia, where public policies have been more effective, resurgent cases may give a flavour of the risk to the Northern hemisphere once people start to meet more frequently in closed rooms this autumn.

As we lay out in a recent White Paper, the economic, behavioural and market impact of the Covid crisis will prove very protracted. A V-shaped recovery will remain a summer illusion. After an initial rebound, the recovery will lose momentum, with the persistent Covid uncertainties and elevated unemployment weighing on investment and consumption. Already in the US, the recovery in the labour market has stalled, with initial jobless claims rising for the first time again since March on Covid resurgence. US policy uncertainties are not helping either, with Congress still at loggerheads over extending or replacing a US$ 600 boost to weekly unemployment benefits per person. Meanwhile, US/China trade frictions have morphed into an open diplomatic conflict, with little signs of relief ahead of the US presidential elections in November.

Hiding in havens still premature

Yet despite the mounting concerns about the sustainability of risk sentiment, hiding in safe havens still looks premature. Local lockdowns may need to be reinstated, but not in the same scale as in spring, as more tools for containing the virus are at hand and medical capacities have been expanded. Support from both fiscal and monetary policy remains extremely strong. We assume US Congress will deliver a new bout of stimulus before the summer recess (8 August). The Fed may turn even more dovish if it opts to some form of average inflation targeting as it concludes the review of its monetary policy strategy (September?). In the meantime the Jackson Hole (virtual) gathering will lay down very dovish ideas about the future of monetary policy. The (hard fought) European compromise on € 750 bn Recovery Fund (incl. €390bn earmarked as grants) is a particularly welcome signal by EU leaders to mutual assistance. Also, the big retreat in the USD by almost 5% since mid May is reassuring especially for indebted firms and sovereigns in the emerging world. Valuations and investor positioning in most risky assets are now less compelling, but still not exuberant.

As we continue to surf the risk-on wave, we are preparing to scale back positions into what we think may be a difficult autumn. By then the virus might be more threatening. The idea of a V-shape recovery will die. Political risk will also be mounting (US election in November, conclusion of Brexit deal talks in October).

Overall we stick to a prudent pro-risk tilt in the portfolios mostly via an overweight in EUR IG Credit with a tilt towards longer maturities while underweighting Cash and short-dated Govies. We keep the equity OW minimal. The USD is headed for further weakness, even though at a much more contained speed than seen over recent weeks.