Insurance solutions with ESG components

As part of our range of insurance offers, we are committed to developing and promoting some solutions that have ESG components.

Insurance solutions, by their very nature, have a high social and environmental value as they concretely respond to customers’ pension and protection needs and to the growing requirements of society, contributing to make it more resilient in relation to changes and adversities.

Coherently with its commitment as responsible insurer, the Group has developed an internal classification to identify those products that, more than others, include ESG components and contribute to create shared value for all the stakeholders.

In Generali 2022-2024 Strategy Lifetime Partner: Driving Growth we confirm our commitment to further develop Insurance Solutions with ESG components, increasing our gross direct written premiums by 5-7% CAGR by the end of 2024 . Given the strong emphasis that the Group places on these themes, an inter functional working group was established with technical and socio-environmental expertise. This working group meets regularly to monitor and deep-dive the evolution of the regulatory context on sustainability.

In 2023, second year of the new strategic plan, we collected a total gross direct written premium amount of €20,815* million from Insurance Solutions with ESG components, showing a CAGR of +7,4% vs 2021.

Social sphere

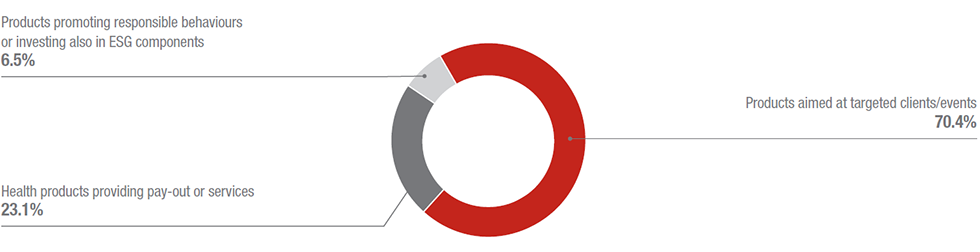

- Products aimed at targeted clients/events: products aimed at enabling and enhancing social inclusion, focusing on the disadvantaged and vulnerable sector of the population, like the young, the elderly, the disabled, the migrants. To this category also belong those products that respond to specific negative life events, such as disability, loss of independency, unemployment, dread diseases, etc., or to different lifestyle needs subsequently, for instance, to the termination of the employment relationship.

- Products promoting responsible behaviours or investing also in ESG components: products that promote responsible and healthy lifestyles, leveraging on the opportunities provided by new technologies, the importance of preventive healthcare or other virtuous behaviours of policyholders. To this category also belong those Life investment products that allow customers to invest insurance premiums into financial assets also with ESG components.

- Health products providing pay-out or services: products that integrate or supplement the public health service, designed to help manage the costs of treatment and assistance, as well as the reduction in earnings of customers in the event of serious illnesses or the loss of self-sufficiency.

In 2023, premiums of €18,228 million were collected from insurance solutions with ESG components – social sphere, with a CAGR of +6,9%% vs 2021.

Premiums from insurance solutions with ESG components - social sphere

Environmental sphere

- Mobility: products offering coverages and services dedicated to sustainable mobility and/or with reduced environmental impact, including coverages offered to customers that, thanks to their driving style, can contribute to reducing CO2 emissions. This category includes insurance products dedicated to electric and hybrid vehicles, and those rewarding low annual mileage and responsible driving behaviour, also thanks to the use of telematics, or those designed for other means of transport, such as bikes, scooters, etc..

- Energy efficiency: products supporting the certified measures taken to improve the energy efficiency of buildings. In some cases, consultancy is provided to customers to identify possible solutions for optimizing energy consumption, thus reducing the environmental impact.

- Renewable energies: products covering risks connected with the production of renewable energies. These kinds of products are designed to cover equipment for the production of renewable energy, to guarantee reimbursement of damage caused by atmospheric events to solar and photovoltaic panels, or similar systems, which can be integrated with guarantees to protect against loss of profit deriving from the interruption or decrease of the production of electricity.

- Risk reduction: products specifically designed to answer to coverage needs against natural and climate risks. Risk prevention and reduction represent a key factor in these cases.

- Pollution liability/Own damages: products targeting sudden and accidental pollution, such as third party liability policies. These solutions, for instance, provide reimbursement of expenses for urgent and temporary interventions aimed at preventing or limiting the recoverable damage. In some countries, the restoration of the polluted site is guaranteed in order to protect environment and biodiversity.

- Circular economy: products supporting companies dealing with materials recovery/recycling and/or start-ups that manage shared services platforms, etc..

In 2023, premiums of €2,587 million were collected from Insurance Solutions with ESG Components – Environmental Sphere, with a CAGR of +11,9% vs 2021.

Premiums from insurance solutions with ESG components - environmental sphere

The perimeter includes all subsidiaries of the Parent Company which consolidate on a line-by-line basis.

* Insurance solutions with ESG components is an internal definition used only for identification purposes. Premiums from insurance solutions with ESG components refer to consolidated companies representing 96,2% of the Group’s total gross direct written premiums. The change was on equivalent terms, I.e., at constant exchange rates and consolidation scope.

As for premiums from Insurance Solutions with ESG components – environmental sphere, the premium from multi-risk policies covering NATCAT events only refers to the NATCAT guarantee. If the premium cannot be split into green-related component, and other components, only the premium from the policies which are predominantly providing a green coverage or service is reported.

Coherently with the S&P framework on Sustainable Insurance Underwriting Products & Services, at year end 2022 the amount of Gross Direct Written Premiums was € 2,364,685,589.