Performance by segment

Life Segment: 2023 results

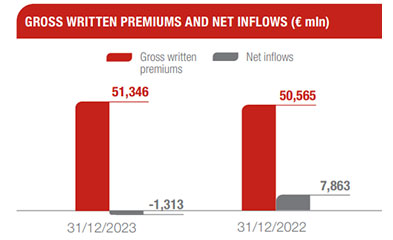

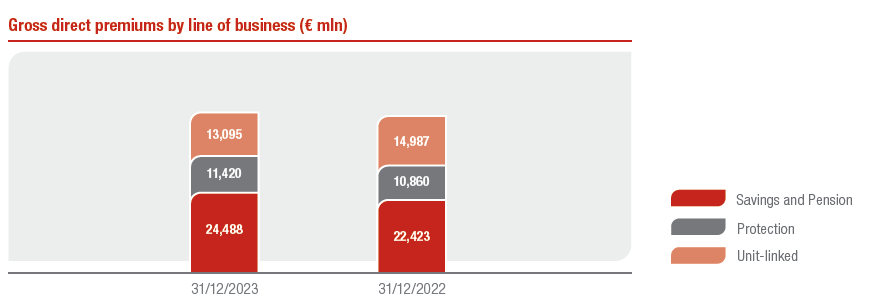

Gross written premiums in the Life segment rose to € 51,346 million (+2.0%). The protection line confirmed its healthy growth trajectory (+6.4%), driven by France and Italy. The savings line also improved significantly (+10.0%), mainly driven by Italy and Asia. The unit-linked line was down (-13.1%), in particular in Italy and France.

Life Net inflows were € -1,313 million. The protection and unit-linked lines recorded positive net inflows, with protection inflows growing to € 4,552 million, led by Italy, France and CEE, while net inflows in the unit-linked line reached € 4,357 million, demonstrating their resilience.

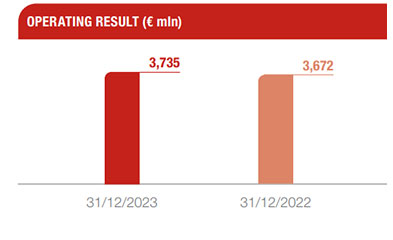

Life operating result stood at € 3,735 million (€ 3,672 million at 31 December 2022). The operating insurance services improved to € 2,901 million (€ 2,841 million at 31 December 2022), while operating investment result was substantially stable at € 833 million (€ 832 million at 31 December 2022).

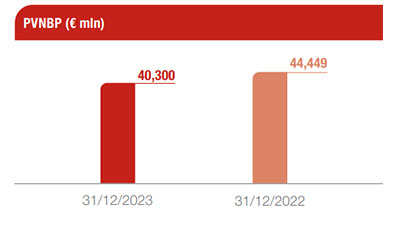

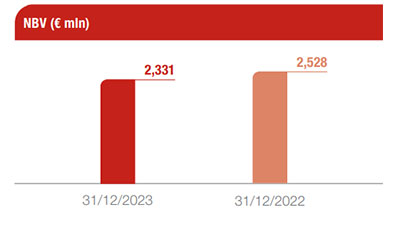

New business volumes (expressed in terms of present value of new business premiums - PVNBP) were € 40,300 million (-9.2%), reflecting the unfavorable economic environment amplified by higher interest rates. The volumes, when expressed in annual premium equivalent terms, which exclude the discounting impact, saw a reduction of 2.7%.

New Business Margin on PVNBP reached an excellent 5.78% (+0.09 p.p.) mainly thanks to the increase of interest rates. The combination of the afore mentioned trends resulted in a New Business Value (NBV) of € 2,331 million (-7.7%).

P&C segment: 2023 results

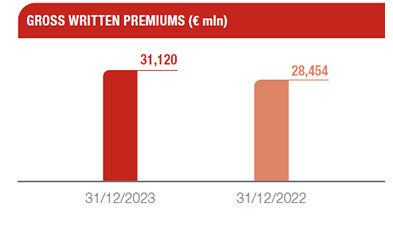

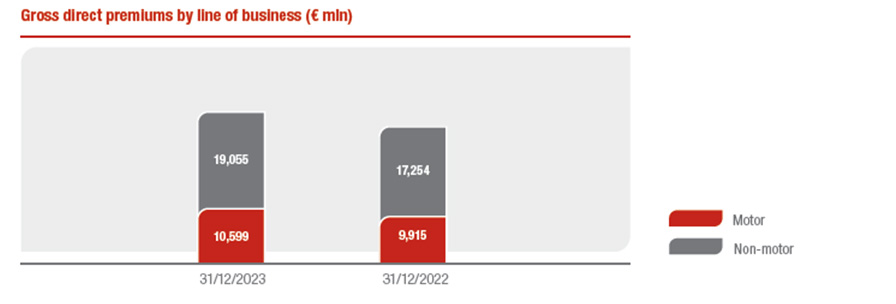

P&C gross written premiums grew to € 31,120 million (+12.0%) thanks to the positive performance of both business lines.

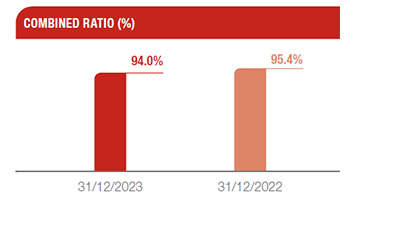

The Combined Ratio was 94.0%, an improvement of 1.4 p.p. from FY2022, thanks to the positive development in the loss ratio to 64.9% (-2.1 p.p.), partly compensated by a slightly higher expense ratio at 29.2% (+0.7 p.p.). The increase in the expense ratio was driven by higher acquisition costs. The positive dynamics in the loss ratio benefitted from a higher discounting effect and an improvement in the undiscounted attritional loss ratio.

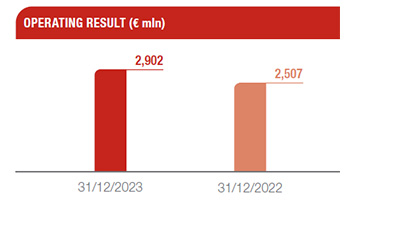

The operating result grew substantially to € 2,902 million (+15.8%). The increase was driven by the higher operating insurance services result, from € 1,297 million to € 1,807 million, offset by the reduction of the operating investment result amounting to € 1,095 million ( € 2,210 million at 31 December 2022).

Asset management segment: 2023 results

Asset & Wealth Management segment, in addition to including the activities of the Banca Generali group, is also related to Asset Management companies that provide products and services both for the insurance companies of the Generali Group and for third-party customers.

The operating result of the Asset & Wealth Management segment stood at € 1,001 million (+4.9%).

In particular, the Asset Management result stood at € 559 million (-12.3%), mainly reflecting market effect on average Assets Under Management and lower performance fees.

The operating result of the Banca Generali group rose to € 441 million (+39.6%), thanks to the positive contribution of the net interest margin and the continuous diversification of fee income sources.

Total net inflows at Banca Generali in 2023 were € 5.9 billion, up 3% compared to the previous year.