A test of character for Europe

By Vincent Chaigneau, Head of Research, Generali Investments

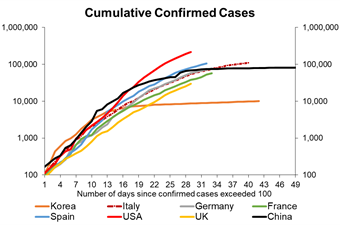

Down but not out. The contagion of the corona virus continues, but at a slower pace. In the first days of April the total number of recorded cases, now well over one million globally, was rising by about 8.5% a day, vs. 12% around 25 March. Social distancing measures are working: Italy has passed the peak, with new cases now well below 5000 a day, down from a top above 6000. Contagion remains vivid in the UK and the US, at 13-14%, though this is also down from 25% just a week ago. The number of cases there should plateau in a couple of weeks. Unfortunately the risk of second waves is such that the lockdowns must continue until new cases drop to a very low level. Even then, substantial restrictions will most likely remain for a couple of weeks as most governments will prioritise health security. The return to a normal social and economic life will only be progressive. The roll out of fast antibody testing may facilitate that normalisation.

Quantifying the economic shock. We have cut our global growth forecasts to -1% for 2020. The Eurozone GDP is likely to be at least 6% lower in 2020 than in 2019. The recession will thus be deeper than during the Great Financial Crisis (GFC, 2008-09). In just two weeks, 10 million Americans have applied for jobless claims. In other words, the unemployment rate has probably surged by more than 6 points already! Eventually it is likely to soar towards 20%. The OECD estimates that each month of lockdown costs 2 points of annual GDP in major economies. We hope for a strong rebound in the second half of the year, yet we know from past crisis that the economic loss is mostly permanent: GDP does not return to its previous path.

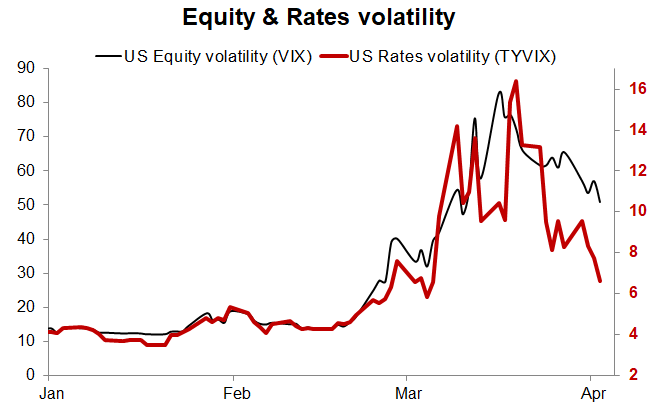

Creditors over shareholders. Global financial markets are finding their feet, thanks to the impressive global policy response. Oil prices may have found a bottom, as the lose-lose situation eventually leads the US, Saudi Arabia and Russia back to the negotiation table. Volatility is pulling back from record levels, slowly in equities but more rapidly in rates markets (see chart). The Fed has taken new measures, less spectacular maybe but still essential to the well-functioning of financial markets (easing the banks’ Supplementary Leverage Ratio and providing Treasury repo to foreign central banks in need of US dollars). Risk-free bond yields are pulling back as they should – a sign that financial dislocations are diminishing. Equity markets are still wobbly, as economic growth and earnings expectations are revised down at a record pace. This vindicates our preference for defensives sectors and stocks, as discussed last week. We also expect long rates to fall further, and favour safe credit (Investment Grade corporates): government loans, guarantees and central bank purchases will cap spreads. The past few days have also confirmed that policy makers will give a preference to creditors over shareholders. The regulators are calling for European banks not to pay dividends until at least October. Companies receiving public support will face a ban on dividends and stock buybacks. For now creditors, e.g. owners of Additional Tier 1 bonds (unsecured and subordinated debt issued by banks) are not facing such bans.

War time, really? Many governments have talked about war times as they rolled out their plans to fight the viral contagion and economic recession. If they are serious about it, they will also need to show the cooperative spirit and solidarity that war times have required. The past few days have seen progress. The European Commission announced the launch of a temporary fund: member states will provide guarantees to raise up to €100 billion to support workers in countries that have been hit hard. Good start. More will be needed for people in those countries to conclude that Europe is effectively protecting its citizens. Not all countries have the same means (fiscal room) to offset the most unusual trauma on the economic and social fabric. This creates a new fragmentation risk. For 2020, we expect the shock on net bond issuance to be essentially absorbed by the ECB’s Pandemic Emergency Purchase Programme. But the PEPP is temporary, while the crisis will have long-lasting effects on public deficits and gross government bond supply. The ECB will not be able to keep the European house for ever. The calls for social safety nets, health security, climate change, increased government intervention etc. will require funding. We do expect progress over the coming week(s), via the launch of a temporary (5 to 10 years) rescue fund or existing vehicles such as the European Stability Mechanism (ESM). The devils will be in the details, e.g. support from the ESM should require very limited conditionality, be free of stigma and not subordinate existing holders of national government bonds. Assuming the post-GFC (Great Financial Crisis) errors will not be repeated (premature tightening of monetary and fiscal policy), the Euro Area crisis of 2011-12 is unlikely to return. However we cannot exclude that permanently higher public debt would cause refinancing troubles once the ECB retrenches from its massive bond buying program, leading the markets to question European stability again. To prevent such stress, Europe must act early.