Old society, new welfare

In Western countries demographic aging is reversing the balance between the active and passive population. The pay-as-you-go pension model will not hold out for much longer, healthcare will become too expensive and new solutions are required: a tax on robots anyone?

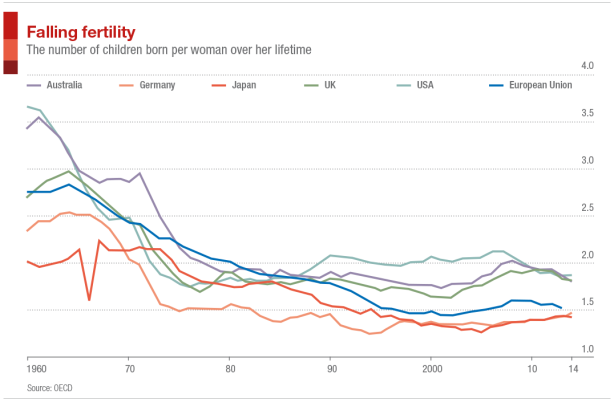

In the industrially advanced countries the increases in life expectancy and the simultaneous fall in birth rates (see graph from the Financial Times based on OECD data) have over the last ten years reversed the balance between the active and passive population. Until recently the former were in the majority, nowadays this is no longer the case; this trend has been confirmed also by OECD data. In Japan the percentage of the population of working age (between 15-64 years) of the total population fell from 24% in the 1970s to 13% in 2013, while the category of the elderly rose from 7.01% to 25.06%. In Germany over the same period the ratio between the active and passive population changed from 23-14 to 13-23; in Italy from 25-11 to 13-21; in the United States from 28-10 to 19-15.

Demographic aging results in serious social consequences. Labourers, clerks and artisans today will have less respectable pensions than those of previous generations, whose pensions they will, nonetheless, be contributing to through their work. The cost of healthcare will rise given that there will be an increasing number of old people to look after. The impact of these factors on the public accounts will be notable. Keeping them under control order will not be simple. There is no point beating around the bush: welfare can no longer remain the same. Solutions are required.

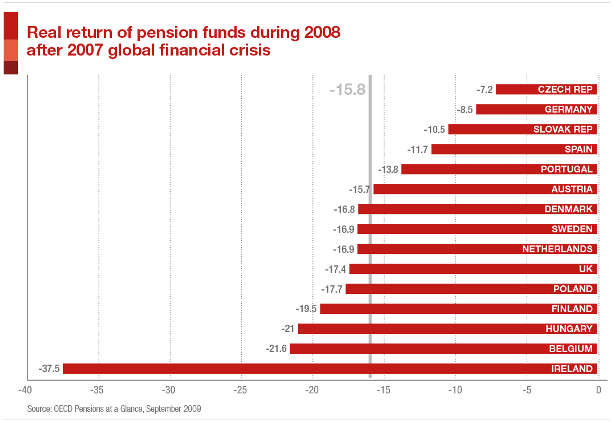

On the pension front the pay-as-you-go model, predominant in the West, will not be able to keep going much longer. Once upon a time the many were supporting the few, now it is the opposite. One idea to thwart the collapse could be to resort more to using pension funds, but there are no lack of pitfalls to such an approach. The global crisis has demonstrated as much, with the associated financial returns going up in smoke (see the illustration – University of Mannheim, source OECD).

Among those in the sector a suggestion has been circulating for some time, one that is perhaps more reasonable: to adopt the Swedish pension model. It adapts quite flexibly with the oscillations of growth and the demographic curve. But as has been written in the Financial Times, aside from the models that are more or less virtuous, “probably the overall solution will be the less attractive mix of extending the working age, encouraging saving and making less generous payments.”

Another possibility is to develop policies that help families, such as extending maternity leave and increasing financial subsidies. One country that has achieved a substantial change concerning the family allowance is Poland, where the rate of dependence of inactive people on the working population is the second highest in Europe (the highest is Slovakia). A study by the University of Mannheim has examined how one year ago the conservative Polish government introduced the 500 Plus programme that distributes a generous family allowance of 500 zloty per month (around 125 euros) for second and subsequent children until they reach adulthood. The sum of money is substantial if we consider that the average net salary in the country is 1000 euros. The aim of the Warsaw government is to provide incentives to stimulate the birth rate and also encourage consumption. The cost of this policy, which is non-means tested and open to everyone whatever their income, is enormous. It might well tip the country’s budget deficit beyond the European set limit of 3%.

Amidst all of this, many analysts ask where the frontier lies between consensus and welfare, an issue that has been turned upside down also when it comes to pensions. The adjustments to pensionable age and contributions can erode governments’ popularity. The same is true for immigration policies, where there is a significant discrepancy between the need to encourage immigration in order to maintain the workforce at an acceptable level and a public diffidence towards for immigrants. A study by the Delors Institute on Europe’s capacity to attract highly skilled migrants shows that Europe lags behind global competition.

These are the traditional approaches that have been the source of discussions for years. Then there are the new solutions; of these one that stands out is the concept of guaranteed minimum income. Aside from questions of political manipulation, this scheme is based on providing just enough money to satisfy basic needs. The idea has gained added pertinence with acceptance that less and less people are working due to the advance of robots, a development that looks set to cost many jobs even more rapidly than automation eliminated factory jobs in the last century. A proposal put forward rather provocatively in recent weeks by Bill Gates raised the question of taxing robots precisely because they take jobs away from people.

But that solution differs greatly from that of the minimum guaranteed income to which we turn now. In San Francisco in the United States a pilot project (budget 50 million dollars) will involve only families with children that will each receive between one and two thousand dollars per month. The project in San Francisco is set to be followed by another experiment, again in California, in Oakland. The project has involved 100 families from a selection of social, economic and cultural backgrounds. They too will receive between one thousand and two thousand dollars regardless of whether they continue to work or whether they choose to take things a bit easier. The project is promoted by Y Combinator, a company that supports and finances promising innovative companies. Its founder Sam Altman, a 31 year-old entrepreneur, programmer and venture capitalist, like many others in Silicon Valley is convinced that those who use robots to create profit (and destroy jobs) should be morally obliged to “compensate”. For those who believe that a guaranteed basic income encourages people to shun work, Altman responds, “I don’t believe that we should morally judge the way in which people choose to use their own time.”

There are studies, however, that would indicate that the guaranteed minimum income does not induce people to give up work. The most celebrated is a project launched in the 1970s in Dauphin, a small Canadian farming town, not noticeably wealthy and inhabited by many families of Ukrainian origin. The project was set up at the behest of both the regional administration and the national, left-wing government. When the winds of change blew, the project was abandoned and the results were filed away. They were brought to light recently and those leafing through the documents discovered that the guaranteed minimum income did not induce the inhabitants of Dauphin to leave their jobs. Some mothers and teenagers chose to do so but in only in order to prolong their maternity leave or continue attending school. This is precisely the philosophy behind the guaranteed income: to provide everyone enough to survive, and thus encourage personal investment in social activities such as family, school, teaching and helping the elderly.