Interim management report as of 30 June 2016 - Press release (1)

29 July 2016 - 07:30 price sensitive

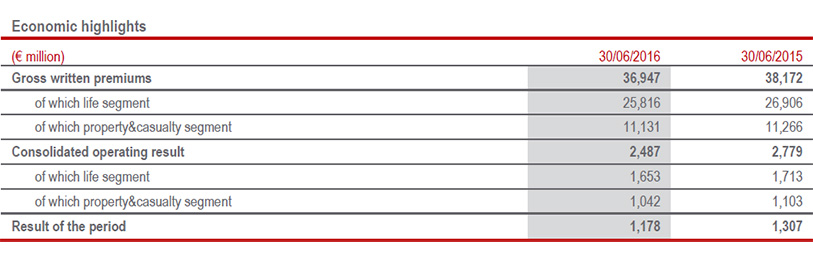

- Solid half-yearly results confirmed by Life and P&C technical results and level of operating income. Financial performance continues to be impacted by volatile markets and low interest rates

- Premiums at € 37 bln (-2.1%): growth recorded in P&C business (+1.3%); Life segment (-3.5%) still impacted by the volatility of equity markets

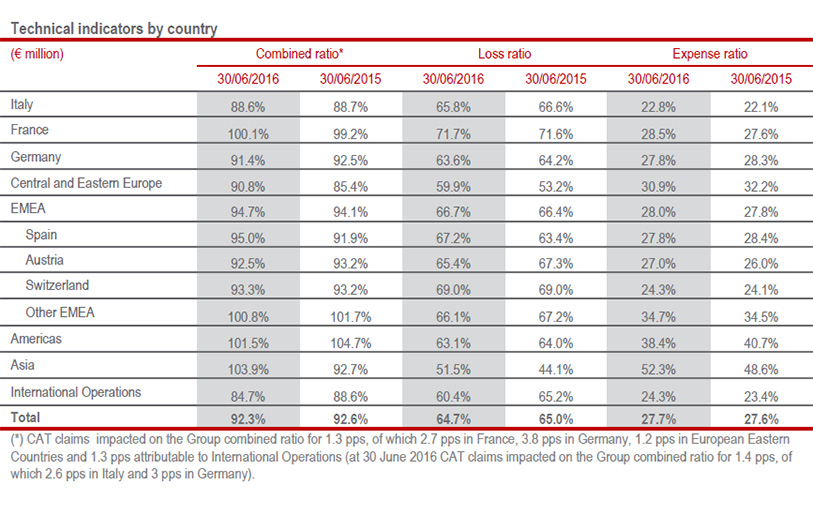

- Improved combined ratio to 92.3% (-0.3 p.p.)

- Operating result of € 2.5 bln (-10.5%) and Net profit at € 1.2 bln (-9.9%) due to higher impairments and lower realised gains, as a result of a policy decision in line with the strategy of preserving future profitability in light of current adverse financial market conditions

- Annualised operating RoE at 12.9%

- Solid capital position with Economic Solvency Ratio at 188%; Regulatory Solvency Ratio at 161%

The Generali Group CEO, Philippe Donnet, commented: “The technical performance of our business in the first six months is solid and encouraging, despite the extremely negative market conditions. Our deep technical expertise and management skills allow us to deal effectively with a period characterised by significant markets volatility, low interest rates and the persistence of catastrophic events. As regards our life business, we pursued a disciplined approach, favouring quality and profitability, and not just the growth in volumes. A significant increase was recorded in property&casualty premiums, taking into account the highly competitive context in which we operate, and will allow us to gradually rebalance the portfolio towards this segment, in which we show excellent levels of profitability. These results and the work of all our employees throughout the world confirm our ability to offer our shareholders a return in line with our targets”.

Milan - At a meeting chaired by Gabriele Galateri di Genola, the Assicurazioni Generali Board of Directors approved the consolidated results as of 30 June 2016.

Executive Summary

The Generali Group’s results in the first six months of the year were solid. This performance demonstrates the effectiveness of our business model in a macroeconomic and political environment that is even more uncertain, characterised by volatility of financial markets, record low interest rates and exacerbated by the natural catastrophe claims in May and June in Europe.

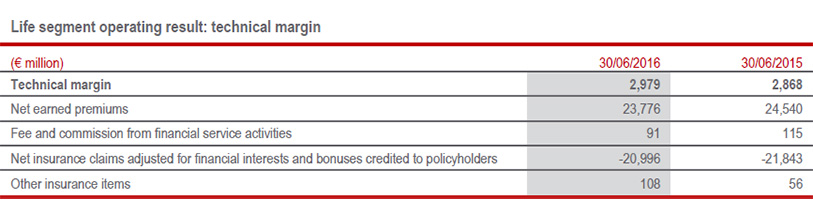

The technical performances of both segments recorded growth: in the P&C segment, the combined ratio improved to 92.3% (-0.3 p.p.) and in the life segment, the technical margin, net of insurance expenses, rose by 49%. Despite the lower financial profitability resulting from market volatility and the current scenario of lower interest rates, the Group maintained excellent levels of operating profitability: with an annualised operating RoE2 at 12.9%.

Group gross written premiums reached € 37 bln (-2.1%; € 38.2 bln 1H15). P&C premium income recovered thanks to the trend in the Motor sector; life business declined, impacted by the current financial markets condition and in comparison to a particularly favourable first half of 2015. Life net cash inflows exceeded € 7.5 bln, albeit down 7.3% as a result of the aforementioned decrease in premiums and the continued policy of active portfolio management in order to increase profitability in certain Group countries.

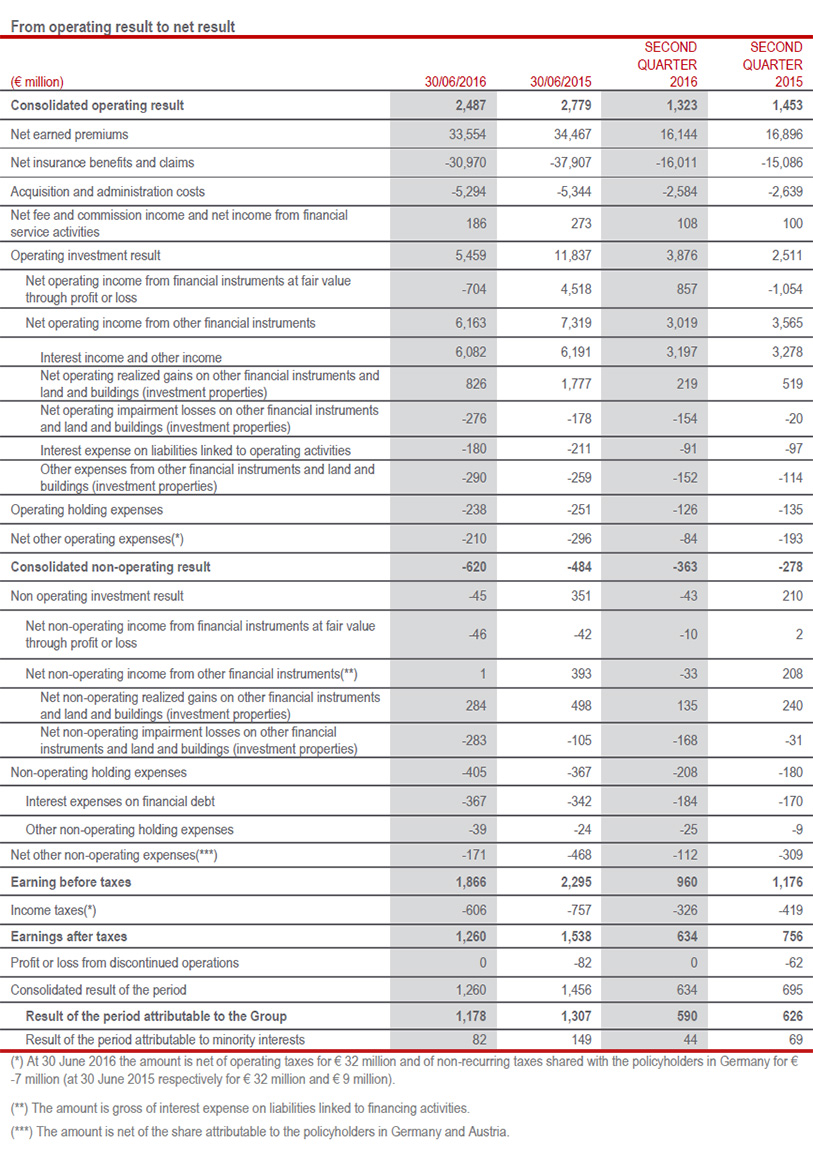

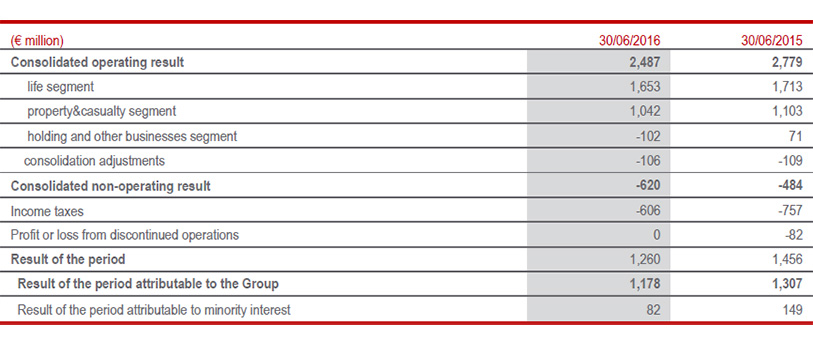

Operating result amounts to € 2,487 mln (-10.5%; € 2,779 mln 1H15). Despite the aforementioned improvement in both life and P&C technical performances, the decline follows the financial performance, impacted by the current low interest rate scenario, higher impairments in the second quarter due to the equity markets trend and the adoption of a cautious approach which envisages a lower contribution from realised gains. This policy, mainly focused on the bond segment, aims at sustaining future returns of own investments, faced with the protracted adverse conditions in the equity markets in the first half of 2016, compared to the positive trend in 2015. The decrease in operating result was also impacted by the reduction in the Holding and other activities segment, due to the lower financial performance of Banca Generali within the negative market trend, and the lower net realised gains in the real estate and private equity sectors. Non-operating performance, which went from € -484 mln to € -620 mln, was also impacted by the financial markets performance.

Operating and non-operating performances are reflected in net profit, which stood at € 1,178 mln (-9.9% € 1,307 mln 1H15).

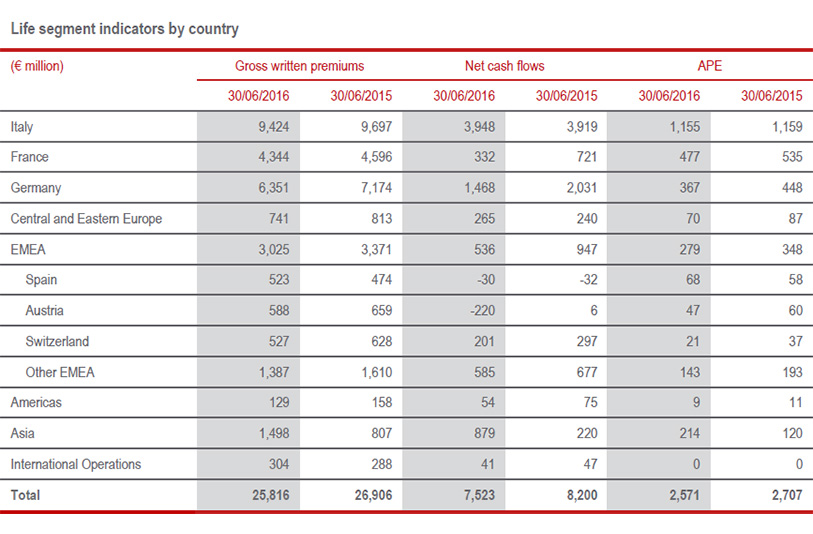

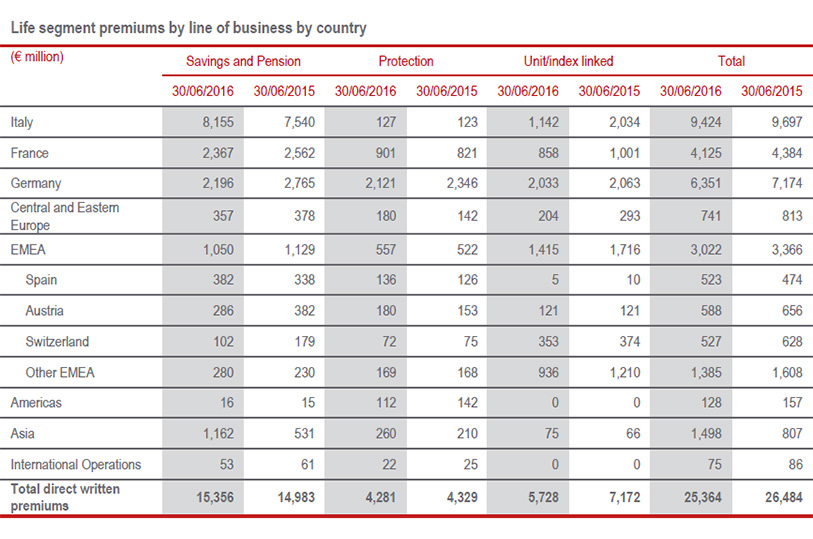

Life premiums amounted to € 25,816 mln (€ 26,906 mln 1H15), down by 3.5% as a result of the decrease in the unit-linked premiums (-19.9%), still being impacted by equity market volatility. By contrast, savings products (+2.9%) and protection lines (+0.4%) recorded a positive performance.

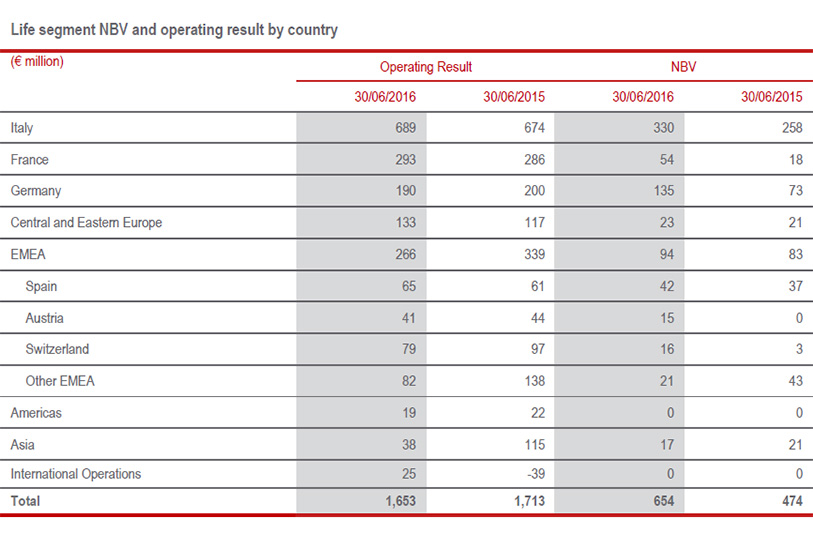

New business in terms of Annual Premium Equivalent (APE) came to € 2,571 mln (-4.5%; € 2,707 mln 1H15), recovering with respect to the previous quarter, due to the good performance of annual premiums level. Single premiums recorded a drop of 9.1%, with a further decrease registered in the second quarter in almost all areas, with the exception of Asia. Despite the reduction in APEs, new business value (NBV) showed a sharp increase (+38.4%), standing at € 656 mln (€ 474 mln 1H15). Driven by the management actions to improve profitability, such as the measures to recalibrate guarantees, New Business Margin (NBM) increased by 7.9 p.p. to 25.5% (17.5% 1H15), also due to the trend in interest rates and volatility compared to the first half of 2015.

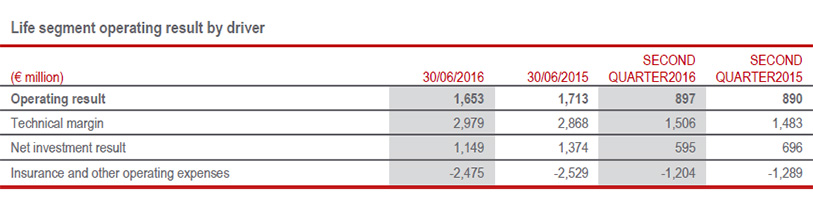

Operating result in life segment stayed solid, at € 1,653 mln (-3.5%; € 1,713 mln 1H15) despite the current complex financial market situation.

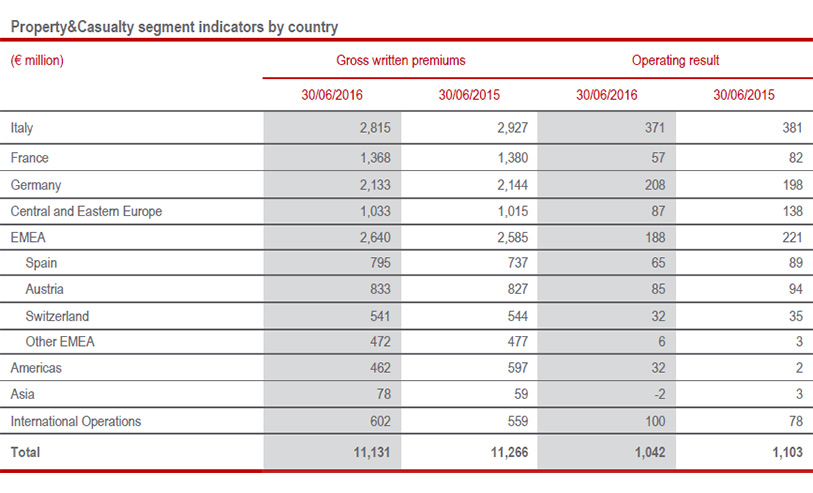

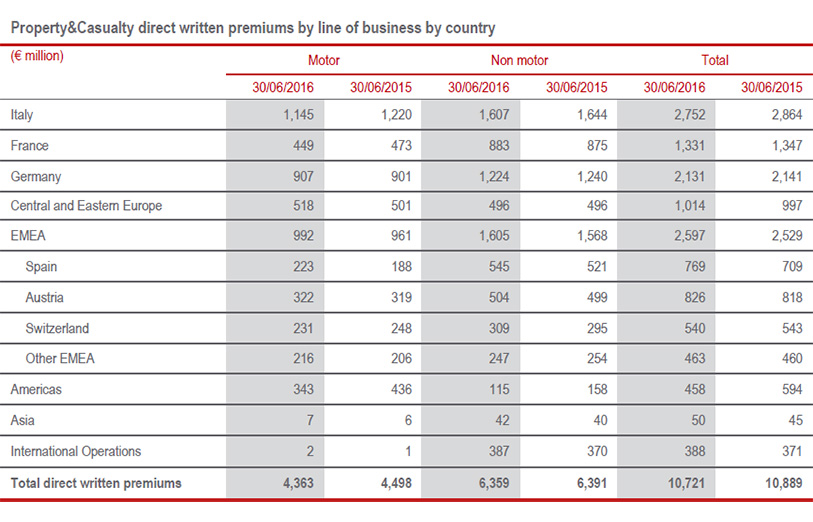

Premiums in the P&C segment rose to € 11,131 mln (+1.3%) due to the recovery in Motor segment (+2.3%) and stable premiums in Non-Motor segment (+0.1%).

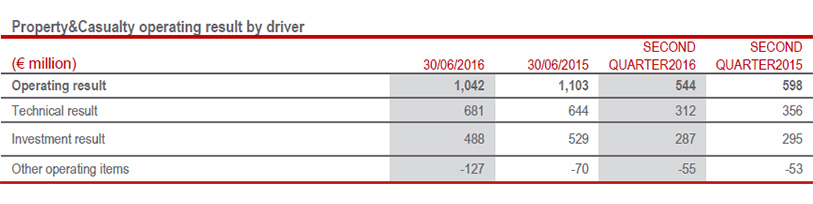

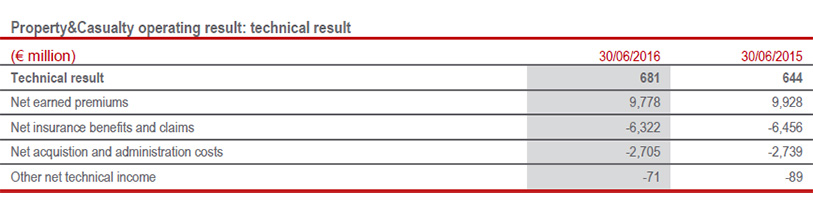

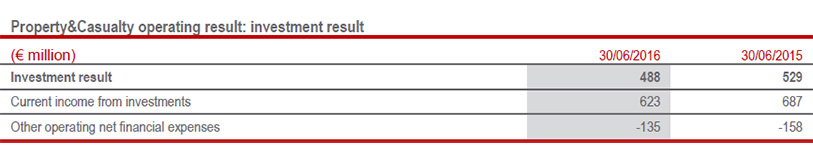

Despite growth in the technical result, deriving from further improvement of combined ratio to 92.3%, operating result in the segment of € 1,042 mln (-5.6%; € 1,103 million 1H15) has been impacted by decrease of the investment result and other operating components, that also include the higher costs of brand royalties paid to the Parent Company starting from the fourth quarter of the previous year for marketing and branding activities.

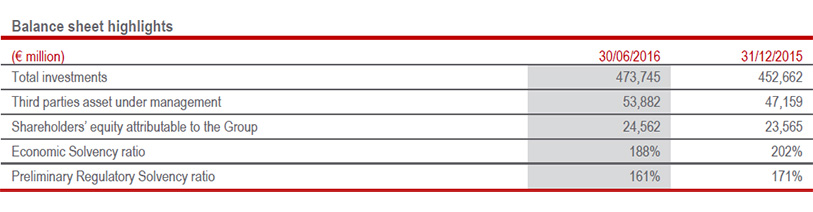

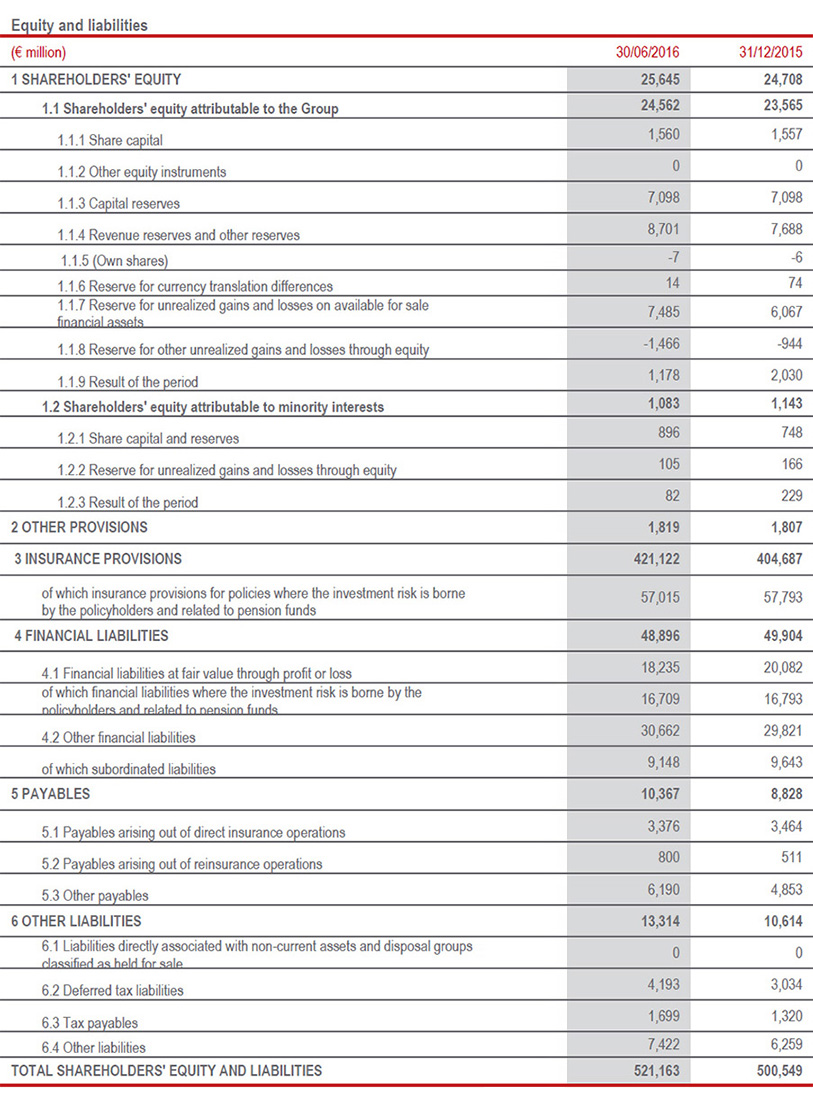

Group shareholders’ equity is confirmed as solid at € 24,562 mln as at 30 June 2016, a growth of 4.2% compared to € 23,565 mln as at 31 December 2015, benefitting from both the profit in the period and the positive performance of the value on financial assets available for sale, which more than offset the payment of the dividend totalling € 1,123 mln.

The Regulatory Solvency Ratio - that represents the regulatory view of the Group’s capital and considers the use of the internal model solely for the companies for which IVASS approval was obtained and with the remaining companies applying the Standard Formula - amounted to 161% (171% FY 20153; -10 p.p).

The Group Economic Solvency Ratio, which represents the economic view of the Group’s capital and is calculated by applying the internal model to the whole Group's perimeter, stood at 188% (202% FY15; -14 p.p.).

Strong recurring capital generation made it possible to maintain an excellent level of solvency and to partially offset the negative impact of the adverse economic context.

Life segment: positive development in technical result, solid levels of premiums and strong operating performance despite adverse financial markets. NBV improving

- Premiums at € 25.8 bln (-3.5%), despite the clear decline in unit-linked premiums (-19.9%) due to the equity market volatility. The other business lines recorded growth

- Net cash inflows exceeded € 7.5 bln (-7.3%)

- New business value (NBV) grows by 38.4% to € 656 mln, with NBM at 25.5% (+7.9 p.p.)

- Operating result at € 1,653 mln (-3.5%), due to lower realised gains and higher impairment

Life premiums amounted to € 25,816 mln (€ 26,906 mln 1H15), down by 3.5% as a result of the decrease in the unit-linked premiums (-19.9%), still shaped by equity market volatility. By contrast, savings products (+2.9%) and protection lines (+0.4%) recorded a positive performance.

The decrease in linked products influences the premium income of the main countries in which the Group operates. In fact, Italy declines by 2.8%, because the growth in savings (+8.2%) and protection (+3.2%) lines are fully absorbed by the decrease of 43.8% in linked policies. The decrease of 5.5% in France and 8.8% in CEE countries also felt the effects of the reduction in these products (14.3% and 29.2% respectively), similarly to the EMEA (-16.8%), which decreased by 9.7% on the whole. The performance in Germany (-11.5%) is attributable primarily to the decline in savings products (-20.6%), particularly single premium products, which recorded a drop, in line with the strategic initiatives targeted at reducing this type of product. A positive performance was recorded in Asia, whose premiums grew by 94.1% mainly thanks to the performance of the bancassurance channel products in China and the recent development of the protection line in Hong Kong.

Life net cash inflows - the premiums written net of claims and benefits paid - reached more than € 7.5 bln (-7.3%; € 8.2 bln 1H15). This performance reflects the decrease in Germany and Switzerland, as a result of the trend in premiums, and of France and Austria, whose net inflows were affected not only by the decline in premiums but the increase in payments. Driven by the premium income growth the contribution from Asia continued to be excellent, with net cash inflows more than quadrupling.

New business in terms of APEs came to € 2,571 mln (-4.5%; € 2,707 mln 1H15), up compared to the previous quarter, due to the good levels of annual premiums, in particular in savings business, thanks to the solid contribution of Italy (+4.2%) and Asia (+70.2%). Single premiums recorded a further drop in the second quarter in almost all areas, with the exception of Asia, registering a decrease of 9.1% in the half. Despite the reduction in APEs, new business value (NBV) significantly improved (+38.4%), standing at € 656 mln (€ 474 mln 1H15). Driven by the management actions to improve profitability, such as effective measures to recalibrate guarantees, NBM increased by 7.9 p.p. to 25.5% (17.5% 1H15), also due to the interest rates trend and volatility compared to the first half of 2015.

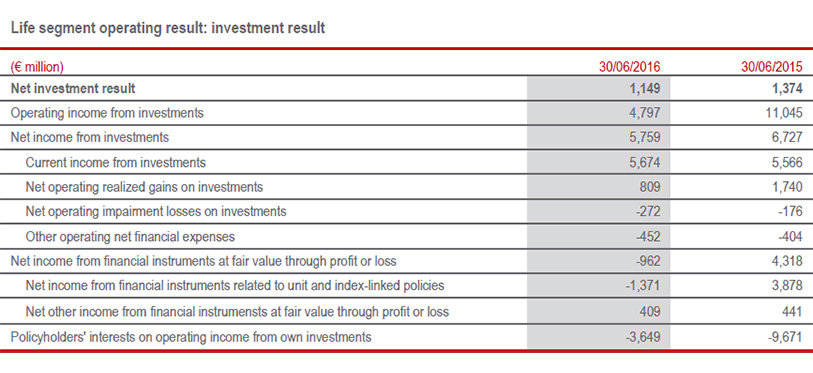

Operating result of the life segment came to € 1,653 mln (-3.5%; € 1,713 mln 1H15). The growth in the technical margin and the reduction of insurance business expenses are more than offset by thedecline in net investment result. The latter derives from higher impairments recorded especially in the second quarter of the year and the lower contribution from realised gains. In fact, the Group pursued the aforementioned policy of sustaining future returns on its investments, given the current changed financial conditions, with respect to the previous year in which markets favoured excellent results. Other operating items also include the costs for the brand royalties which have been conveyed to the Parent Company for marketing and brand development activities starting from the fourth quarter in 2015.

Finally, operating return on investments of life segment stood at 0.40% (0.43% 1H15).

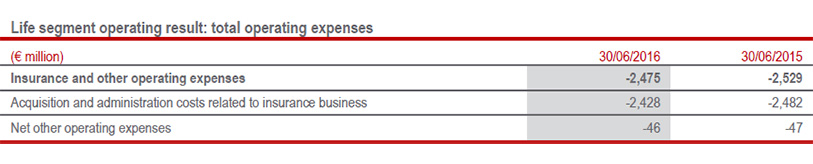

The expense ratio - the ratio between costs and the earned premiums - went from 9.4% 1H15 to 9.6% 1H16 mainly due to the decline in premium income in Germany and in France, the latter reporting an increased cost rate following the planned changes in the business mix.

P&C segment: growth in premiums and technical profitability

- Premiums up to € 11.1 bln (+1.3%), despite the challenging market environment

- Operating result at € 1,042 mln (-5.6%), due to a lower current income. Excellent technical result performance (+5.6%)

- Improved combined ratio to 92.3% (-0.3 p.p.)

A positive performance was recorded by P&C premiums, which rose to € 11,131 mln (+1.3%), thanks to the growth in the Motor segment (+2.3%), albeit with different performances in the various countries in which the Group operates. Premiums in the Non-Motor segment were stable (+0.1%).

CEE country premiums grew by 2.3%, concentrated in the Motor segment (+4.3%). Premiums also rose in the EMEA area (+3.1%), thanks to the positive trend in both segments. Italy still recorded a decrease (-3.8%), observed in the Motor and Non-Motor segments. In particular, the Motor segment (-6.1%) continues to be impacted by both the decrease in average premiums in a highly competitive market and the exit of some large fleet contracts in the first quarter. Premiums in Germany were essentially stable (-0.5%), up compared to the first quarter thanks to the growth of the Motor segment (+0.7%), while the Non-Motor segment declined by 1.3%, due to planned portfolio pruning in the broker channel and in part in the agency channel. France recorded a slight decrease (-0.9%), due to the performance in both segments. Premiums were positive in Latin America (+19.8%).

Operating result amounts to € 1,042 mln (-5.6%; € 1,103 mln 1H15). Despite the positive performance of the technical margin which reflects the actions taken by the Group to boost profitability, the decrease reflects the trend in investments’ result, whose current return was affected by persistently low interest rates, and other operating components that also include the aforementioned brand royalty cost and higher indirect taxes.

The combined ratio improved further to 92.3% (-0.3 p.p.; 92.6% 1H15). The first half was affected by catastrophic events for around € 125 mln, relating mainly to the flooding in Germany, France and the Czech Republic in May and June, for an impact of 1.3 p.p. on the CoR, in line with the impact registered in the same period of the previous year. Current year loss ratio excluding natural catastrophes improved slightly (-0.5 p.p.), due to the evolution observed in the Motor segment. The contribution of previous generations amounted to -4.4 p.p. (+0.3 p.p.).

As regards our main operations countries, in Italy, the CoR remained stable at 88.6%, continuing to rank as the best Group ratio, as already recorded at the end of 2015. The CoR in Germany improved to 91.4% (-1.1 p.p), despite the greater impact of natural catastrophe claims of 0.8 p.p.. Due to the flooding between May and June (equal to 2.7 p.p.), the combined ratio in France stood at 100.1% (+0.9 p.p.); excluding this impact, the CoR would register improvement. The CoR in CEE countries was also confirmed at excellent levels, even if up from 85.4% to 90.8%. This performance reflects the greater impact of natural catastrophe claims, as well as the effect of the legislative amendments in Poland to the reservation method in the Motor segment launched in the final quarter of the previous year, and the increase in average claims in the motor third-party liability and health lines.

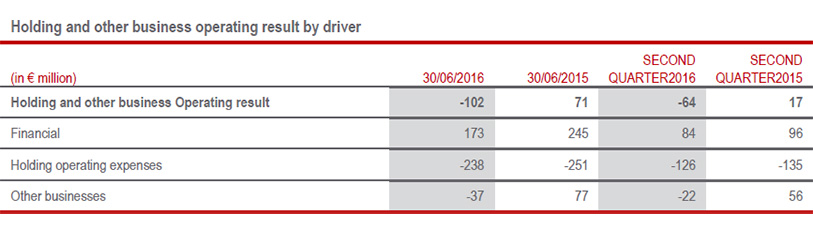

Holding and other activities segment 4

The operating result of the Holding and other activities segment went from € 71 mln to € -102 mln. This performance reflects the drop observed in the financial segment, whose operating result went from € 245 mln to € 173 mln due to the trend in Banca Generali, within the operating result’s decrease deriving from the financial and equity markets performance.

Operating holding expenses amounted to € -238 mln (€ -251 mln 1H15); for 2016, this value includes brand royalties recorded by the Parent Company starting from the fourth quarter of the previous year. Excluding this item, the increase reflects the strengthening in the last 2 years of the Group Head Office structures, as well as the development of the Regional Offices aimed at directing, coordinating and controlling the business in key areas of growth opportunities, e.g. Asia.

The operating result of other activities went from € 77 mln to € -37 mln, reflecting the lower net profits realised in real estate and private equity sectors, which benefitted from favourable financial market conditions in the previous year.

From operating result to net profit

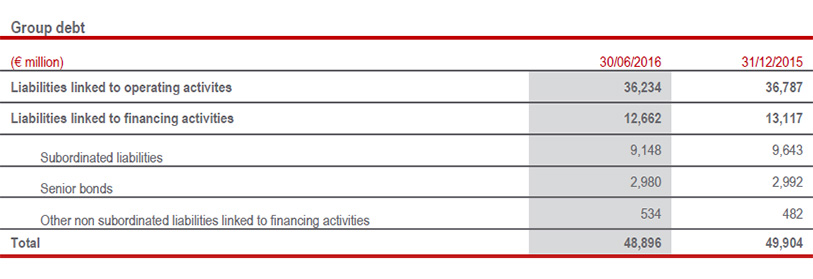

Non-operating result of the Group went from € -484 mln to € -620 mln. This reflects in particular the decline by € 395 mln of investment result due to the aforementioned lower realised gains compared to last year, as well as to higher impairment on financial investments.

Holding non-operating costs went from € -367 mln to € -405 mln and include interest on financial debt which, as a result of new issues of € 1.25 bln in the fourth quarter of the previous year and € 850 mln in May 2016, went from € -342 mln to € -367 mln.

Finally, other net non-operating costs improved to € -171 mln (€ -468 mln 1H15). This item mainly consists of € -62 mln for the amortisation of the value of acquired portfolios (€ -66 mln 1H15) and € -91 mln for the restructuring costs (down compared to € -181 mln 1H15). The improvement in other net non- operating costs was due mainly to the absence of other non-recurring provisions, which amounted to € -221 mln in the first half of 2015.

Tax rate came to 31.6%, in line with the second half of 2015 (31.8%).

Result attributable to minority interests, amounting to € 82 mln, which corresponds to a minority rate of 6.5% (10.2% 1H15), declining compared to € 149 mln in the previous year due to the results of Banca Generali and China.

As a result of the performances commented on above, the result of the period attributable to the Group stood at € 1,178 mln (-9.9%; € 1,307 mln 1H15).

Shareholders’ equity

Shareholders’ equity attributable to the Group amounted to € 24,562 mln as at 30 June 2016, an increase of 4.2% compared to € 23,565 mln as at 31 December 2015. The change was due to the result for the period attributable to the Group, amounting to € 1,178 mln and the unrealised gains attributable to available for sale of € 1,417 mln, which more than offset the payment of the dividend totalling € 1,123 mln and the decrease of € 475 mln in gains deriving from the re-measurement of the financial liabilities for defined benefit plans attributable to the reduction in the applicable rates used to discount those liabilities.

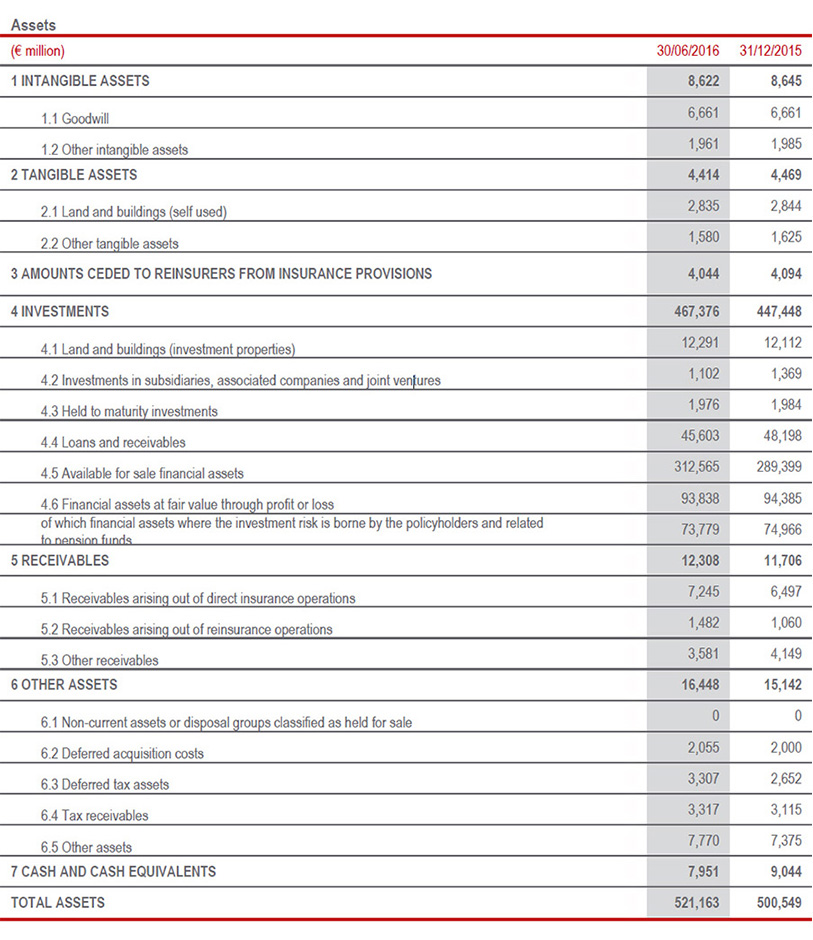

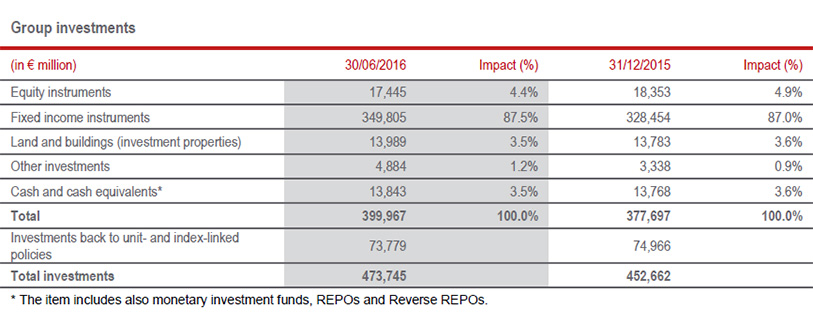

Group investments policy

The Group’s total investments recorded an increase of 5.6% at 30 June 2016, up to € 527.6 bln. In particular, Group investments amounted to € 473.7 bln, while third party assets under management came to € 53.9 bln.

Group investments, amounting to € 400 bln, recorded an increase of 5.9%, primarily due to the increase in the bond portfolio which benefitted from both the recovery in the value determined by the interest rates trend, and net purchases in the period in Government and corporate bonds. A reduction was recorded in the equity portfolio, primarily due to the negative equity market performance. Real estate investments remained essentially stable.

The additional liquidity generated in the first quarter of 2016 was re-invested, standing, at 30 June, at levels in line with the Group's investments policy.

The investment strategy for fixed-income investments aims at portfolio diversification, in both government bonds, and corporate bonds, including private placements and guaranteed loans. The objective is to ensure adequate returns for policyholders and satisfactory return on capital, while maintaining a controlled risk profile.

Equity and investment property exposure will be kept substantially stable.

Significant events within the period and after 30 June 2016

Fitch affirmed Generali’s rating

On 26 January 2016, the rating agency Fitch affirmed the Generali and its subsidiaries’ IFS rating (Insurer Financial Strength) at A-; the outlook was confirmed stable. This rating reflects the improvement in the Group’s capital position, the expectations that Generali’s operating performance will remain strong and that management's ongoing focus will be to preserve capital and reduce financial leverage. On the basis of Fitch’s internal model (FBM), Generali’s score remained “strong” at end 2014 and it is now close to the “very strong” level, reflecting the improvement in the Group’s capitalisation.

Resignation of the Group CEO

On 26 January 2016, the Group CEO Mario Greco affirmed that he would be unwilling to serve another term as CEO. On 9 February the Board of Directors of Assicurazioni Generali approved the mutually agreed termination of all existing relations between Mr. Greco and the Company, in line with the Group’s remuneration policies and resolved to assign temporarily the powers of Group CEO to the Chairman of the Company, Gabriele Galateri, pursuant to the Group’s provisions for succession planning.

Solvency II: approval of partial internal model

In March, following the authorization request submitted by Assicurazioni Generali S.p.A., IVASS - the Italian Insurance Supervisory Authority - approved the use, starting from 1 January 2016, of a partial internal model to calculate the consolidated Solvency Capital Requirement at Group level as well as the Solvency Capital Requirement for its main Italian and German insurance companies, for the Non-Life French companies and for the Czech company Ceska Pojistovna a.s..

Appointment of the new Group CEO and the new General Manager

On 17 March 2016, the Board of Directors of Assicurazioni Generali, following the selection process lead by the Corporate Governance Committee, appointed Philippe Donnet as Group CEO, conferring him all related executive powers. The Board of Directors of Assicurazioni Generali also appointed the Group CFO Alberto Minali as General Manager of the Company.

Modification of the share capital

On 21 April 2016, Assicurazioni Generali completed the share capital increase to euro 1,559,883,538, in execution of the Long Term Incentive Plan adopted by the Shareholders’ Meeting of the Company on 30 April 2013.

The Shareholders’ Meeting appoints the new Board of Directors

On 28 April 2016, the Shareholders’ Meeting elected the new Board of Directors to hold office for three financial years, until the approval of the financial statements of December 2018. The following were elected from the majority list: Gabriele Galateri di Genola, Francesco Gaetano Caltagirone, Clemente Rebecchini, Philippe Donnet, Lorenzo Pellicioli, Ornella Barra, Alberta Figari, Sabrina Pucci, Romolo Bardin, Paolo Di Benedetto and Diva Moriani. Paola Sapienza and Roberto Perotti were elected from the minority list presented by institutional investors.

The Board of Directors appointed for the three years 2016-2018 Gabriele Galateri di Genola Chairman of the company, Francesco Gaetano Caltagirone and Clemente Rebecchini Deputy Chairmen, and Philippe Donnet Group CEO and Managing Director.

Generali placed subordinated bond for € 850 mln

In May Generali issued a subordinated bond for an overall amount of € 85 mln, targeting institutional investors.

The issuance is intended to refinance the subordinated debt with the first call date in 2017, early repayment which, by law, is subject to prior authorization by IVASS, which amounts to € 869 mln. The subordinated bond issue received ratings “BBB” by Fitch, “Baa3” by Moody’s and “bbb+” by AM Best.

Early redemption option exercised on perpetual subordinated bonds

On 16 June Generali Finance B.V. (Issuer) exercised the early redemption option of two perpetual subordinated notes respectively for € 1.275 mln and GBP700 mln.

These debts have already been refinanced through the subordinated bond launched by Assicurazioni Generali on the 20th October 2015 for an overall amount of € 1.250 mln, targeting institutional investors.

Launch of Generali Vitality

On 23 June Generali announced the launch of Generali Vitality, an innovative health and wellness programme – the first in Europe – designed to encourage and reward healthy behaviour for customers seeking a healthier lifestyle. Starting from 1 July Generali Vitality is available to customers in Germany and will be extended shortly to other countries.

Moody’s affirmed rating Baa1 and outlook stable

In July Moody’s affirmed the Baa1 IFS rating on Generali and outlook stable. Concurrently Mood’s affirmed the ratings of debt instruments issued or guaranteed by Generali (Baa2 senior debt; Baa3 senior subordinated debt; Ba1 (hyb) preferred stock). The affirmation of ratings and outlook stable reflects the Group’s strong and diversified business profile, as well as the improvements in profitability and capitalisation over the recent years. Moody’s views Generali’s business profile as strong thanks to very good market positions in its main markets, notably Italy Germany and France, a predominance of retail business, which is typically less volatile than the commercial business, ad very good geographic and business diversification. The stable outlook also reflects Moody’s expectations that the impact of low interest rates and of the volatility in financial markets will remain moderate on Generali’s profitability and capital.

Outlook

In a macroeconomic and financial environment still facing low interest rates and high uncertainty in financial markets, in the Life segment the Group will continue to favour a portfolio of policies less sensitive to interest rates and with lower capital absorption.

The P&C segment will continue to be key to the execution of the Group strategy to become retail leader in Europe. Also here, a continued focus on technical profitability will help the overall performance in a scenario of declining financial income.

Despite the challenging environment and the high volatility of the financial markets, in 2016 the Group expects to improve shareholder remuneration, consistently with the strategic plan presented to the market.

The Manager in charge of preparing the company’s financial reports, Alberto Minali, declares, pursuant to paragraph 2 article 154 bis of the Consolidated Law on Finance, that the accounting information in this press release corresponds to the document results, books and accounting entries.

Following the amendment of paragraph 5, art. 154-ter of the legislative decree no. 58 of 24 February 1998, the obligation for the listed issuers to publish the Interim management statements was removed, while Consob was empowered to compel, with an own regulation, the publication of recurring additional financial information. As of today the regulation has not been issued yet.

From the third quarter of 2016, consistent with the changes in the applicable regulatory framework, Assicurazioni Generali decided to develop its quarterly financial disclosure, through a more concise presentation of its business, more closely focused on more significant financial and income information.

The Group used the option provided for under art. 70, paragraph 8, and art. 71, paragraph 1-bis of the Issuers’ Regulations to waive the obligation to publish the information documents provided for in relation to significant mergers, de-mergers or capital increases by contribution of assets, acquisitions and disposals.

DEFINITIONS AND GLOSSARY5

Gross written premiums = Equal to gross written premiums of direct business and accepted by third parties.

Gross direct premiums = Equal to gross written premiums of direct business.

Annual Premium Equivalent (APE) = It is an indicator of volumes of life segment, annual and normalized, and it is equivalent to the sum of new annual premium policies, plus a tenth of premiums in single premium policies (net of the portion attributable to minority interests).

New business value (NBV) = It is an indicator of new value created by the new business of life segment. Is obtained by discounting at the date of new contracts the corresponding expected profits net of the cost of capital (net of the portion attributable to minority interests).

New Business Margin (NBM) = It is a performance indicator of the new business of life segment, equal to the ratio NBV / APE.

Net cash inflows = It is an indicator of cash flows generation of the life segment. It is equal to the amount of premiums collected net of claims and benefits paid (outflows) of direct insurance business.

Combined Ratio (COR) = It is a technical performance indicator of the P&C segment, calculated as the weight of the loss ratio and the acquisition and general expenses (expense ratio) on the earned premiums.

Current accident year loss = It is a further detail of combined ratio calculated as the ratio between: current year incurred claims + related claims management costs net of recoveries and reinsurance; and earned premiums net of reinsurance.

Previous accident year loss = It is a further detail of combined ratio calculated as the ratio between: previous year incurred claims + related claims management costs net of recoveries and reinsurance; and earned premiums net of reinsurance.

Solvency II Regulatory ratio = defined as the ratio between the Eligible Own Funds and the Group Solvency Capital requirement, both calculated according to the definitions of the SII regime. Own funds are determined net of proposed dividend. The ratio at 30 June 2016 has to be intended as preliminary since the definitive Regulatory Solvency Ratio will be submitted to the supervisory authority in accordance with the timing provided by the Solvency II regulations for the official reporting.

Economic Solvency ratio = defined as the ratio between Eligible Own Funds and the Group Solvency Capital requirement, both calculated applying the internal model also to all the companies for which at present the authorization was not obtained yet.

Equivalent consolidation area = Refers to equivalent consolidation scope.

Equivalent terms = Refers to equivalent exchange rates and equivalent consolidation scope.

Operating result = obtained by reclassifying the components making up earnings before tax in each line of business on the basis of the specific characteristics of each segment, and taking account of recurring expense of the holding. All profit and loss items were considered, with the exception of net non-operating costs, i.e., results of discontinued operations, corporate restructuring costs, amortisation of portfolios acquired directly or through acquisition of control of insurance companies or companies in the holding and other activities segment (value of business acquired or VOBA) and other net non-recurring costs. In the Life segment, the following are also considered as non-operating items: realized gains and losses on investments not considered in determining profits attributed to policyholders and net measurement losses that do not contribute to the formation of local technical reserves but exclusively in determining the deferred liability to policyholders for amounts not relating to policyholders and those on free assets. In the P&C segment, the following are considered as non-operating items: all realized and measurement gains and losses, including exchange-rate gains and losses. In the holding and other activities segment, the following are considered as non-operating items: realized gains and losses and non-recurring net measurement losses. The total operating result does not include non-operating holding costs such as interest expense on borrowings and costs arising from parent stock option plans and stock grants.

Operating return on equity = an indicator of return on capital in terms of the Group operating result adjusted related to the Group shareholders’ equity.

For a description of the alternative performance measures, please refer to the Methodological Note of the Group Annual Integrated Report.

1 Changes in premiums, net premium income and Annual Premium Equivalent (APE) are presented in equivalent terms (at constant exchange rates and scope of consolidation).

2 The annualised operating RoE is calculated as the sum of the last four quarterly Operating RoEs.

3 The ratio has been submitted to the supervisory authority in accordance with the timing provided by the Solvency II regulations for the official reporting and it represents an update of those disclosed on March 18, 2016.

4 The “Holding and other activities” segment includes the activities carried out by the Group companies in the financial advisory and savings products sectors (financial segment), the costs incurred for the management, coordination and financing of the business, and other activities that the Group considers subsidiary to its core insurance business.

5 The alternative performance measures illustrated in the financial statements are compliant to the ESMA “Alternative Performance Measures (APM) Guidelines”, effective from 3 July 2016. The Group APMs are in effect compliant and reconciliable with the applicable reporting framework. In particular the new business indicators of the Life segment are connected with the emedded value, indicator of the estimated future cash flows, included in IFRS 4 “Insurance contracts”.

LIST OF ANNEXES

Additional key data by segment

LIFE

Operating result by country

PROPERY&CASUALTY OPERATING RESULT

Operating result by driver

Information on significant transactions with related parties

With reference to transactions with related parties, in accordance with the provisions of paragraph 18 of the Procedures relating to transactions with related parties approved by the Board of Directors in 2010 and subsequent updates, it should be noted that:

(i) no significant transactions were concluded during the reporting period and

(ii) no transactions with related parties having a material effect on the financial position or results of the Group were concluded.

Further details on related party transactions can be found in the related section of the Consolidated half yearly financial statements.

For more info: Report Archive