Investing in Generali

Investing in Generali means investing in one of the largest global insurance and asset management player which aims to pursue Excellence

Established in 1831, the Group is present in over 50 countries in the world, with a total premium income of € 95.2 billion in 2024.

With around 87,000 employees serving 71 million customers, Generali has a leading position in Europe and a growing presence in Asia and Latin America. At the heart of Generali’s strategy is its Lifetime Partner commitment to customers, achieved through innovative and personalised solutions, best-in-class customer experience and its digitalised global distribution capabilities.

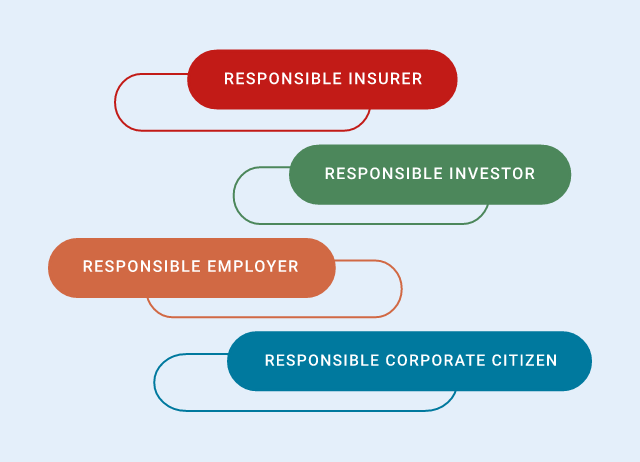

The Group has even more integrated sustainability a positive impact on profit, on people, and on the planet by supporting a green and just transition and fostering societal resilience, acting as a Responsible Insurer, Investor, Employer, and Corporate Citizen.

On January 30th 2025 Generali launched the Group’s new three-year strategy Lifetime Partner 27: Driving Excellence.

Further information can be found in the page dedicated to the Investor Day.