12 February 2024

HealthTech, progressively reshaping the insurance industry

How insurers can boost wellness and prevention, cut costs, and enhance customer experience thanks to digital healthcare technology

What is HealthTech?

Healthcare technology, or “HealthTech,” refers to the use of technology to enhance the delivery, payment, and consumption of healthcare services. It encompasses a broad range of products, services, and methods such as telemedicine, health Apps, wearable devices, and more.

An unprecedented growth

Thanks to smartphones and widespread internet access, health information and services are now directly into the houses and hands of consumers.

Moreover, in the last decade an unprecedented influx of investments in HealthTech has been witnessed worldwide – especially as the COVID-19 pandemic unfolded in 2020, when the industry witnessed a surge to $28.5 billion, underscoring the sector's pivotal role during the crisis.

Subsequent years saw a contraction in investments, but still consistent with the overall VC market trend, also demonstrating the maturity reached by the sector.

HealthTech and the insurance industry

From an insurance industry's perspective, HealthTech can be seen as both a challenge and an opportunity. The challenge lies in adapting to the rapid pace of technological change as well as processes, procedures, and ways of working of insurance companies and their distributors.

However, HealthTech presents also immense opportunities, so far largely unexploited: by leveraging data from HealthTech applications, it is possible to gain deeper insights into patients’ health, leading to more accurate risk assessments and personalized insurance solutions.

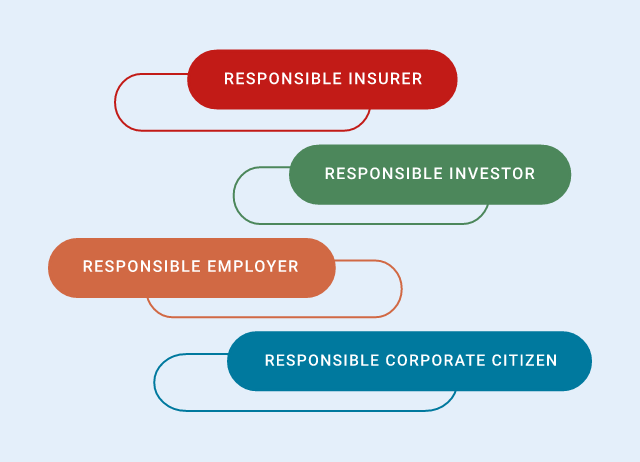

As a Lifetime Partner, customer-focused and data-driven innovator, Generali is committed to making people’s lives safer, and this set of technologies is an asset to achieve that goal – especially in three areas:

- Wellness and prevention: focusing on strategies to prevent illnesses and health issues;

- Cost reduction: seeking opportunities to lower the costs associated with medical treatments, both for customers and the insurance company reimbursing them;

- Enhanced customer experience: improving the overall customer journey by providing a more efficient and smoother clinical pathway, thereby fostering greater customer loyalty.

Wellness and prevention

Among other initiatives, the Group has launched Generali Engagement Solutions (former Generali Vitality): a fully digital programme, in partnership with South African insurer Discovery, to help customers monitor and improve their health and fitness status, leveraging incentives such as coupons on products and services from partners as well as discounts on related insurance products, all through a dedicated App.

This is part of Generali’s commitment as a Responsible Business to encourage a healthier and more active lifestyle. In fact, a study conducted by Discovery showed how the risk profile of people that started to exercise thanks to this programme changed significantly, delivering e reduction in morbidity of 14%, and even of 69% in mortality rates, ceteris paribus.

Cost reduction

Besides promoting prevention, HealthTech solutions also enable insurers to reduce costs. Telemedicine / teleconsultation services, for instance, allow customers-patients to consult with healthcare professionals remotely, saving on travel expenses, time and, often, related consultation costs.

An example of that is the My Clinic telemedicine service, developed by Europ Assistance and offering remotely to clients a certified symptom checker, GP/specialist visits together with virtual medical patient records.

Next to teleconsultation, remote monitoring tools - especially for chronic conditions like diabetes or heart diseases - can enable continuous monitoring without the need for frequent, unnecessary, and expensive hospital visits.

Enhanced customer experience

HealthTech is playing a crucial role in improving the patient experience in the healthcare sector. Not only do these advancements make the healthcare journeys more efficient and patient-centred, but they also provide insurers with the opportunity to build stronger relationships with their customers, by offering improved healthcare experiences, while cutting some of the related costs.