Principles of the Remuneration Policy

Our Policy is founded on clear and shared principles that guide compensation programmes and the actions that ensue:

We are convinced that by drawing inspiration from these principles, our remuneration systems can be a key element for attracting, developing and retaining talent and key people with critical skills and high potential as well as engaging all employees, thereby promoting a correct approach in aligning their performance with Company results and building the premises for solid and sustainable results over time.

Equity and Consistency

- The Remuneration is set in line with local laws and regulations, the provisions of national and Company collective agreements, and must be fair with respect to the duties and responsibilities assigned to the person, the roles held, and the skills and capabilities demonstrated;

- Generali is committed to promoting equal treatment and pay equity across genders fostering a culture based on meritocracy and equity, where equal work or work of equal value are matched by equal pay;

- Generali promotes fair remuneration practices, ensuring employees’ compensation can meet their needs adequately in light of national economic and social conditions;

- The principles of equity and consistency, with respect to position and task performed, shape the composition of remuneration packages, defined by calibrating the different forms of remuneration, also taking into account best market practices.

Alignment with the Strategy and Long-Term Sustainable Value Creation

- Remuneration structures, calibrated based on the relevance of the role, are a fundamental tool for aligning our people’s conduct with corporate strategies to support strategic achievement of financial (risk-adjusted) and non-financial results (including sustainability);

- Remuneration practices are strategically designed, and calibrated based on the relevance of the role, to align employee results, actions, and behaviours with the interests of investors, shareholders, and clients, thereby enhancing value creation;

- Remuneration structures adopt an approach aimed at ensuring the integration of sustainability risks.

Competitiveness with Respect to Market Trends and Practices

- Remuneration structures are continually updated, following constant monitoring of the latest market practices and trends. This includes adjustments in Pay-Mix, remuneration levels, and systems to ensure compliance with specific local and business regulatory requirements and alignment with effective market and specific business practices.

Merit and Performance-Based Reward

- Merit is a key factor in Remuneration Policies and is valued based on several elements:

- definition of a reward process that sets a link between remuneration and actual results achieved over time assessing it at Group, Business Unit, and individual level, as appropriate;

- assessment of conduct, considering not only results, whether financial (risk-adjusted), economic or operational, but also the behaviours demonstrated to achieve them and their consistency with Corporate values;

- time perspective assessing performance not only yearly, but also on a long-term basis;

- transparency of the meritocratic structures to promote equity and coherence;

- periodic performance check to consider feedback on trends and facilitate alignment.

Compliance

- Rigour, independence, and accountability are the founding elements of the governance system which involves both the corporate bodies, part of the Company Management, and the Key Control Functions;

- Regulatory compliance, alignment with the business strategy, and corporate values guide the processes and roles to define, approve and implement Remuneration Policies.

The Generali Group has set up a governance process that involves both the corporate bodies and part of the Company management and the Key Control Functions, with the aim of defining, regulating, implementing and managing remuneration policies.

Furthermore, the Group pays special attention to the governance processes related to the members of the Global Leadership Group (GLG) who represent the approximately 200 roles with the greatest Group organisational weight and impact on the results and the process of rolling out, cascading, implementing and guiding the strategy and transforming the business.

To learn more about our policy on remuneration and related compensation information for the top management, refer to the Report on Remuneration Policy and Payments.

The remuneration package for top management

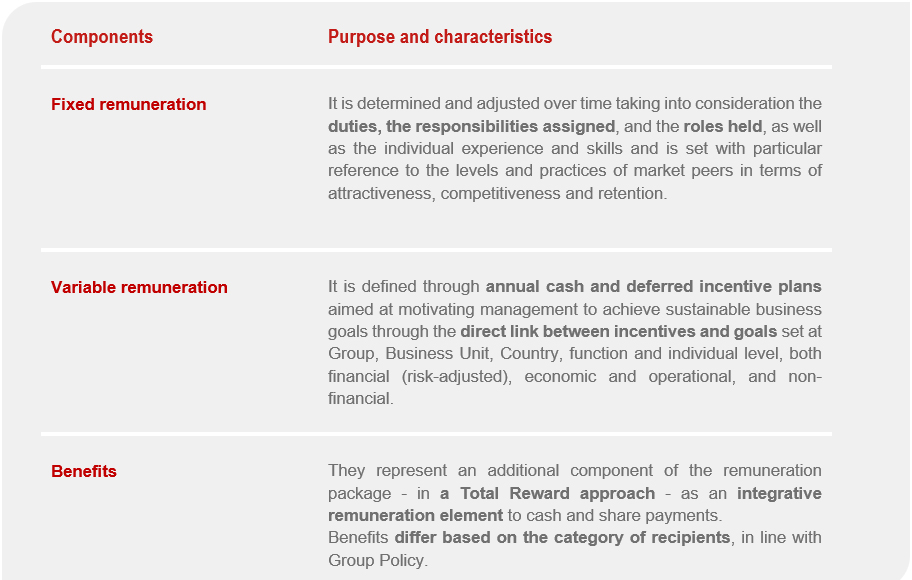

The remuneration package is comprised of fixed remuneration, variable remuneration and benefits, structured in such a way as to ensure a proper balance of the components. Generali regularly performs structural analyses of the systems, in order to ensure a fair equilibrium of the various components and to foster the persons' commitment to achieving sustainable results.

In particular:

- the remuneration package is clearly defined in order to guarantee a balance between fixed remuneration and variable remuneration, as well as to encourage the achievement of sustainable long-term results;

- the remuneration package is structured as a whole to ensure balance between the requirement to adequately incentivise the achievement of the best results in the interest of the Group and, at the same time, to guarantee, through the adoption of a series of precautions and safeguards, a healthy and prudent management, in accordance with the relevant regulatory framework;

- the “target” remuneration package is defined with the aim of maintaining a competitive level between median and upper quartile of the specific reference market, with the individual positioning linked to the evaluation of performance, potential, and strategic role, according to a segmented approach;

- variable remuneration is defined through annual cash and deferred share-based incentive plans, tied to individual and Group performance indicators, which also take into account the sustainability requirements, also in terms of the risks undertaken;

- the structures of the incentive plan provide access thresholds related to the Company's financial situation and risk management, as well as risk indicators and malus and clawback mechanisms and prohibitions on hedging;

- the expected performances are clearly defined through a structured and explicit system of performance management;

- the variable component (including an annual cash and a deferred in shares component) is as a whole:

- made up of at least 50% of shares;

- structured according to percentages and deferral periods differentiated by cluster of beneficiaries.

The variable remuneration

As in past years, the annual cash component of the variable remuneration consists in the so-called Short Term Incentive (STI), based on an annual performance assessment period and which provides for the payment of a cash remuneration upon the achievement of predefined goals.

The annual incentives system for the top management (excluding personnel belonging to Key Functions), aims at aligning the incentive with the actual performance of both individual recipients as well as the Group as a whole, through four rigorous process phases articulated in the definition of:

- the Group Bonus Pool, linked to the level of achievement of Group Normalised Adjusted Net Result and Group Operating Result and subject to prior verification of the Group Gate mechanism;

- Individual Performance, determined in accordance with predefined and measurable financial (risk-adjusted), economic and operational, and non-financial goals within the individual Balances Scorecards (BSC);

- the Individual Performance Calibration process in relation to the overall performance distribution, the reference context and compliance assessments;

- the Payout and individual cash allocation.

Generali's deferred variable remuneration consists in multi-year plans (so-called Long Term Incentive plan - LTI) approved from time to time by the competent bodies. Starting from 2019, the structure of the LTI plans provides for a share allocation system with deferral and lock-up periods over a time frame of 6-7 years, depending on the population of reference.

The 2025-2027 LTI plan has a structure and mechanisms that are consistent with those of the previous year, with revisions to the performance indicators, the related thresholds and target levels, and the percentage weight to reflect the reference context and are in alignment with and in support of the Group's strategy, specifically considering:

- maintaining the 3-year relative Total Shareholder Return (rTSR) (with a confirmed weight of 55%) as a fundamental indicator of performance for shareholders, confirming the threshold and target level for the allocation of shares starting from the median positioning with respect to the comparative insurance peer panel, to further link incentives to shareholders’ interests;

- maintaining the cumulative 3-year Net Holding Cash Flow (NHCF) (with a confirmed weight of 25%) as driver of the cash generation, being also an indicator not impacted by the implementation of the new accounting standards (IFRS 9 and 17);

- maintaining internal and measurable ESG goals (with a confirmed weight of 20%) linked to the Generali 2025-2027 Climate & People Strategy, with focus on:

- CO2 Emissions Reduction Target from Group Activities: underlining the strategic role of sustainability in every business action with the inclusion of enhanced targets in line with the Group’s commitment to Climate Strategy;

- People Engagement Rate: reaching and maintaining an Engagement Rate above the external market benchmark is one of the Group’s strategic commitments to the market and lies at the heart of our People Strategy, confirming how engaged People are the Group’s core asset to successfully deliver our Strategy and sustain our cultural and organisational transformation

The remuneration of Heads and First Reporting Managers belonging to the Key Control Functions is structured in line with market practices and regulatory requirements.

Remuneration consists of fixed remuneration, a variable remuneration linked to participation in a specific deferred cash incentive plan, as well as additional benefits in line with the Group Policy.

Remuneration and sustainable performance

Sustainability for Generali

Our journey towards sustainability is rooted in the fundamental principle of embedding long-term value creation for all stakeholders and society at large. With the launch of the new “Lifetime Partner 27: Driving Excellence” strategy, Generali reaffirms its ambition to deliver profitable growth with a positive impact on people and the planet, while continuing to act as a responsible player. The aim is to strengthen its position with an enhanced sustainability value proposition. This will be supported by a range of updated targets focused on the green and just transition, as well as societal resilience. The Human Safety Net’s expertise will also be leveraged to assist the most vulnerable communities.

Generali stands firm in its role as a Responsible Insurer and Investor, weaving sustainability into the very fabric of our core business. As a Responsible Employer, we champion an inclusive workplace, prioritising the well-being and growth of our employees, while also committing to reducing greenhouse gas emissions from our own operations. This commitment is equally reflected in our role as a Responsible Corporate Citizen, where our engagement with communities reinforces our strategic intent. Underpinned by robust governance, comprehensive policies and guidelines, and reliable integrated reporting, our sustainability journey is both meaningful and accountable. The integration of sustainability into management remuneration is a key step in strengthening the link between company/individual performance and sustainability. This is made possible by drawing on a panel of strategic sustainability goals that reflect the priorities of the “Lifetime Partner 27: Driving Excellence” strategy.

Over the years, the commitments made and the results achieved by the Group have led to improved ratings from leading agencies specialising in sustainability performance analysis as well as to the Group's inclusion in key international sustainability indices. In particular, in November 2024 MSCI ESG reaffirmed Generali's "AAA" rating, the highest possible, for the third consecutive year. Moreover, Generali has been included for the seventh year running in the Dow Jones Best-in-Class World index and for the sixth year in the Dow Jones Best-in-Class Europe Index.

Sustainability Goals in the Remuneration Policy

In line with industry regulations and market recommendations, Generali’s remuneration structure is in continuity with the progressive improvements on decisions made last year, reinforcing, on the one hand, an incentives system that continues to be focused on sustainability issues and, on the other, data-driven performance evaluation models.

The variable component of the remuneration is based on a meritocratic approach and on a multi-year horizon, including an annual cash component and a deferred component in shares, based on the achievement of a combination of sustainable business goals and the direct link between incentives and results set at Group, Business Unit, Country, function and individual level, both financial (risk-adjusted), economic and operational, as well as non-financial.

The goals are predefined, measurable, linked to the achievement of economic, operational, financial and non-financial results. In line with our Group strategy, the performance goals consider the risks undertaken and are assessed not only with respect to the achievement of predefined and measurable targets, but also considering the demonstrated behaviours to achieve them and their coherence with Group values.

Since the 2023 Group Remuneration Policy there is a focus on internal and measurable non-financial and sustainability KPIs in the Group incentives system, in line with market recommendations and the “Lifetime Partner 27: Driving Excellence” Group Strategy. In particular, the updates pertaining the Policy itself include:

Gender Balance & Pay Equity

In alignment with the Group strategy on Diversity, Equity and Inclusion (DEI), Generali's Remuneration Policy supports specific initiatives and ambitions and promotes pay equity across genders.

These actions are aimed at ensuring equal opportunities and equal treatment for all Group employees during their work experience, eliminating any institutional barriers or unconscious biases, and recognising people's diverse circumstances and needs so that they can fully contribute to the success of our Group.

In this respect, since 2020 our policies, analyses, and actions have been focused on applying clearly measurable and comparable metrics throughout the entire Group and on reducing the base salary gaps by analysing and comparing males and females doing the same work or work of equal value (Equal Pay Gap) and by observing this gap throughout the organisation (Gender Pay Parity Gap).

During 2024, Generali's ongoing commitment to this path led to further progress in our pay equity journey, culminating in the successful achievement of our strategic target of zeroing the Equal Pay Gap on base salary (0.35%). To ensure continuous improvement, we have strengthened our data-driven methodologies, consolidating our multiple regression-based analytics model in collaboration with PayAnalytics. We have also maintained a strong focus on monitoring the Gender Pay Parity Gap and the Accessibility Gap to variable remuneration, enabling the identification of targeted actions at the local level.

In line with our Group strategy on DEI, all Countries/Business Units continue to monitor the pay gaps annually, with the goal of identifying specific actions aimed at structurally reducing disparities and sustaining our long-term commitment to equitable remuneration for all employees.

Share Plan for Generali Group Employees

In order to promote a meritocratic environment that fosters alignment with strategic goals and people’s participation in the value creation process, in 2019 Generali developed and launched We SHARE, the first Share Plan of its kind for Group employees. Based on the high employee participation in the first edition of the Plan and to further promote our culture of ownership, in April 2023 the Annual General Meeting approved a new Plan with ~90% of favourable votes.

In continuity with the previous edition, the “We SHARE 2.0” Plan provides employees1 with the opportunity to purchase Generali shares at favourable conditions within a protected framework, awarding them additional free shares in case of share price appreciation.

In this second edition, with the aim to embed the Group’s climate strategy objectives and to make the new Plan more effective with respect to the current market context, some enhancements have been introduced:

- the introduction of an Environmental Social Governance (ESG) goal connected to the CO2 emissions reduction;

- the allocation of additional free shares linked to the new ESG goal;

- the broadening of the exercise period, assessing the share price appreciation condition up to 3 times instead of 1;

- the allocation, in case of share price depreciation, of free additional shares linked to the dividends distributed, if the Net Holding Cash Flow (NHCF) goal is reached.

The Plan, having a duration of indicatively 3 years, was launched in June 2023 and offered to over 68,000 people in 34 countries. More than 23,400 Generali employees joined the Plan with a global take-up rate of almost 35%2. This extremely high rate of participation and commitment is strong evidence of the enthusiasm and sense of belonging of Generali employees towards their company and its strategic vision. It is a clear indication that Generali people positively received the enhancements introduced in this edition to make the Plan more effective with respect to the market context and the link with the ESG Goal of decarbonising Generali’s operations.

Also in this second edition, Generali renewed its support to The Human Safety Net Foundation, by making a donation for each employee joining the Plan, and participants have the opportunity to do the same. Overall, more than € 380,000 have been donated to further support the financial education project addressed to families living in vulnerable circumstances, launched in the first edition of the Plan. This is a demonstration of the Group’s commitment towards the shared purpose of enabling people to shape a safer and more sustainable future by caring for their lives and dreams.

This initiative is a tangible sign of Generali’s drive to promote across the Group employee commitment towards the achievement of strategic objectives, a culture of ownership and empowerment, and their participation in Group sustainable value creation.

For more details about the Share Plan for Generali Group Employees, click here.

1 Excluding members of the Group Management Committee and the Global Leadership Group.

2 Equal to 34% when considering the updated Group perimeter, and 35% on a like-for-like basis compared to the previous edition.

People Engagement & Caring

In Generali, we fully acknowledge the importance of providing a working environment that addresses the engagement, health, and wellbeing of our employees as an important part of our organisational culture and identity.

We believe that everything is possible for people who are engaged, believe in a common purpose, operate in an environment that can nurture their passion, and have the ambition to succeed in everything they do. From this perspective, Generali wants to be a workplace where everyone feels valued, included, and empowered to face the future at their best.

To enhance our employees’ sense of belonging, making them feel more connected, supported, and closer than ever to their organisation, we commit to improving interaction through regular and active listening. This “Listening Strategy” helps us design and take action based on what matters most to our employees.

The feedback from our Generali Global Engagement Survey 2021, conducted to measure our people's engagement at the start and end of each 3-year strategic cycle, highlighted opportunities for improvement in supporting work-life balance, fostering inclusive work environments, and attracting and retaining talent. Following the Global Engagement Survey 2021, Business Units implemented more than 400 targeted local engagement initiatives. For example, regarding ways of working, the valuable insights gleaned from the Survey not only confirmed the positive reception of our existing hybrid and flexible working model but also uncovered additional opportunities to optimise its effectiveness.

Additionally, in 2022 as part of our “GPeople24 - Ready for the Next” Strategy, we introduced the Global Pulse Survey, a dynamic platform enabling ongoing employee interaction and bridging the gap between the Global Engagement Surveys conducted every three years. This approach has been upheld for the upcoming 2025-2027 strategic cycle, driven by the outstanding participation rates achieved in all previous editions. These targeted employee listening sessions across the Group aim to identify year-over-year trends and specific areas for improvement, such as our ways of working, business processes, and internal tools. The goal is to streamline employees’ daily activities, thereby enhancing their working conditions overall.

The high level of participation reflects the Group’s acknowledgment of individual feedback, as well as the tangible transformative initiatives implemented following the analysis of survey results. By actively listening, we ensure our initiatives remain relevant and impactful. The recently launched Global Engagement Survey 2024 helped identify new strategic priorities to be addressed with further engagement actions in the upcoming 3-year cycle.

As part of the Group strategic commitments to the market, our People Strategy aims to reach and maintain a People Engagement Rate above the external market benchmark1.

We continue to maintain a fruitful and open dialogue with the European Works Council (EWC) to support the transformation of our working model, primarily characterised by the implementation of the hybrid way of working. Specifically, we have engaged with the EWC in a monitoring phase to evaluate the application of the Joint Declaration on the 'New Sustainable Way of Working in a Next Normal Scenario' one year after its issuance. Trust, empowerment, and care for people are key elements highlighted in the declarations defined with the EWC over the years, alongside inclusion, equality, non-discrimination, and the right to disconnect - ensuring a balanced work-life setting for all employees.

Within our efforts to build a sustainable organisation, employee well-being has emerged as a top priority and remains essential for our employees, now and in the years to come. Currently, Generali companies have launched several initiatives aimed mainly at promoting physical health and preventive care, supporting mental well-being, fostering physical activity, and providing training on various topics such as well-being, health, and ergonomics.

Within the new People Strategy 2025-2027, the Group aims to further build on the initiatives already in place across Countries/BUs and develop a Group-wide well-being framework.

Our focusing on employee well-being demonstrates the Group’s commitment to our people and recognises the vital role it plays in sustaining engagement and achieving business success.

3 Willis Towers Watson Europe HQ Financial Services Norm.

Remuneration policy for non-executive directors and members of the supervisory body

NON-EXECUTIVE DIRECTORS

The Remuneration Policy related to all Directors without executive powers - with the exception of the Chairman, whose remuneration is detailed below - provides that the remuneration is composed of three elements: a fixed annual fee, an attendance fee for each meeting of the Board of Directors where they participate, as well as reimbursement of expenses incurred for attending the meetings.

The Shareholders' Meeting of 24 April 2025 determined that, for the three-year period 2025-2027, each member of the Board of Directors is entitled to:

- a gross annual fixed remuneration of € 100,000, with an increase of 50% for the members of the Executive Committee, if established;

- an attendance fee of € 4,000 gross for each meeting of the Board of Directors and of the Executive Committee, if established;

- the reimbursement of out of pocket expenses incurred to attend meetings and perform other activities required by their office.

Directors who are also members of Board Committees are paid fees that are additional to those already received as members of the Board of Directors, with the exception of those who are also executives of the Generali Group. The remuneration is established by the Board of Directors pursuant to Article 2389, paragraph 3 of the Italian Civil Code according to both the powers assigned to these Committees and the commitment required for participation in their work in terms of number of meetings and preparatory activities.

Furthermore, in line with regulatory legislation and international market best practices, no variable remuneration is paid to non-executive directors.

The Remuneration Policy for the Chairman of the Board of Directors provides for the payment of a fixed annual remuneration determined based on comparative analyses with similar national and international figures. Like all Directors without executive powers, the Chairman does not participate in the short- and medium/long-term incentive plans. For this figure, the Remuneration Policy of Assicurazioni Generali also provides for the allocation of some benefits such as, for example, insurance coverage for death and total permanent disability from injury or illness, as well as health care and the availability of a Company car with driver for both private and business use.

SUPERVISORY BODY

For these parties, the Policy provides for the payment of an annual fixed gross remuneration for the entire duration of the mandate, with an increase of the amount for the Chair of the Board of Statutory Auditors considering the related coordination activities. The members of the Board of Statutory Auditors may be granted an attendance fee for participating in meetings of the Board of Directors and Board Committees. There are no variable remuneration components.

The remuneration levels of the members of the Control Body are defined taking into account, among other things, the reference benchmark and the size/complexity of the Company.

The Annual General Meeting of 28 April 2023 approved the remuneration to be paid to the Board of Statutory Auditors, deciding for the remuneration payable to the Statutory Auditors at € 130,000 gross per year, for each of the financial years 2023, 2024 and 2025 and € 180,000 gross per year for the Chair of the Board of Statutory Auditors considering the related coordination activities. Moreover, the members of the Board of Statutory Auditors receive an attendance fee of € 500 for participating in meetings of the Board of Directors and Board Committees.

The members of the Body are reimbursed for expenses incurred while exercising their functions and the coverages of the D&O insurance policy as illustrated below.

For more details about the remuneration tables of the Administrative and Control Bodies, General Managers and other Managers with Strategic Responsibilities, click here.

Download Documents

2025