GENERALI GROUP CONSOLIDATED RESULTS AT 31 DECEMBER 2016 - Press release (1)

16 March 2017 - 07:30 price sensitive

EXCELLENT 2016 RESULTS, DIVIDEND PER SHARE 11.1% HIGHER

Acceleration on cost savings and improved performance in all markets driven by successful execution of strategic plan

- Record operating result, more than €4.8bn with excellent Life (+5.5%) and P&C (+2.9%) trends, thanks to improvements in technical performance and even greater discipline on Opex costs, decreasing for the first time

- Operating RoE at 13.5%, reconfirmed in line with target (>13%)

- Market leading P&C technical profitability, improvement in CoR to 92.5% (-0.7 p.p.), reconfirmed as the best amongst peers. Further improved performance of Life profitability with NBM growing at 25.9%

- Gross premiums above €70bn: P&C up (+2.1%), continued disciplined approach in Life (-6.3%), confirmed by the high quality of life net inflows, above €12 bn

- Net profit up to €2.1 bn (+2.5%), notwithstanding lower realized gains

- Dividend per share of €0.80 (€0.72 FY15) an increase of 11.1%

- Significant increase in cash generation: Net Operating Cash at €1.9bn

- Solid capital position confirmed: Regulatory Solvency ratio at 177%; Economic Solvency ratio at 194%

- Acceleration to 2018 from 2019 of targeted €200mln net Opex cost reduction in mature markets

The Generali Group CEO, Philippe Donnet, affirmed: “Our excellent 2016 results confirm that Generali is an industry leader in terms of profitability and performance. These results demonstrate our ability to deliver on our commitments. Operating result and cash generation are the highest ever, driven by further improvements in the performance across the whole group. In Life, the net inflows are very strong, with high margins thanks to a successful focus on the business mix. In P&C we improved our already best in class combined ratio. Thanks to a tighter focus on the efficiency of our operating machine, we reduced costs for the first time and we will now deliver our 2019 savings target on mature markets one year ahead of plan.

I am encouraged by Generali's progress in the last year. We are already seeing the early results of our “Simpler, Smarter. Faster” Plan, announced in November 2016. We will build further on these achievements and we have the best possible team to accelerate the execution of our current strategy. Moreover, Generali can count on a unique distribution model of more than 150 thousand dedicated agents and salespeople around the world, who ensure a closer relationship with clients based on trust, expertise and understanding. This, together with the unparalleled level of pride and passion of all Generali employees, is an incredible asset which underpins our success at all times.

We are proud of these results, but we consider them only a first step in a journey to become the best insurance company for clients, distributors, employees and investors and we look to the future with confidence, as an independent, Italian, international group. In the light of our excellent results and the solid capital position of the Group, we have recommended a dividend of €0.80 an increase of 11.1% over the previous year”.

Milan - At a meeting chaired by Gabriele Galateri di Genola, the Generali Board of Directors approved the consolidated financial statements and the Parent Company’s draft financial statements for the year 2016.

EXECUTIVE SUMMARY

The Group closed the year 2016 with excellent results which confirms the strength of its strategy and effectiveness of its implementation. The operating result has reached the best performance ever, thanks to the strong performance of both Life and P&C segments, driven by further improved technical performances and even greater discipline on Opex costs, while the net profit and dividend are the best of the last 9 years.

In spite of a challenging macroeconomic environment and low interest rates, the actions undertaken by the Group have resulted in: excellent operating income, which remains above target; technical profitability, which steadily improved and constant diligence on cost management – for the first time decreasing almost by €70mln – which will allow the acceleration to 2018 from 2019 of targeted €200mln2 cost reduction. The Group also produced an increase in product profitability, and confirmed its capital strength.

The Group’s operating result reached €4,830 million (€4,785 mln FY15), up by 0.9% thanks to further improvements both in Life (+5.5%), benefitting from good technical performance despite the financial market environment, and in P&C (+2.9%) due to a continued improvement of the Group’s CoR.

Operating RoE, the main profitability target, stood at 13.5% (14% FY15), meeting the strategic objective for the third consecutive year (>13%).

Thanks to improvements in the operating performance, the net profit rose to €2,081 million (+2.5%; €2,030 mln FY15). This net profit increase has been achieved despite planned lower realized gains in line with the strategy of preserving future profitability and is a testament to the quality of the results.

On the production side, gross written premiums amounted to € 70,513 million (-3.9%; €74,165 mln FY15). The P&C segment improved (+2.1%), confirming the trend already observed during the year, while the Life segment amounted to €49,730 million (-6.3%; €53,297 mln FY15), reflecting both a disciplined approach on products, aiming to optimize the return on invested capital, and the current performance of financial markets.

This disciplined approach is reflected by the excellent quality of life net inflows, surpassing €12 bn (-18.5%), higher than the average of the last 5 years and the best amongst peers. New production in terms of APE amounted to €4,847 million (-6.6%). With reference to the business lines, considerable improvement was recorded in protection policy products (+12.4%). At the same time, there was a decline in both unit-linked business (-11.3%), due to market volatility, and in the savings business (-9.7%), because of the unfavourable financial situation and due to the Group’s planned actions to carefully recalibrate guarantees. Thanks to the effective execution of the strategic plan, the new business value (NBV) improved significantly to €1,256 million (+14.6%), driven by a higher new business margin (NBM) of 25.9% (21% FY15). This improvement in profitability is thanks to the effective recalibration of the business mix towards protection policy products and recalibration of guarantees, and helped to counteract a deterioration in the economic environment against the previous year.

In the P&C segment, premiums grew by 2.1% on a like for like basis to €20,783 million (€20,868 mln FY15), thanks to the growth recorded in the Motor line (+4.3%) as well as in the Non motor line (+0.5%). High technical profitability was confirmed in the P&C business, with a combined ratio further and constantly improving to 92.5% (-0.7 p.p.), the best ratio amongst our peers, thanks to the decline in the loss ratio.

These results are accompanied by a strengthened capital position which the Group continues to hold in a sharp focus. Shareholders’ equity grew 4.2% to €24.5bn, mainly benefitting from the net profit of the period that offsets the dividend distribution.

The Regulatory Solvency Ratio - that represents the regulatory view of the Group’s capital and considers the use of the internal model solely for the companies for which IVASS approval was obtained and for the remaining companies applying the Standard Formula - after accruing the proposed dividend - amounted to 177% (171% FY15; +6 p.p.). The 2016 ratio benefits from the internal model approval used to calculate the Solvency Capital Requirement of the Life insurance portfolio in France, that in 2015 was calculated applying the Standard Formula.

The Group Economic Solvency Ratio, which represents the economic view of the Group’s capital and is calculated by applying the internal model to the whole Group's perimeter and after accruing the proposed dividend, remains stable at 194% (202% FY15; -8 p.p.) thanks to the strong capital generation that has partially offset the negative impact of the adverse economic context and to regulatory changes for the calculation of the Volatility Adjustment3.

As a result of this, as expected, the progressive convergence of the two ratios is confirmed. Its gap decreased from 31 p.p. by the end of 2015 to 17 p.p., as the process of achieving the planned expansion of the internal model application scope progresses.

Lastly, thanks to the higher dividends received from all main markets the Net Operating Cash has significantly increased by 13% to €1.9 bn. We continue towards reaching the financial target of a cumulative Net Operating Cash generation above €7bn by the end of 2018, and as of the end of 2016 a cumulative €3.5bn has been achieved.

DIVIDEND PER SHARE AT €0.80 (+11.1%)

The dividend per share to be proposed at the next Shareholders’ Meeting is €0.80, up by €0.08 cents per share (+11.1%) relative to the previous year (€0.72 FY15). The payout ratio is equal to 60%, from 55.3% in 2015.

The total dividend relating to shares outstanding amounts to €1,249 million. The dividend payment date shall be from May 24, 2017 with record date on May 23, 2017 and ex-dividend date from May 22, 2017.

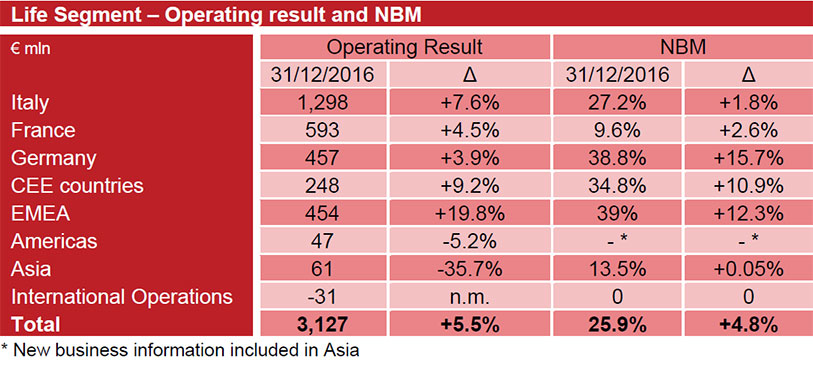

LIFE SEGMENT: EXCELLENT OPERATING RESULT PERFORMANCE, PREMIUMS IN LINE WITH THE DISCIPLINED PRODUCT STRATEGY AND LIFE NET INFLOWS AT EXCELLENT LEVELS

- Operating result at €3.1bn (+5.5%) thanks to the development of the technical margin

- Premiums at €49.7bn (-6.3%) due to the increasingly disciplined approach to our product offer

- Excellent levels of life net inflows above €12bn (-18.5%)

- New business value (NBV) up significantly (+14.6%) in line with the objective of creating long-term value. Significant increase in profitability with a NBM of 25.9%(+4.8 p.p.)

Life premiums amounted to €49,730 million (-6.3%; €53,297 mln FY15), following the increasingly disciplined approach pursued in all countries where the Group operates. With regard to the lines of business, the planned decline in savings products continues (-5.7%), by rebalancing inflows towards products with better risk/return characteristics. Unit-linked income (-10.9%) is still impacted by equity market volatility, but recovering compared to the first half of the year, while protection products (-2.8%) registered positive performances across all of the main areas of operations; the decline in Germany (-12.4%) derived from a very positive performance in 2015 in the health lines.

Life net inflows - the difference between the payments received and payouts made - is confirmed at excellent levels at €12,049 million (-18.5%; €14,920 mln FY15), above the average of the last five years and the highest amongst its peers. The decline compared to 2015 was caused by the record level of inflows achieved that year. The 2016 performance in particular reflects the decline seen in Germany, France and Italy due to a more highly selective uptake of policies for savings products, which are also subject to a significant revision to adjust to the current low-interest rate environment. The excellent performance continues in Asia, where net inflows grew by 40.7%.

New production in terms of APE is equal to €4,847 million (-6.6%; €5,210 mln FY15) due to the increasingly disciplined approach to the product offer. This performance is mainly attributable to the contraction in single premium policies (-13.4%) observed in all of the main markets except Asia (+47.8%). Annual premiums are stable (-0.5%) thanks to growth in France (+10.2%) and Asia (+34.3%).

Regarding the business lines, risk business improved significantly (+12.4%), primarily thanks to production in France (+21.7%) and Asia (+72%).

Market volatility impacted the unit-linked business (-11.3%) in all the main areas of operations, while the decline in the savings business (-9.7%) is on account of an unfavourable financial situation and to the Group’s actions for prudent management of the guarantees offered.

Despite the reduction of APE, the new business value (NBV) improved significantly (+14.6%) to €1,256 million (€1,097 mln at FY15), attesting to the effectiveness of the strategic actions put into place. In the same way, thanks to the refocusing towards protection policy products business and to the effective recalibration of guarantees, the new business margin (NBM) recorded a considerable growth of 4.8 p.p., reaching 25.9% (21% FY15), even though the economic environment is worse than the previous year.

The operating result of the segment grew to €3,127 million (+5.5%; €2,965 mln FY15), thanks in particular to the increase in the technical margin (+2%) which benefits from the positive development in profitability of risk lines. The financial margin (-7.7%) reflects lower net realized gains, in line with the strategy of supporting future returns on investments.

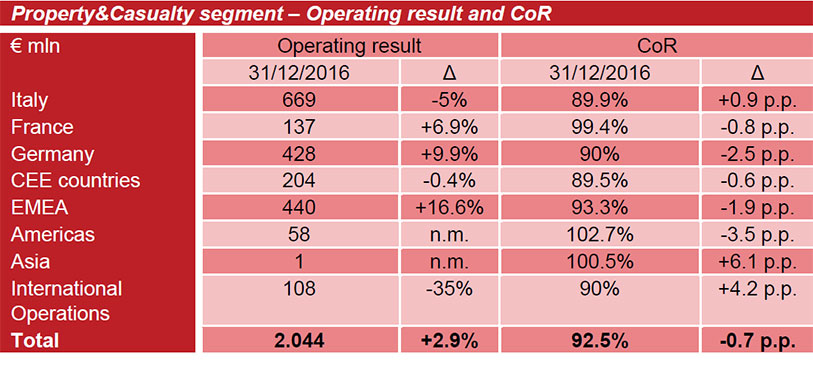

P&C SEGMENT: OPERATING RESULT UP, PREMIUM INCOME GROWTH. BEST IN CLASS COMBINED RATIO

- Operating result in continued growth, at €2bn (+2.9%) thanks to a significant improvement in the technical result (+15%)

- Premiums up to €21bn (+2.1%), driven by Motor (+4.3%)

- CoR improving significantly to 92.5% (-0.7 p.p.), thanks to the declining loss ratio (-0.8 p.p.)

The performance of P&C premiums was positive, rising to €20,783 million (+2.1%; €20,868 FY15) confirming the recovery already observed during the year. There was a sharp rise in the Motor line (+4.3%), driven by Spain (+17.8%), CEE countries (+7.1%), Germany (+2.3%) and Argentina (+43.4%), while Italy (-5.2%) continues to be impacted by both the decrease in average premiums in a highly competitive market and the termination of some large fleet contracts. France is stable. Non motor was up as well (+0.5%), benefitting from a positive general development across the countries where the Group operates, while Italy was down by 3.6%, following the decline in SME business within a highly competitive market.

High business profitability is confirmed, with an operating result up to €2,044 million (+2.9%; € 1,987 mln FY15). This is attributable mainly to the excellent performance of the technical result (+15%) and also inclusive of the impact of catastrophe claims of around €295 million (€313 mln FY15), mainly deriving from the storms and flooding that took place in France and Germany in May and June, and the earthquakes that struck central Italy in August and October.

The combined ratio (CoR) improved further to 92.5% (-0.7 p.p.), thanks to a declining loss ratio (-0.8 p.p.). There was a slight increase in the current year loss ratio excluding natural catastrophes (+0.4 p.p.) due to the deterioration of the Non motor line and an impact deriving from catastrophe claims of 1.5 p.p. (1.6 p.p. FY15). The contribution of prior year loss ratio is increasing (-5.7p.p.). The Group maintained its prudent reserving approach, confirmed by the stable reserving ratio of 155%.

The CEE countries recorded the best CoR at group level, reaching 89.5% (-0.6 p.p.) thanks to the limitation of the expense ratio (-1.3 p.p.), linked to cost reduction actions. Italy, the second best group ratio, remained at an excellent level, with a CoR of 89.9% (+0.9 p.p.), despite the increase in the expense ratio due to higher costs for fees, as the business mix has shifted towards Non motor products. The loss ratio improved (-0.6 p.p.) due to the positive performance of prior year loss ratio and the lower impact of catastrophe claims. The latter amounted to a total of €100 million, of which €56 million is linked to the earthquake in central Italy, with an impact of 1.9 p.p. (2.1 p.p. in 2015).

Germany improved significantly (-2.5 p.p.) thanks to the decline in current year loss ratio excluding natural catastrophes, the limitation of the expense ratio, reflecting cost efficiency improvement policies, and the lower catastrophe impact. EMEA improved (-1.9 p.p.) due to the decline in the loss ratio in Austria, Belgium and Spain. Technical profitability in France was also good (-0.8 p.p.).

HOLDING AND OTHER BUSINESSES SEGMENT

The holding and other businesses segment comprises the activities carried out by the Group’s companies in the banking and asset management sectors, the costs incurred in the activity of managing, coordinating and financing the business as well as other activities the Group considers subsidiary to its core insurance business.

The operating result of the holding and other businesses segment amounted to €-91 million, down compared to the €59 million at 31 December 2015. This performance was mainly caused by the financial segment, particularly the lower results of Banca Generali due to lower performance fees, as well as lower realized gains on real estate within the Other Activities. The third party assets managed by the Group banks and the asset management companies amounted to €54,877 million (+23.8%; €44,323 mln FY15). Operating holding expenses amounted to € -459 million (€ -429 mln FY15). This increase primarily reflects the development of the Regional Offices tasked with directing, coordinating and controlling the business in key areas in terms of growth opportunities.

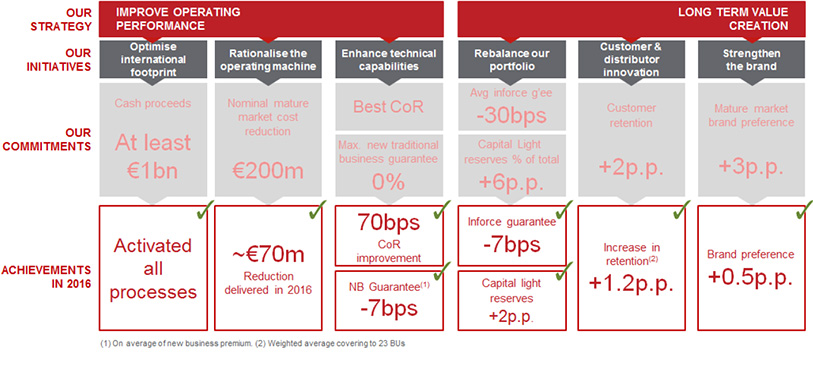

PROGRESS OF THE STRATEGIC PLAN “SIMPLER, SMARTER. FASTER” AND FINANCIAL TARGETS TO 2018

The Group is committed to the execution of the strategic plan presented at the Investor Day of November 2016. The results achieved in 2016 show that the plan is progressing as expected, with an acceleration on the €200 million nominal costs cut in mature markets by the end of 2019, that as a result has been moved one year ahead of plan.

The Group confirms the main 2018 financial targets. Regarding the target of more than €7bn of cumulative Net Operating Cash by 2018, at the end of 2016 the Group has reached €3.5bn, whereas regarding the target of €5bn cumulative dividends by 2018, at the end of 2016 the Group has reached €2.4bn. Lastly, regarding the target of an operating RoE above 13%, at the end of 2016 the Group has reached an average level of 13.8% (RoE annualised at FY16 is equal to 13.5%), calculated over the 2015-2016 period.

OUTLOOK

Within a macroeconomic and financial context characterized by low interest rates, high uncertainty in financial markets and by a constantly evolving regulatory scenario, the Group will intensify its focus on the initiatives of the Technical Excellence (TechEx) programme and cost efficiency. In the Life sector Generali aims to enhance the value of its portfolio by taking a simplification and innovation approach for the range of product solutions. Property&Casualty segment management will therefore continue to play a key role in the implementation of the strategy of the Group, which aims to become a leader in the retail segment in Europe thanks to the degree of capital absorption of those products which allows for efficient allocation. Despite the challenging macroeconomic environment and volatility of the financial markets, in 2017 the Group expects to increase shareholder remuneration, consistent with the strategic plan presented to the market.

The implementation of Long Term Incentive Plan compensation approved by the Shareholders’ Meeting in 30 April 2014

It should also be noticed that the Board of Directors exercised the power to increase, free of charge, the share capital, pursuant to article 2443 of the Italian Civil Code: said power was granted by the shareholders’ meeting on 30 April 2014 in connection with the Long Term Incentive Plan approved by the shareholders on the same date pursuant to Article 114-bis of the Consolidated Finance Act. In particular, the Board of Directors resolved, among other things, to increase, free of charge, the share capital, pursuant to Articles 2443 and 2349 of the Italian Civil Code, with effect from the material assignment of shares, for a nominal amount of EUR 1,924,724,00 through the transfer to capital of a corresponding maximum amount from the extraordinary reserve, with the issue of a number of 1,924,724 ordinary shares with a par value of EUR 1.00 each, with regular dividend, to be allocated to the beneficiaries of the aforementioned plan. The completion of this capital increase should take place within 30 April 2017, subject to the issuance of necessary regulatory approvals.

The Manager in charge of preparing the company’s financial reports, Luigi Lubelli, declares, pursuant to paragraph 2 article 154 bis of the Consolidated Law on Finance, that the accounting information in this press release corresponds to the document results, books and accounting entries.

THE GENERALI GROUP

Generali is an independent, Italian Group, with a strong international presence. Established in 1831, it is among the world’s leading insurers and it is present in over 60 countries with total premium income exceeding €70 billion in 2016. With over 74,000 employees in the world, and 55 million clients, the Group has a leading position in Western Europe and an increasingly significant presence in the markets of Central and Eastern Europe and in Asia. In 2017 Generali Group was included among the most sustainable companies in the world by the Corporate Knights ranking.

NOTE TO EDITORIAL STAFF

At 7:30 a.m. the following documents will be available on www.generali.com: press release, pre-recorded video with transcription, presentation for analysts, financial statements and other financial documents.

The Analyst Call will take place at 12.00. Journalists may listen in by dialling +39 0236009868 (listen-only mode).

The Generali corporate app offers the most recent institutional information package, which has been optimized for mobile devices. The app may be downloaded free of charge from Apple and Android stores.

GLOSSARY

Please refer to the glossary provided at the end of the Integrated Annual Report and Consolidated Financial Statement.

1 Changes in premiums, net premium income and APE are presented in equivalent terms (at constant exchange rates and scope of consolidation). Changes in operating results and own investments exclude entities sold from the comparative period.

2 Net reduction in nominal OpEx cost base in mature markets by 2019 as stated during the Investor Day of last November

3 Updated composition of EIOPA portfolio

List of annexes:

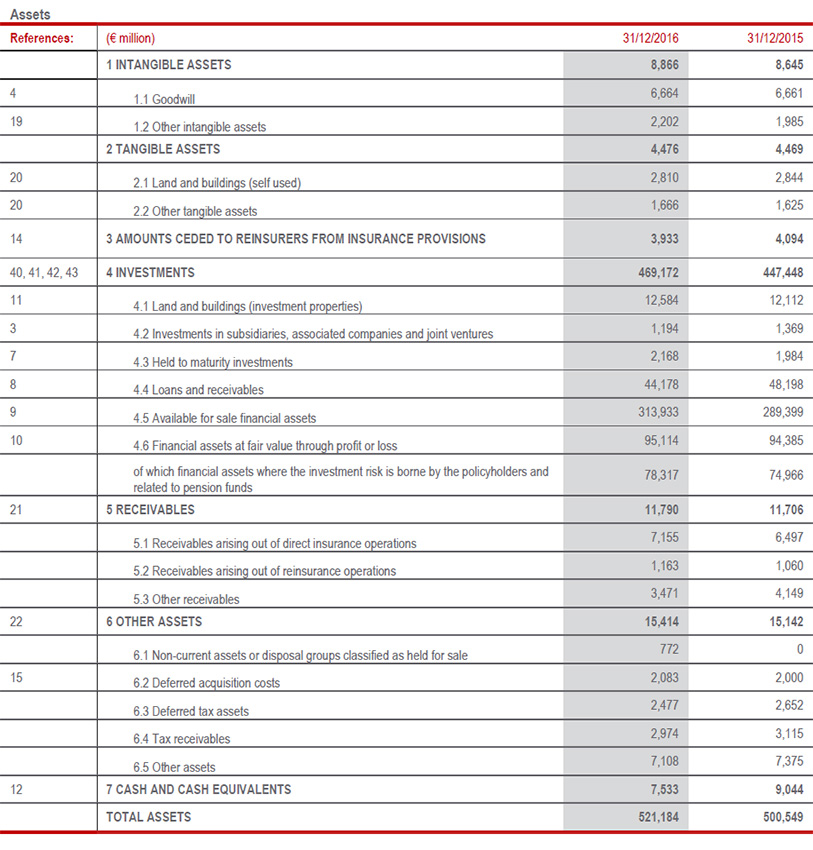

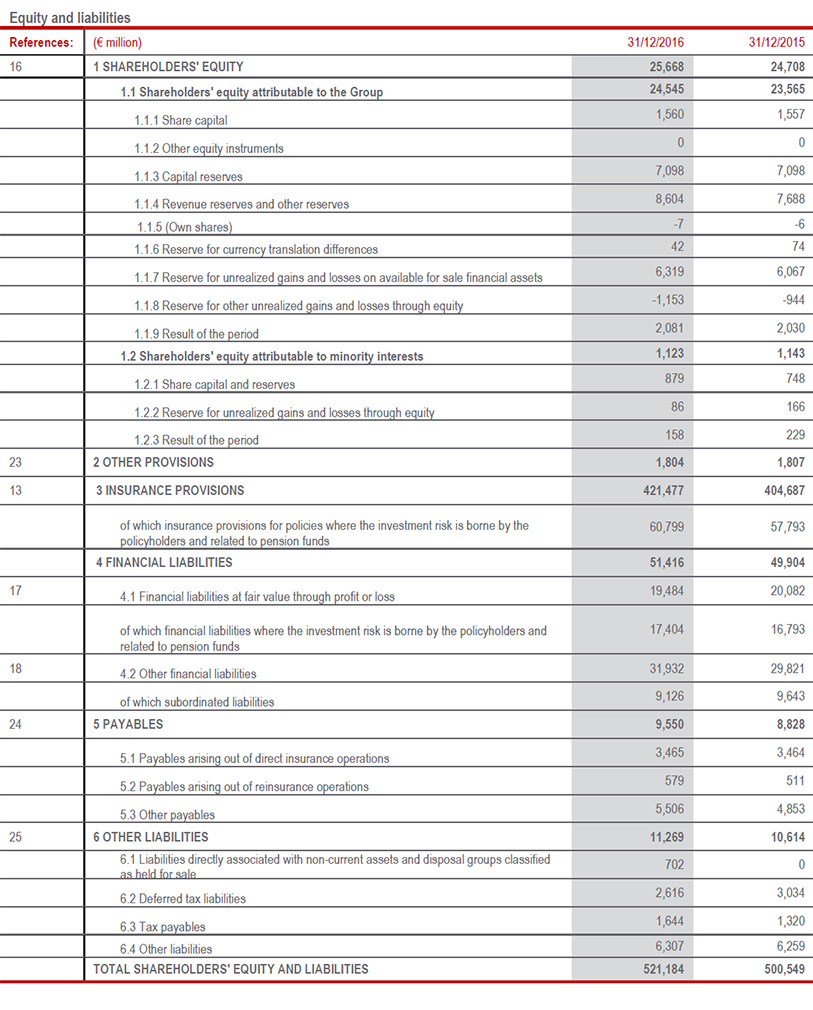

Group balance sheet and income statement

1. Group’s Balance Sheet and Income Statement

BALANCE SHEET

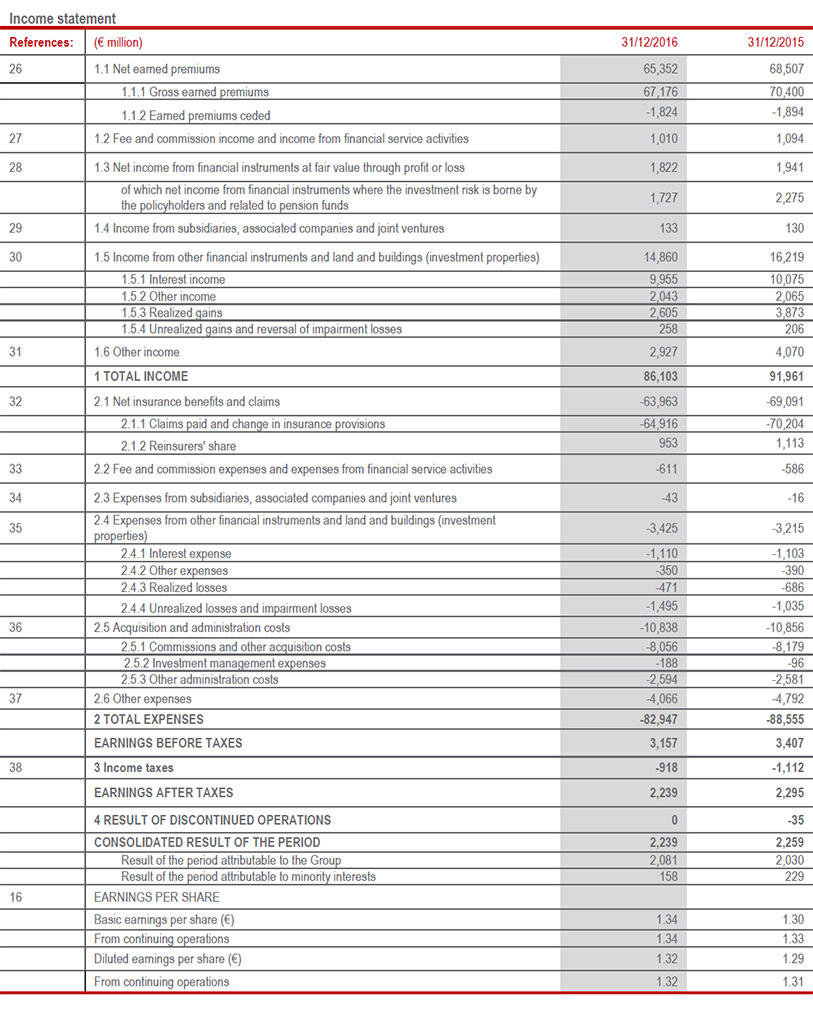

INCOME STATEMENT

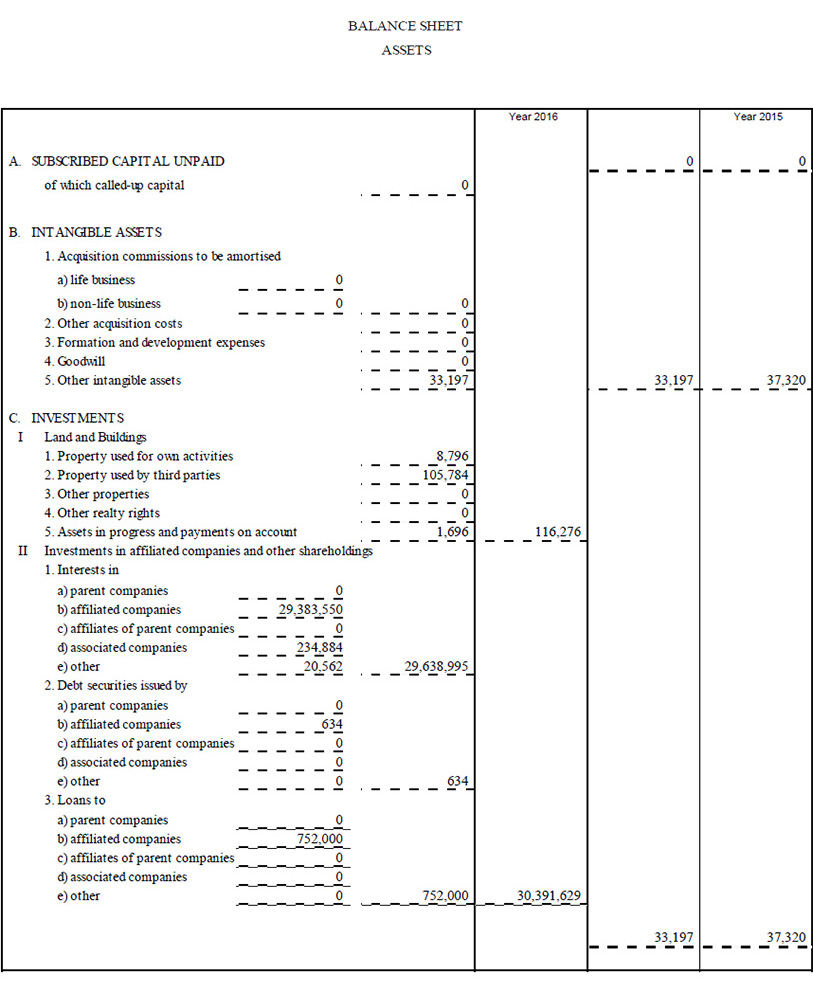

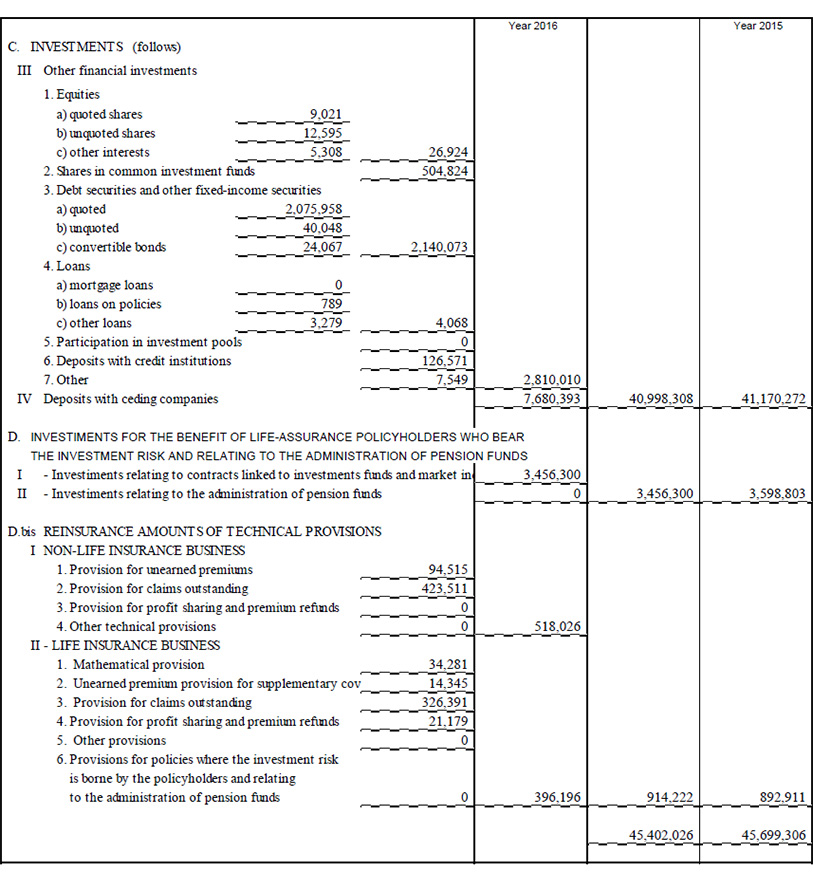

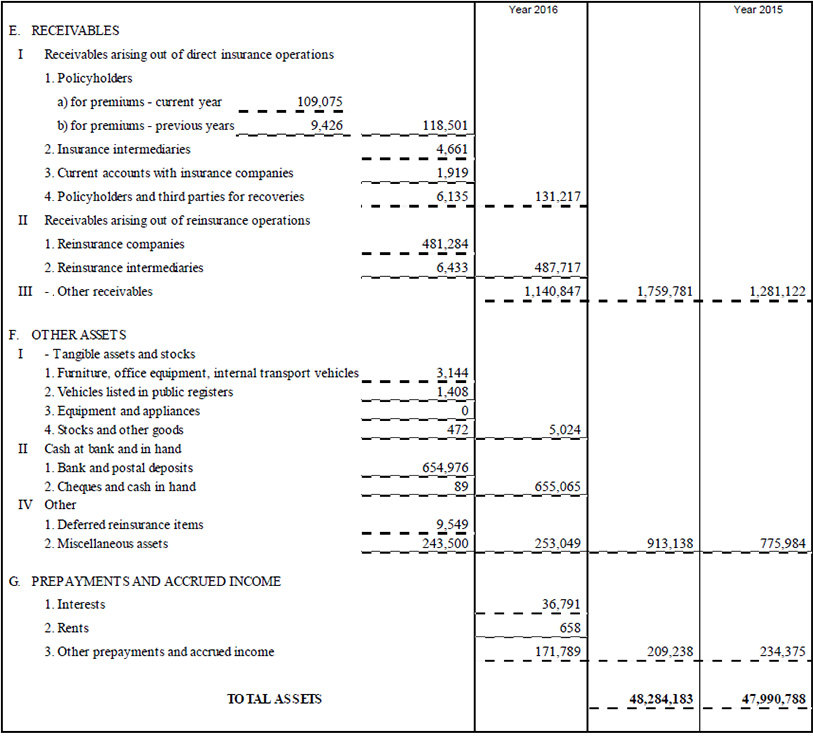

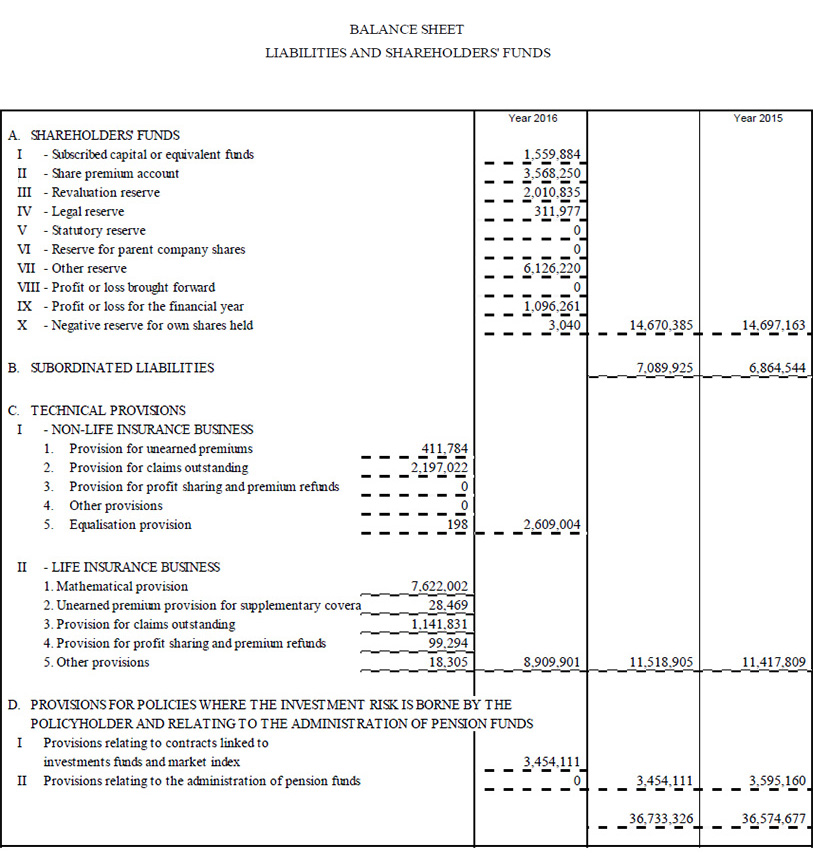

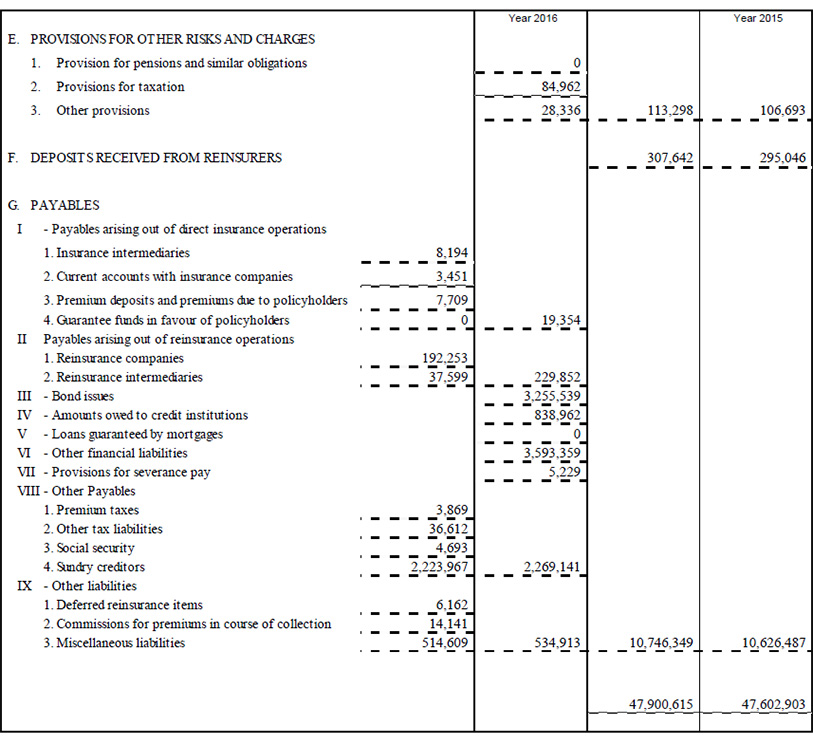

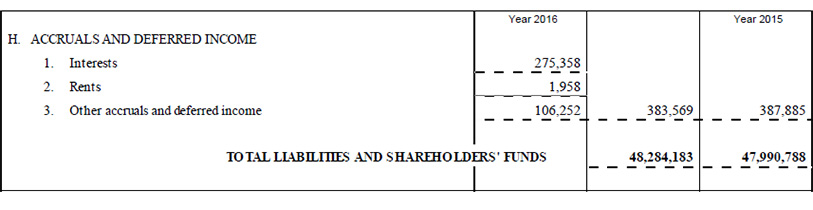

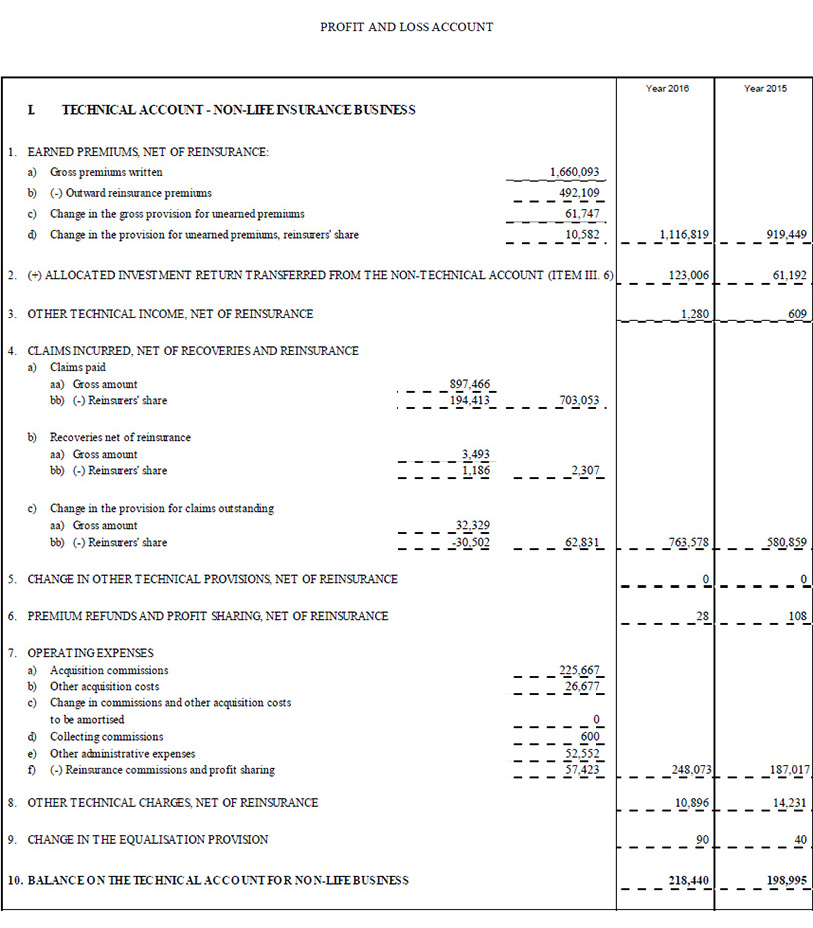

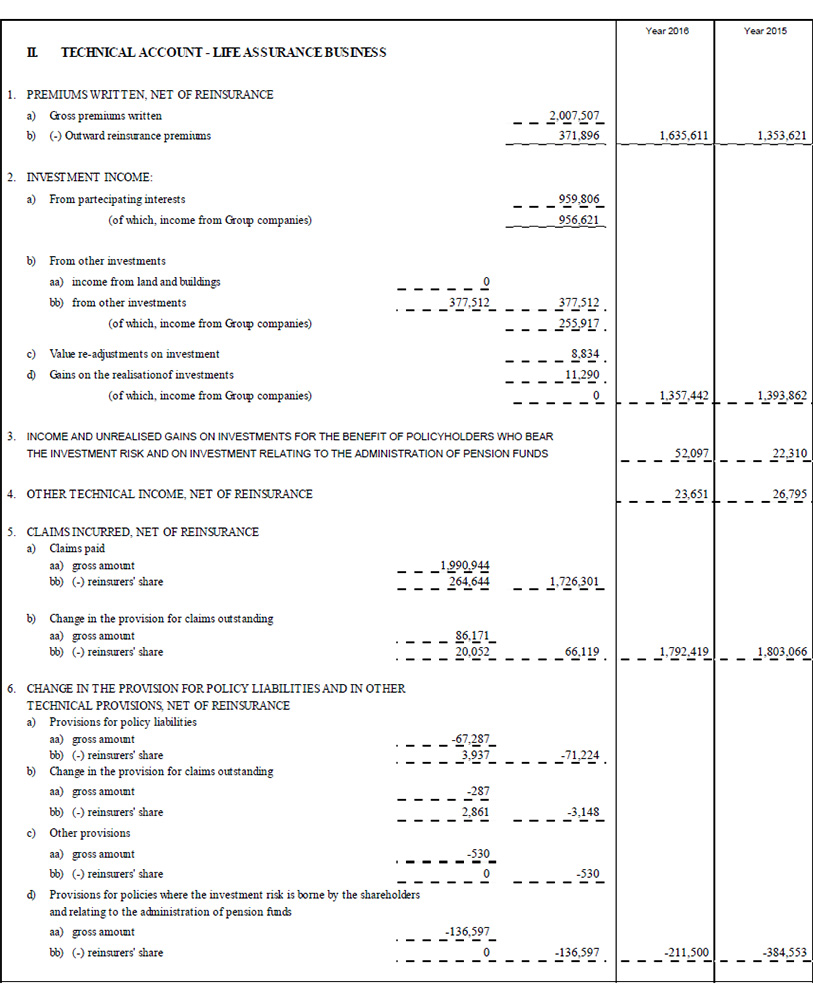

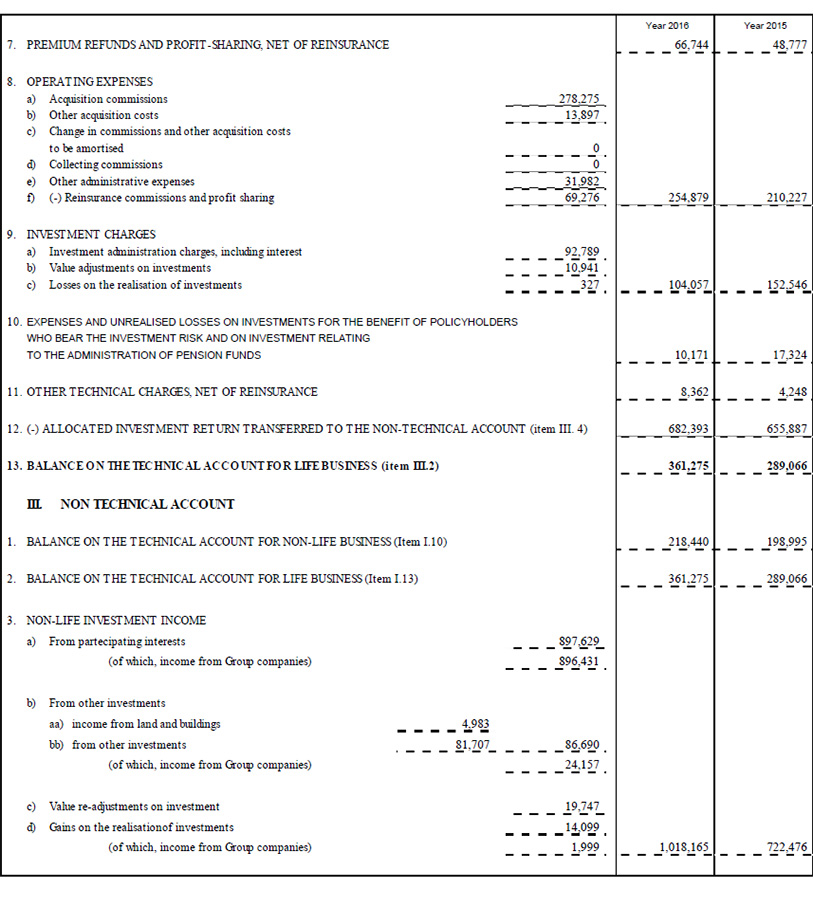

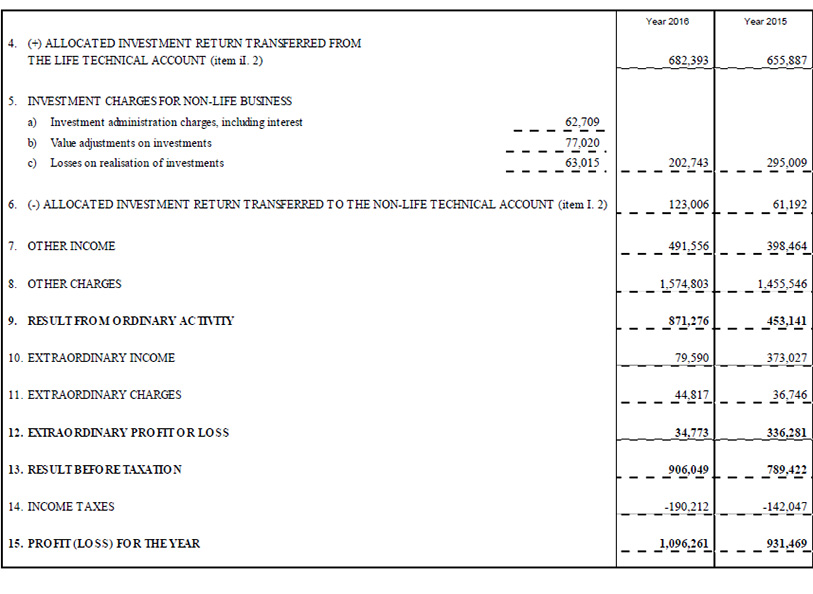

Parent Company balance sheet and income statement

2. Parent company’s Balance Sheet and P&L account

BALANCE SHEET

(in thousands euro)

PROFIT AND LOSS ACCOUNT

(in thousands euro)

Interview with the Group CEO Philippe Donnet