Consolidated results of the Generali Group as at 31 December 2015 - Press release (1)

18 March 2016 - 07:30 price sensitive

- The operating result reached € 4.8 bln (+ 6.1%)

- Operating RoE increased significantly to 14% above the target ( >13%)

- Net profit at € 2 bln (+21.6%; € 1.7 bln FY14)

- Gross premiums above € 74 bln (+4.6%) driven by growth in the Life segment; improvement of the P&C segment

- High P&C technical margins with combined ratio at 93.1% (-0.6 p.p.), despite the higher impact of Nat Cat

- Significant increase in cash generation: Net Free Cash Flow at € 1.6 bln (+30%)

- Dividend per share at € 0.72 (+20%; €0.60 FY14)

- Strong development of Group’s solidity: Economic Solvency ratio at 202% as calculated under the Group’s full internal model (186% FY14)

The Chairman of Generali, Gabriele Galateri di Genola, said: “The positive result for 2015 shows the quality of the turnaround plan accomplished by the company over the last few years and of the new strategy launched last year. These results allow us to propose at the Shareholders’ Meeting a dividend per share of € 0.72 up by 20% compared to 2015. This is an excellent start to a new phase beginning with the appointment of Philippe Donnet as new Group CEO. It is an important acknowledgment of Generali’s internal resources, also affirmed by the appointment of the Group CFO Alberto Minali as General Manager. Both of them are leaders of the highest international quality, with a deep understanding of the insurance business and well appreciated by the markets; they show the capability of Generali Group to enhance its own talents”.

Milan – The Board of Directors of Generali, which met under the chairmanship of Gabriele Galateri di Genola, approved the consolidated financial statements and the draft financial statements of the Parent Company for 2015.

EXECUTIVE SUMMARY

The Group ended the year 2015 with excellent results: operating performance exceeded pre-financial crisis levels, whilst net profit and the dividend are the best in the past 8 years.

In spite of a challenging macroeconomic environment and low interest rates, the strategic initiatives undertaken by the Group have created strong growth in production, excellent operating profitability and a further improvement in capital strength.

The Group’s operating result reached € 4,785 million (€ 4,508 mln FY14), up by 6.1%, driven in particular by the P&C segment (+8.5%) and thanks to a solid result of the Life segment, in spite of the current situation of the financial markets. The operating RoE, the main profitability target, consequently reached 14%, a significant increase compared to 2014 (13.2% FY14), amply exceeding the goal of remaining above 13%.

Net profit grew significantly to € 2,030 million (+21.6%; € 1,670 mln FY14), thanks to the improvement in operating and non operating performance, thus returning to pre-financial crisis levels.

On the production front, the launch of new products and business initiatives boosted total premiums to € 74,165 million, up by 4.6% (€ 70,430 mln FY14): the increase was driven by the Life segment and by the recovery of the P&C segment. Life premium income grew to € 53.297 million (+6.2%; € 49,813 mln FY14), thanks to the improvement of all business lines and the excellent performance of the main Countries where the Group operates (Italy, France, Germany and CEE countries). New production is stable in terms of APE at € 5,210 million (-0.2%), where the positive performance of the unit linked and protection policy products is offset by a decline in savings production, with business mix consequently shifting in line with our strategic ambitions. Profitability (NBM) held firm at 21% (24% FY14) and, due to the decisive actions taken to improve the business mix and to the recalibration of guarantees, it was able to counteract the unfavourable scenario of low interest rates and increase in volatility recorded in the second quarter. The value of new production (NBV) reached € 1,097 million (-13%).

In the P&C segment, premiums grew by 0.8% to € 20,868 million (€ 20,617 mln FY14), through the growth of both the Non Motor line and the steady performance of the Motor line, which however experienced varied performance in the different countries where the Group operates because of the strong competitive pressures. The P&C business confirmed its very strong technical profitability, with a combined ratio which improved further to 93.1% (-0.6 p.p.) thanks to the decline of the loss ratio, in spite of the greater impact of catastrophic claims by € 75 million (+0.4 p.p.). The reserving ratio remained stable at 154%.

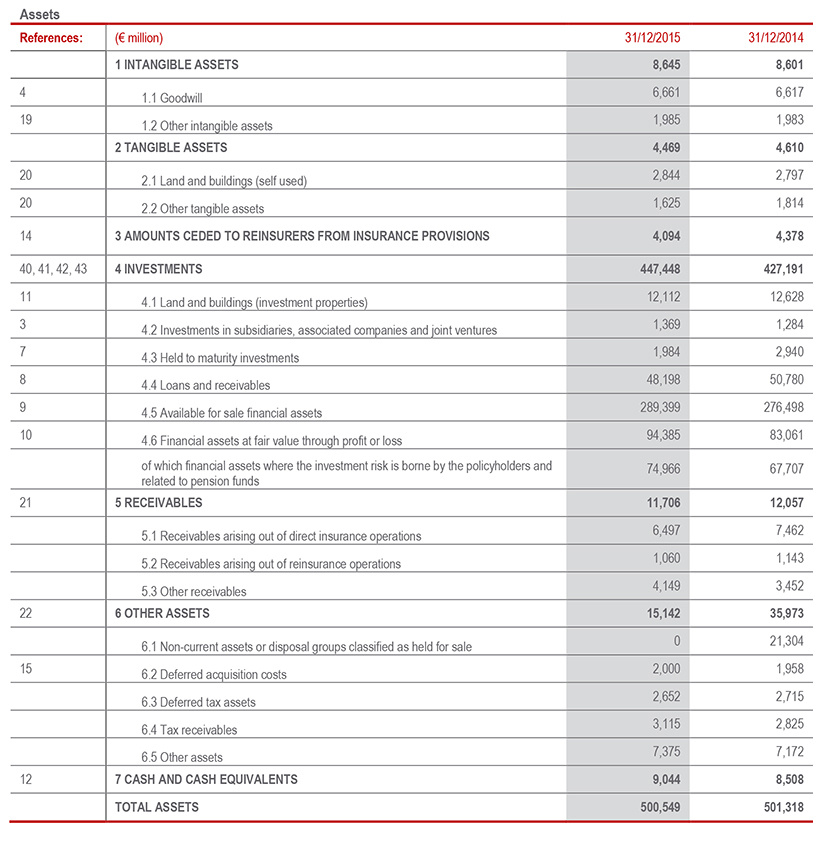

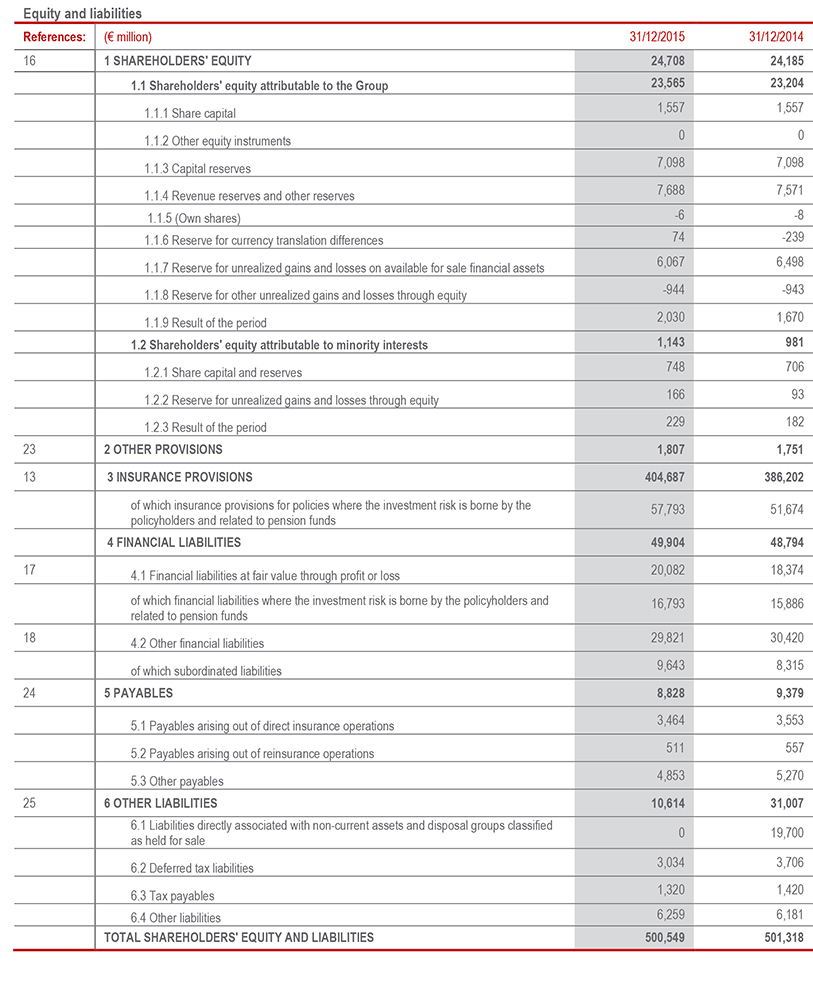

These results are accompanied by a strengthened capital position which the Group continues to hold in a sharp focus. Shareholders’ equity grew 1.5% to € 23.6 bln. The Solvency I ratio is 164% (+8 p.p.; 156% FY14).

The Group’s high level of organic capital generation drove an increase in the Economic Solvency Ratio to 202% (+16 p.p.; 186% FY14), as calculated under Solvency II principles, using the Group’s internal model for the whole Group’s perimeter and after accruing the proposed dividend. From a regulatory perspective, on 8 March 2016, the Group has received the regulatory approval for the use of a partial internal model, starting from January 1, 2016, covering all the entities included in the application2 while the remaining businesses will be treated under the Standard Formula initially. This calculation gives the Regulatory Solvency Ratio, which stands at 175%. The Group is working with the regulators to widen the scope of internal model approval over time, aiming to have substantially all relevant business units in scope by the end of the process. The regulatory solvency ratio is therefore expected converge to the full internal model view, as the process of achieving the planned expansion of the application’s scope progresses.

Furthermore, we have made a strong first step towards the financial target of more than € 7 billion of cumulative Net Free Cash Flow generation by 2018. Thanks to higher dividends from subsidiaries and slightly lower interests expenses, the net free cash flow increased by 30% to €1.6bn (€1.2 bln FY14).

DIVIDEND PER SHARE AT € 0.72 (+20%)

The dividend per share to be proposed at the next Shareholders' Meeting is € 0.72, up by € 0.12 cents per share (+20%) relative to the previous year (€ 0.60 FY14). The payout ratio is equal to 55.3% from 55.9% in 2014.

The total dividend relating to shares outstanding amounts to € 1,123 million. The dividend payment date shall be from May 25, 2016 with record date on May 24, 2016 and ex-dividend date from May 23, 2016.

LIFE SEGMENT: INCREASING INCOME LEVELS AND SOLID OPERATING RESULT

- Premiums increased significantly to € 53.3 bln (+6.2%) thanks to growth in all business lines and excellent performance in major markets

- Net inflows grew strongly to € 15 bln (+15.5%)

- Solid operating result at € 3 bln (-0.4%), in spite of a low interest rate environment

Thanks to the good performance of all business lines, life premium income reached € 53,297 million, growing by +6.2% (€ 49,813 million FY14).

Unit linked contracts continued to increase (+8.6%), consistently with the strategy of promoting insurance products with low capital absorption, while protection policy products performed very well (+11.8%), as did the savings policies (+3.7%).

Highly positive was the contribution from Italy (+11.5%), particularly boosted by the growth in individual single premiums (+19.1%), with good income performance by all companies and all distribution channels. Growth was also experienced in France (+4.1%), with a significant increase in unit linked products (+34.2%) as a result of the preference for alternative forms of savings in a low interest environment, and in Germany (+3.4%) with positive trends both in unit linked contracts and in protection policy products. Business also grew in CEE countries (+7.4%), while the EMEA area contracted (-8%), mainly as a result of the planned decline in single premiums recorded in Ireland. Excellent performance levels were also achieved by International Operations (+7.4%), Americas (+22.2%) and Asia (+56.2%), driven in particular by China (+61%).

Significant growth was also experienced by life net inflows - the difference between the payments received and payouts made - which increased by 15.5%, reaching € 14,920 million. The trend reflects the performance of Italy, France and CEE countries, described above, which offset the decline recorded by EMEA. Asia also provided an excellent contribution, confirming the trend already exhibited at 9 months, with net inflows more than quadrupled.

New production in terms of APE remained stable at € 5,210 million (-0.2%). The positive trend of single premiums (+8.3%) and of the performance of France (+16%) and Asia (+74.5%) was offset by the decline recorded in annual premiums (-6.8%), mainly due to Italy’s performance. The performance of the unit linked business (+14.6%) and protection policy products (+22.4%) was highly positive, while the savings business declined by 9.8%. Profitability (NBM) held firm at 21% (24% in FY14); despite a strong recovery in the second half, brought about by the improvement in the financial situation, profitability (NBM) is still affected by the unfavourable economic scenarios with declining interest rates and severe increase in volatility recorded in the second quarter of 2015, although recovering subsequently. The value of new production (NBV) amounted to € 1,097 million (-13%).

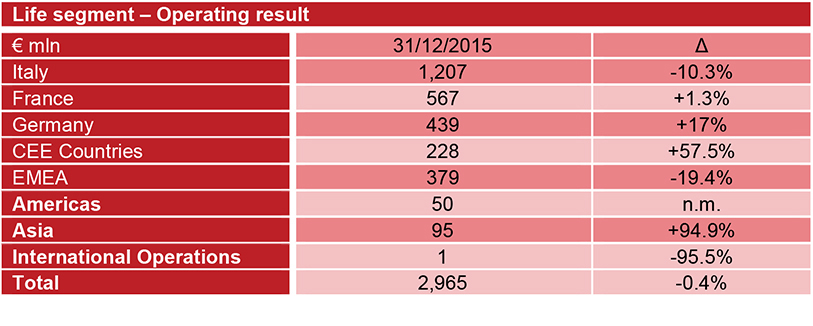

The operating result of the segment amounted to € 2,965 million (-0.4%; € 2,978 million FY14). The strong growth in the underwriting margin (+6.8%), in line with the growth of the premium income, and the increase in the financial margin (+0.9%) - albeit in the current situation of the financial markets – were offset by the higher weight of some operating components. This includes the acquisition costs for the growth in premium income, in particular in France and Asia, and the brand royalties recognised to the Parent Company for marketing and brand development activities.

P&C SEGMENT: EXCELLENT PERFORMANCE OF THE OPERATING RESULT, GROWTH IN PREMIUM INCOME. COMBINED RATIO IMPROVED FURTHER

- Premiums grew to € 21 bln (+0.8%), boosted by Non Motor (+1.1%)

- Strong growth in the operating result to € 2 bln (+8.5%) thanks to the significant increase in the underwriting result (+12.2%)

- CoR improved to 93.1% (-0.6 p.p.), despite higher Nat Cat. Italy best ratio of the Group

The premium income of the P&C segment grew to € 20,868 million (+0.8%; € 20,618 FY14), driven by the positive trend of the Non Motor line (+1.1%), which recorded good performance levels in almost all of the Countries where the Group operates, and by the stady performance of the Motor line (+0.2%), which remained solid in spite of adverse macroeconomic conditions in some of the most important markets.

In particular, significant growth was recorded in CEE Countries (+4.6%), in Germany (+1.7%) and EMEA (+1.8%).

Italy experienced a decline by 3%, mainly weighted down by the Motor line (-7.3%), which is under severe competitive pressure of the market on premiums. France was stable (-0.3%), with a positive trend in Non Motor (+1.4%), as a result, in particular, of the Protection & Health and Commercial line.

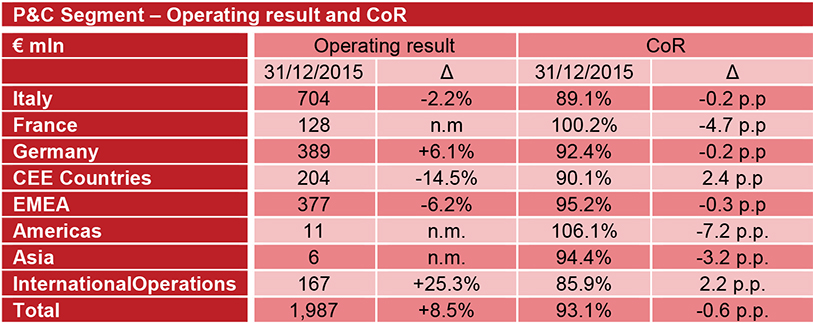

The business confirmed its high profitability, with a sharp growth in its operating result, which reached € 1,987 million (+8.5%; € 1,831 mln FY14), thanks in particular to the performance of the underwriting result (+12.2%).

The combined ratio (CoR) was 93.1% (-0.6 p.p.) due to the decline in the loss ratio (65.9%, -0.8 p.p.) which improved in spite of the impact of catastrophic claims, i.e. € 313 million, equivalent to 1.6 p.p. (+0.4 p.p. compared to FY14). On the loss ratio, of note is the improvement both of the non-catastrophic current part (-0.4 p.p.) and the contribution of the previous generation underwriting (-4.6 p.p.). The expense ratio was substantially stable at 27.3% (+0.2 p.p.).

Italy recorded the best CoR in the Group, at 89.1% (-0.2 p.p.), thanks to the positive trend in the non-catastrophic loss ratio and in spite of € 120 million of damages from catastrophes, up by 0.5 p.p. compared to 2014 and despite the highly competitive motor market. France improved significantly (-4.7 p.p.) to 100.2%, thanks to the improvement in the non- catastrophic loss ratio and the lower impact of nat cat. The increase in catastrophic events and a rise in the non-catastrophic loss ratio led to an increase of the CoR in CEE Countries, which nonetheless remained at excellent levels at 90.1% (+2.4 p.p.). Underwriting profitability was good in Germany, with the CoR at 92.4% (-0.2 p.p.), and in EMEA, at 95.2% (-0.3 p.p.).

HOLDING AND OTHER ACTIVITIES SEGMENT

The holding and other activities segment comprises the activities carried out by the Group’s companies in the banking and asset management sector, the costs incurred in the activity of managing, coordinating and financing the business as well as other activities the Group considers subsidiary to its core insurance business.

The operating result of the holding and other activities sector reached € 59 million, up compared to € -5 million of FY14. The contribution of the financial segment was excellent, with the operating result increasing by 16% to € 434 million (€ 374 mln FY14) thanks to the contribution of Banca Generali. The improvement in performance, achieved also with the contribution of the Asset Management activity in China, was mainly due to the net income from financial operations, which benefited from higher net fees and commissions, only partly offset by the increase in operating expenses.

Third party assets managed by the Group's banking companies and asset management companies reached € 44,323 million (+1.2%; € 43,795 million FY14).

The operating expenses of the holding activities reached € -429 million (€ -418 mln FY14), an increase that reflected the strengthening, started in 2013 and continued in 2014, of the Head Office structures – also with reference to the transition to the new Solvency II regime – as well as the development of the Regional Offices tasked with directing, coordinating and controlling the business in key areas in terms of growth opportunities, e.g. Asia.

OUTLOOK

The operating environment of the insurance sector continues to be characterised by low interest rates and by a constantly evolving regulatory scenario, with ever more stringent regulations in the field of distribution. In line with the strategy to become leader in the retail segment in Europe, Generali will further intensify its focus on the initiatives of the Techex programme and in the investment in new technologies and improved use of data, both at Group and individual business unit level. The aim is to enhance the value of the portfolio whilst simplifying and innovating the product range, both in the Life and in P&C segment. Despite the challenging macroeconomic environment and the high volatility of the financial markets, in 2016 the Group will continue to pursue the strategic actions of the new development phase, confirming the target of an operating ROE above 13%, and improving shareholder remuneration, consistently with the strategic plan presented to the market.

The implementation of Long Term Incentive Plan compensation approved by the Shareholders’ Meeting in 30 April 2013

It should also be noticed that today the Board of Directors exercised the power to increase, free of charge, the share capital, pursuant to article 2443 of the Italian Civil Code, granted by the shareholders’ meeting on 30 April 2013 in connection with the Long Term Incentive Plan approved by the shareholders’ meeting on the same date pursuant to article 114-bis of the Consolidated Finance Act (the "2013 Plan"). In particular, the Board of Directors resolved, among other things, to increase, free of charge, the share capital, pursuant to articles 2443 and 2349 of the Italian Civil Code, with effect from the material assignment of shares, whose number will be determined by the delegated directors, for a maximum nominal amount of EUR 3,010,255, through the transfer to capital of a corresponding maximum amount from the extraordinary reserve, with the issue of a maximum number of 3,010,255 ordinary shares with a par value of EUR 1.00 each, with regular dividend, to be allocated to the beneficiaries of the Plan. The completion of this capital increase is subject to the obtaining of the necessary regulatory approvals and should take place within 30 April 2016.

The Dirigente Preposto (Manager in Charge of Preparing the Company’s Financial Reports), Alberto Minali, declares in accordance with Paragraph 2 of Article 154-bis of the Italian Consolidation Finance Act that the accounting information contained herein matches the accounting records, books, and entries

THE GENERALI GROUP

The General Group is among the world’s leading insurers, with total premium income exceeding €74 billion in 2015. With above 76,000 workers in the world, present in over 60 Countries, the Group has a leading position in Western European Countries and an ever more significant presence in the markets of Central and Eastern Europe and in Asia. In 2015, Generali was the sole insurance company included among the 50 smartest companies in the world by the MIT Technology Review.

NOTE TO REPORTERS

From 7.30 am onwards, the following documents are available at www.generali.com: press release, pre-recorded video with transcript, presentation for analysts, annual financial statements and the other financial documents.

At noon, the Analyst Call will be held. Journalists can follow the event by connecting to the number +3902 3600 9866 (listen-only mode).

Generali’s corporate app offers the most recent package of institutional information, optimised for mobile devices. The app can be downloaded free of charge from Apple and Android stores.

1 Changes in premiums, net income and APE are at homogeneous terms (for equal exchange rates and scope of consolidation). Changes in operating results and own investments exclude sold entities from the comparison period.

2 Italy, Germany, French P&C business, and the Czech Republic.

List of Annexes

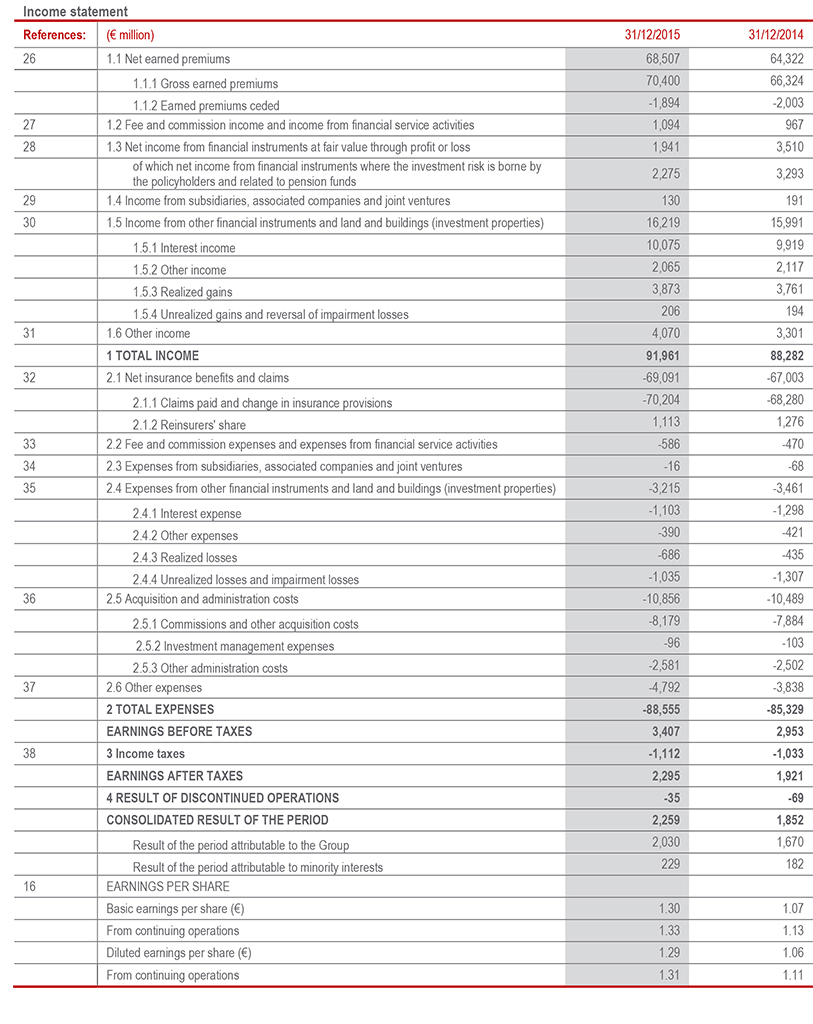

Balance Sheet and Income Statement of the Group

1. Group’s Balance Sheet and Income Statement

BALANCE SHEET

INCOME STATEMENT

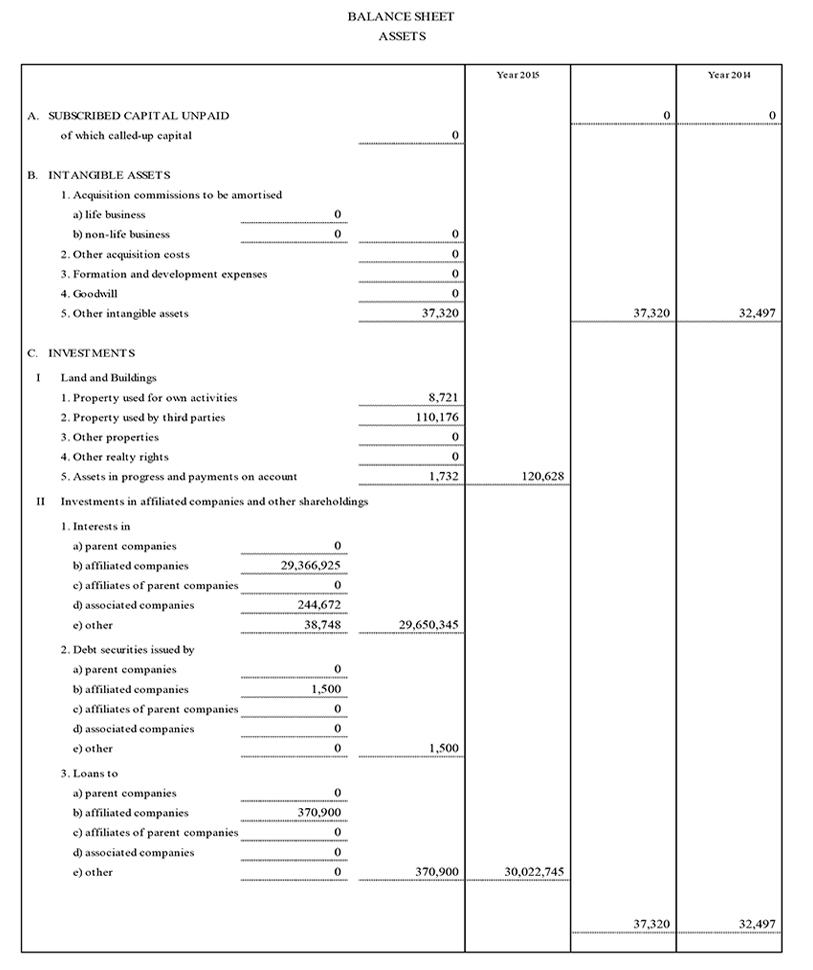

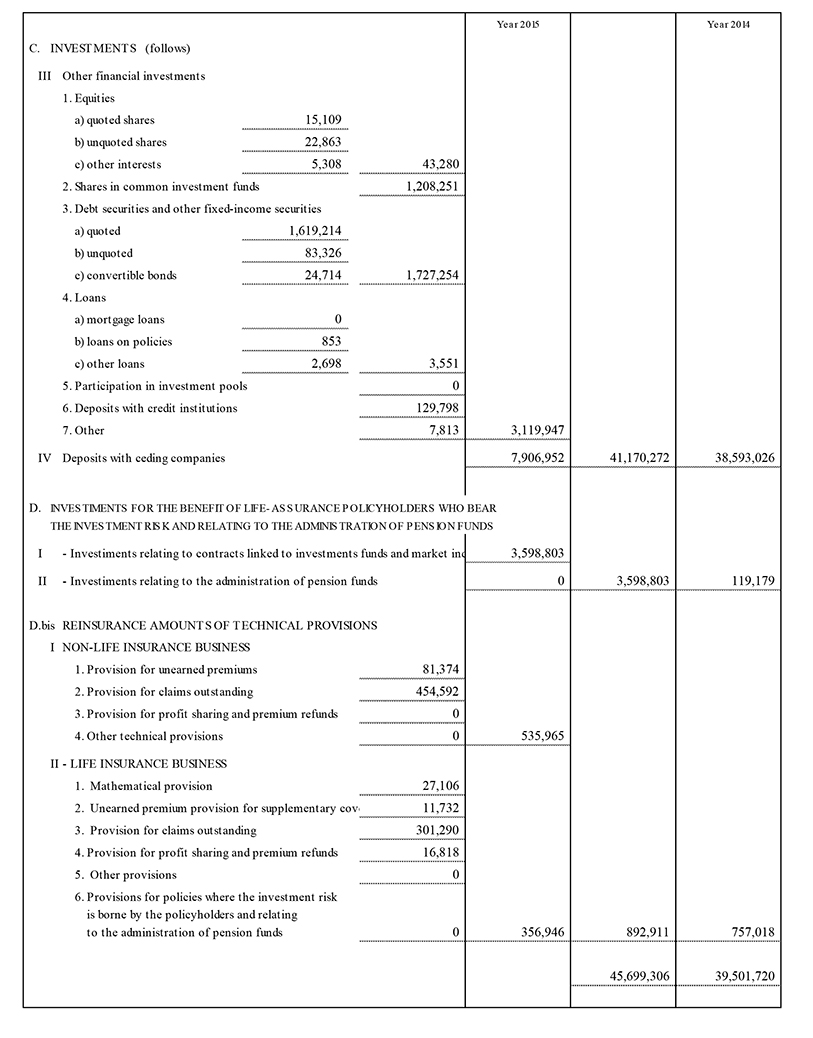

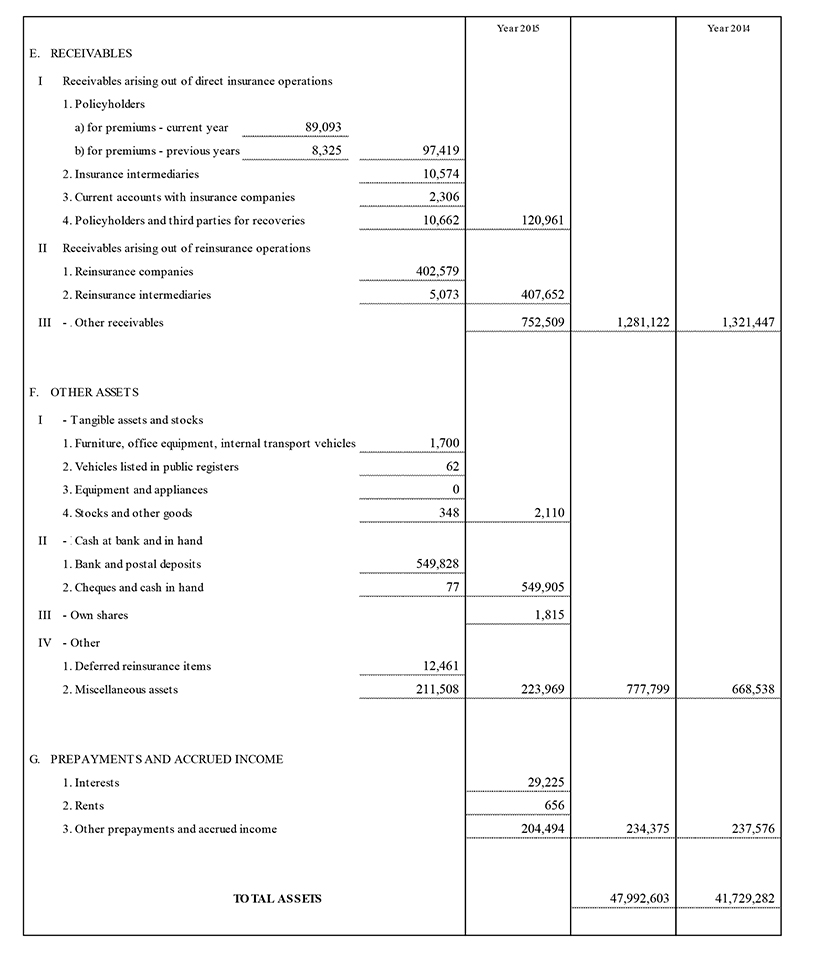

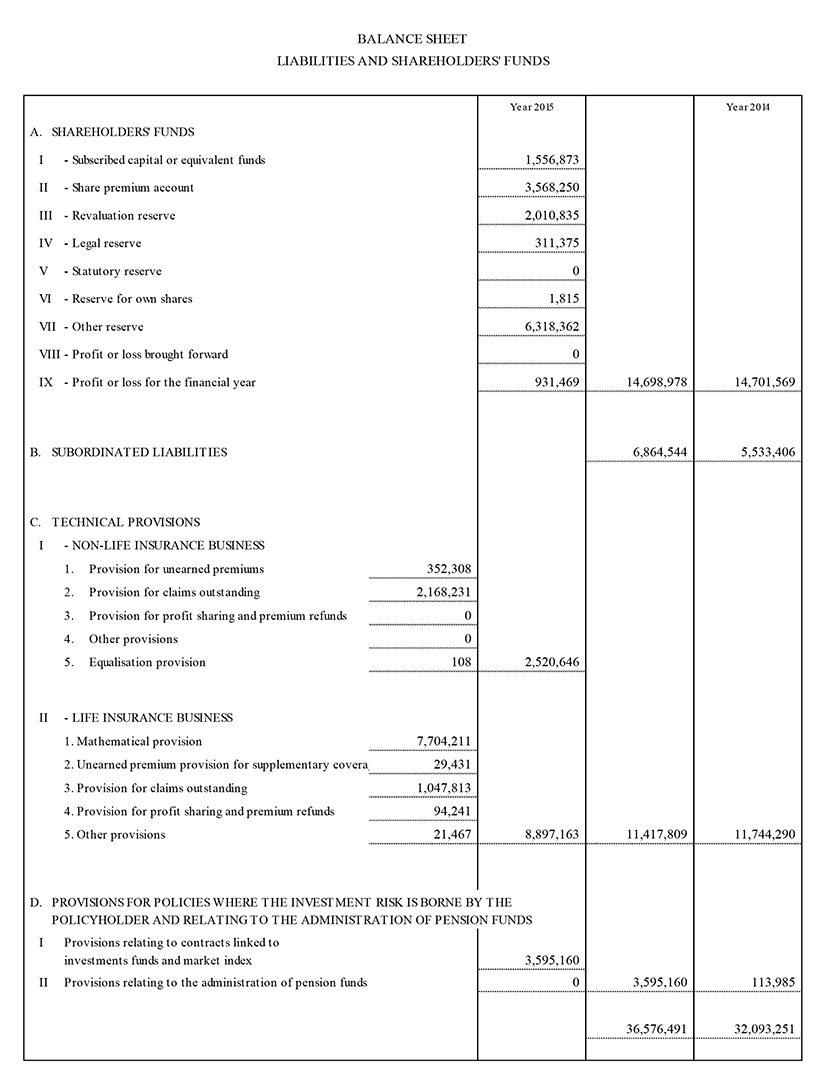

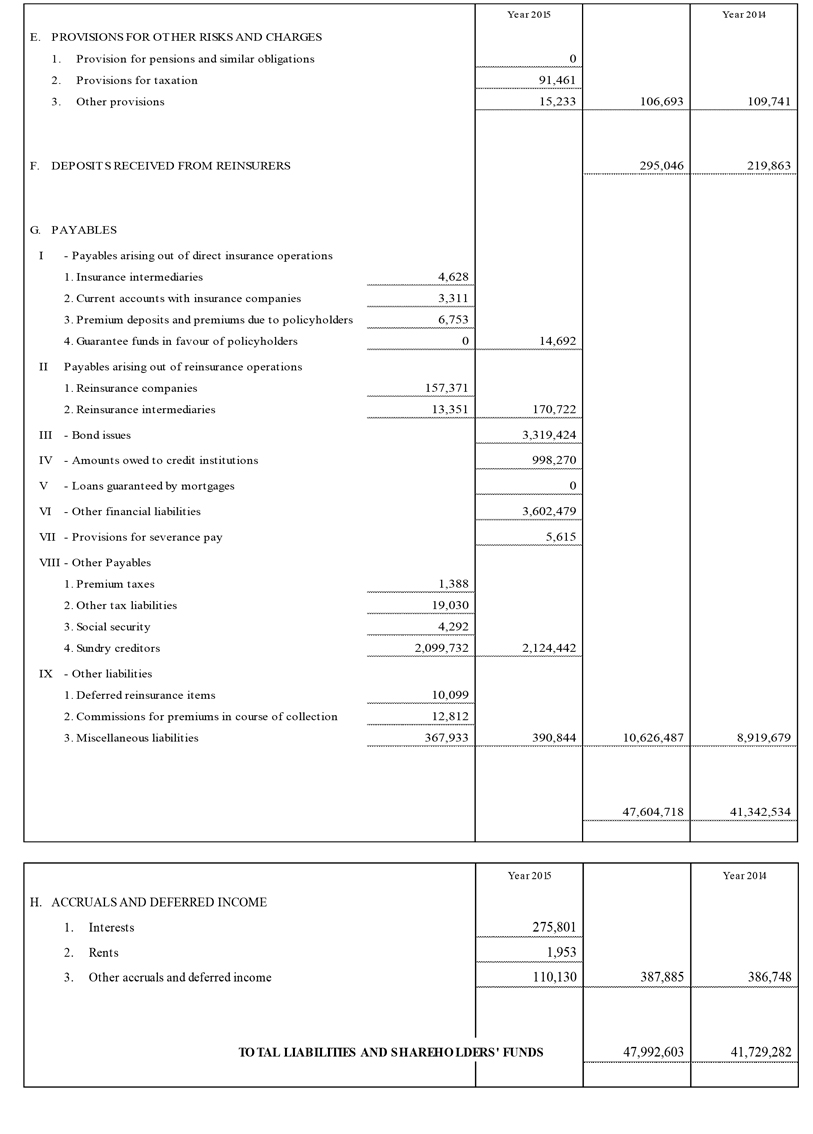

Balance Sheet and Income Statement of the Parent Company

2. Parent company’s Balance Sheet and P&L account

BALANCE SHEET

(in thousands euro)

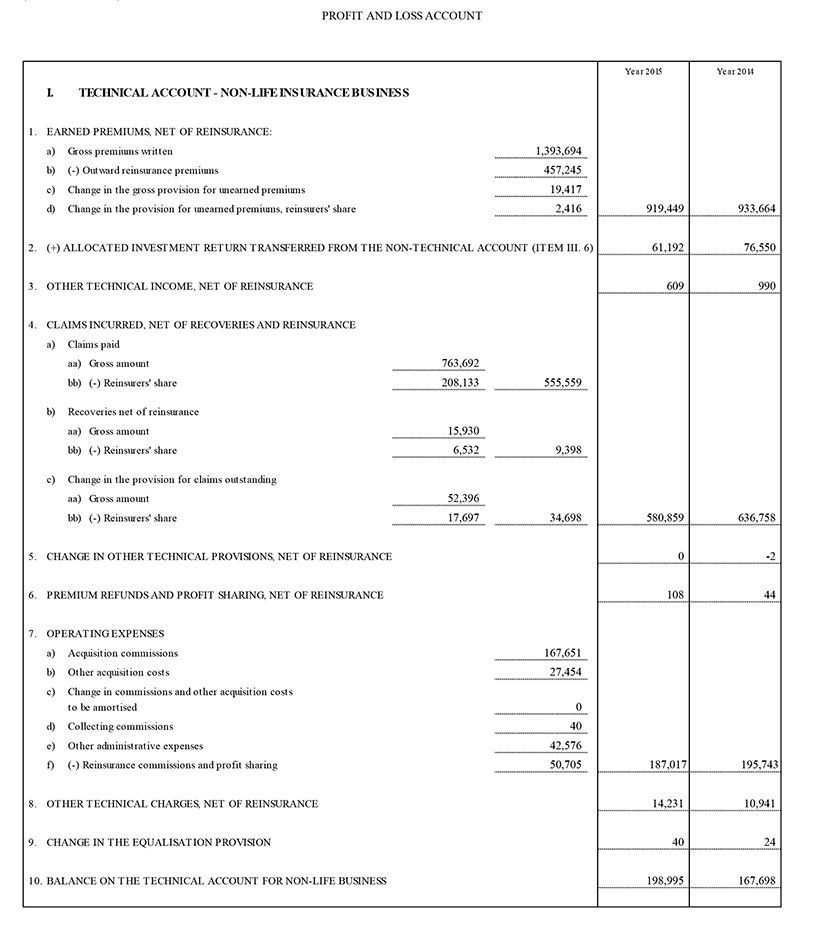

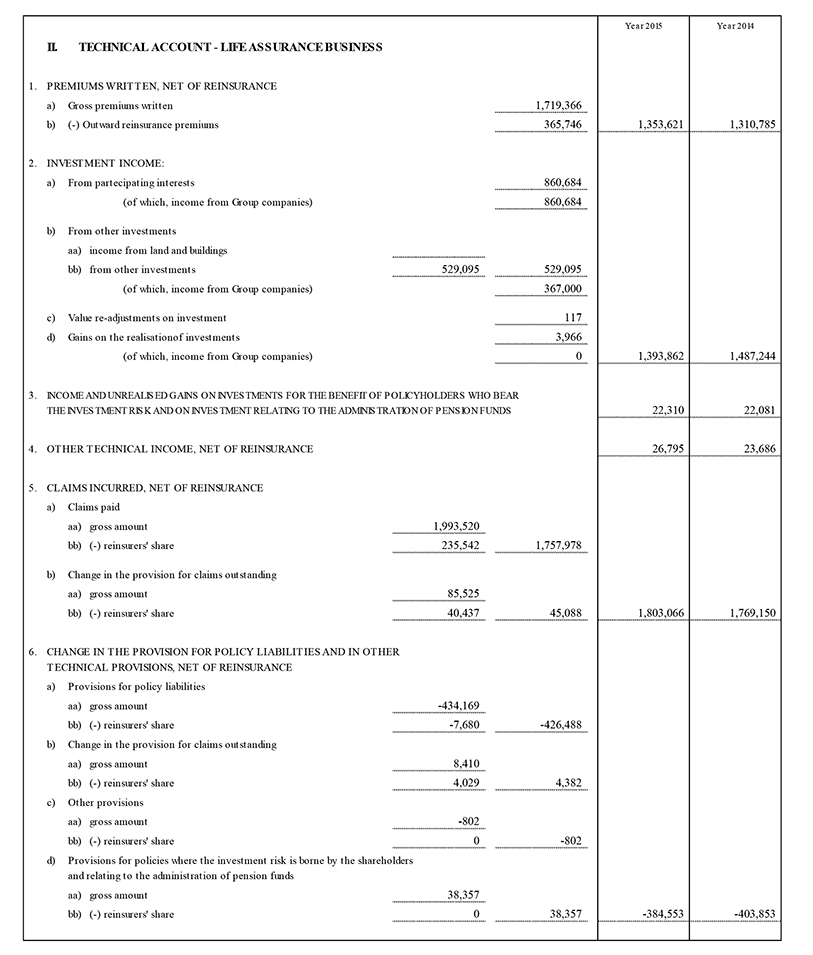

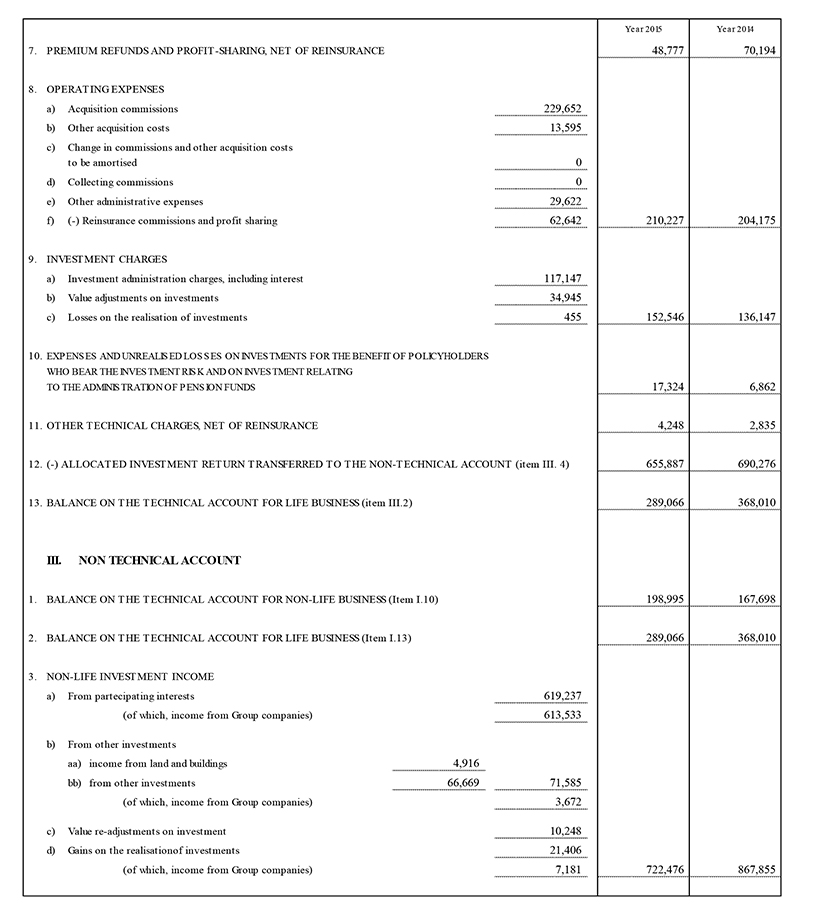

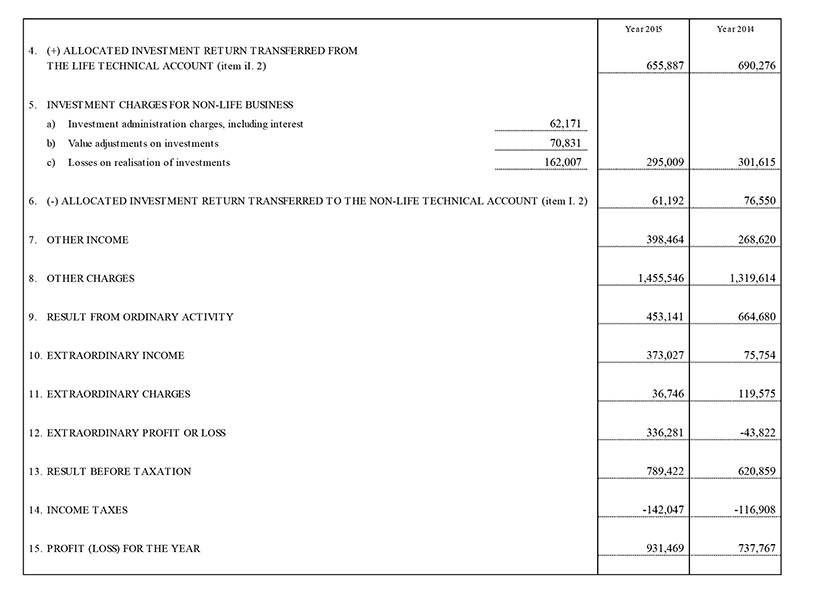

PROFIT AND LOSS ACCOUNT

(in thousands euro)

For more info: Report Archive