Putting the ‘auto’ into automobile

Driverless, hyper-connected, electric, hybrid, shared. The future of the car is set to differ greatly from its past.

Times have been tough recently but it looks like the automobile industry has already recovered: in 2016 according to estimates by OICA (International Organization of Motor Vehicle Manufacturers), a total of 45,794,000 private and commercial vehicles were sold, an increase of 3% on 2015.

Though it might sound surprising, given that the overall economic recovery has been slower here, Europe is the area where sales have increased the most. There were 15.1 million registered new vehicle purchases compared with 14.2 million the previous year. Among EU countries, Italy recorded the greatest increase with a rise of 15.8%.

The figures demonstrate that the demand is there and that the supply is still capable of satisfying it. Meanwhile, it is the very idea of the car that is in question. Technology, Internet, the sharing economy, sustainability and other variables are modifying people’s behaviour and consumption. These changes are having an unprecedented impact on the automobile industry, shaking it to the core and forcing it to reconsider its identity.

There is much talk of the self-driving car, the car that does not require a driver. The race is under way to come up with who is going to become the first mover on the market (Nissan is ready to launch the first semi-autonomous cars). But the revolution depends also on other factors, the first of these being connectivity. In 2021 there will be 380 million connected cars on the roads, according to Business Insider. Connectivity will “progressively transform the car into a platform, enabling drivers and passengers to access to media and services, or perform other activities while in transit,” reads a report on the future of the car published by the consultancy group McKinsey, entitled “Disruptive trends that will transform the auto industry”.

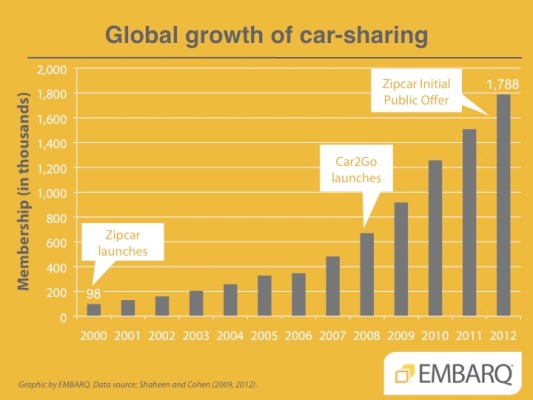

The words ‘disruptive’ and ‘disruption’ have often been used to describe the future technology in the automotive sector. McKinsey have estimated that between now and 2030 overall revenues for the sector could head towards seven trillion dollars, almost double the current business volume, including sales and post sales services. The revenues generated by car sharing (for example Blablacar), ride-hailing (Uber) services and data-driven services could be equal to $1.5 trillion. At the moment, however, the proportion is very small and it is precisely here that the game will be played: the transformation from little today to a lot tomorrow needs to be contemplated, governed and taken advantage of.

One significant break with the past has been the arrival in the sector of the leading tech giants and the big automobile brands’ investment in innovative companies. An article in Vox, highlighted just some of the deals signed in 2016. There’s the self-driving car project involving Fiat Chrysler and Google, which has opened a research centre in Detroit. BMW and Intel have a similar agreement with the same objective. Ford has created a subsidiary in Silicon Valley. Other partnerships have been signed between Toyota and Uber, Apple and Didi Chuxing, the Chinese Uber.

Here we can find an apparent paradox: in theory the objective of Uber and its competitors is to reduce the number of privately owned cars in the world. Such an aim would appear to be anathema to the big car manufacturers but according to Vox, “In a future where on-demand car rental is the default way people get around, the key to success in the auto industry may be winning big orders from companies like Zipcar, Uber, and Google.” Sales will not suffer, they should remain more or less stable and many analysts are convinced of this.

The insurance sector too is taking steps to prepare for the new scenario, trying to adapt with new solutions to this transformation, as Market Watch has reported.

Generali Group, for example, has acquired in 2015 the English start-up MyDrive Solutions, a company among the leading providers in data analytics tools for profiling driving styles. The aim is both to define innovative and tailor-made products for customers and competitive rates for the most virtuous insured.

Proposals are also being studied in the financial sector, given that car purchases frequently involve loans or finance deals. Deloitte, one of the global consultancy giants, has tried to trace an outline of future developments.

The impression is that these changes will soon be moving at an almost uncontrollable speed. In reality the change will occur in a non-uniform way. In the big cities it will have a faster pace and in the provinces it will be slower. At first, more and more people will give up owning cars and switch to car sharing. Secondly, where these services take longer to establish themselves, as long as they manage to meet the diverse requirements of the users, people will continue to purchase cars.

The gap between cities and the rest reveals itself fully in the strategy of automotive giant General Motors. The American group is focusing on sustainability, technology and the consumer revolution in the big urban centres, but the other America continues to bet on gas-guzzling cars that have a heavy impact on the environment.

Electric cars and hybrids are also considered a key component of the new equilibrium in the automotive sector (a share of 30% is forecast for global sales in 2030). There is still an abyss between supply and demand. China is a good example: a country that after years of frenetic development is trying to reconcile growth with environmental concern, progress with health. The increase in purchases of electric and hybrid cars has been notable, perhaps because the government offers significant incentives: almost eight thousand dollars for an electric car and almost four thousand for a hybrid. The market is growing but it still depends in large measure, according to the China Daily, more on state intervention from above rather than the citizens’ demand for alternative consumption.

The revolution is just around the corner. The approach towards cars and the way they are produced looks set to change. As Volvo CEO, Hakan Samuelsson, explained recently at the Detroit Motor Show, “cars will be tailor made for customers: it will be more profitable also for us.” Importantly, car production looks set to continue. The present situation will form the roots of the shape of things to come. The transformation of Detroit is an example. “If we look to the future it is clear that Motor City will continue to play a crucial role, uniting the best of Detroit with that of Silicon Valley,” commented John Krafcik, CEO of Google’s self-driving car project.

In the future the car will continue to be central to society and fundamental to the economy. But the future is sure to differ greatly from the past.